The complexity of tax preparation can be overwhelming, especially when dealing with the intricacies of employment taxes. As a responsible employer, ensuring compliance with all tax regulations is crucial to avoid penalties and fines. One essential document in this process is the 147c form. In this article, we will delve into the world of 147c forms, explaining what they are, why they are necessary, and how to file them online securely.

Understanding the 147c Form

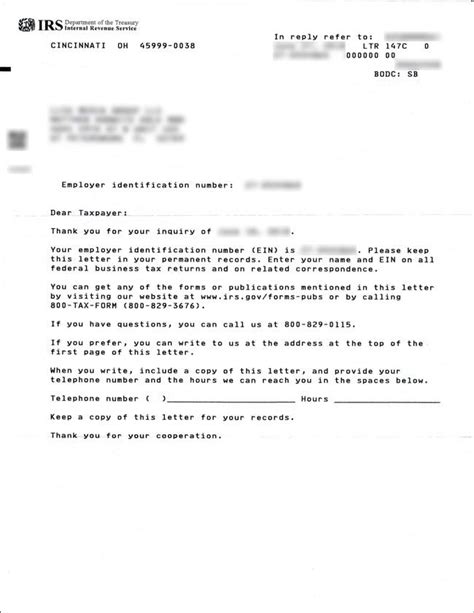

The 147c form is a vital document for employers who need to certify the identity of their employees. This form is used to establish the employer-employee relationship, ensuring that the employer is not responsible for payroll taxes on payments made to independent contractors. It serves as a crucial piece of evidence in case of an audit, helping to avoid costly fines and penalties.

Why Filing the 147c Form is Crucial

Filing the 147c form is essential for several reasons:

- Tax Compliance: The 147c form helps employers demonstrate compliance with tax regulations, reducing the risk of penalties and fines.

- Employer-Employee Relationship: The form establishes a clear employer-employee relationship, which is critical for tax purposes.

- Record Keeping: The 147c form serves as a valuable record-keeping tool, providing a paper trail in case of an audit.

How to File the 147c Form Online

Filing the 147c form online is a straightforward process that can be completed in a few simple steps:

- Gather Required Documents: Ensure you have all necessary documents, including the employee's identification and a copy of the employment contract.

- Choose a Reputable Filing Service: Select a reliable online filing service that specializes in tax forms, such as the 147c.

- Complete the Form: Fill out the 147c form accurately and thoroughly, ensuring all required fields are completed.

- Submit the Form: Submit the completed form to the filing service, which will review and process it.

Security Measures for Online Filing

When filing the 147c form online, security is paramount. Ensure the filing service you choose employs robust security measures, including:

- Encryption: Look for services that use end-to-end encryption to protect sensitive data.

- Secure Servers: Opt for services that store data on secure servers, protected by firewalls and access controls.

- Compliance: Verify the service complies with relevant tax regulations and industry standards.

Benefits of Online Filing

Online filing offers numerous benefits, including:

- Convenience: File the 147c form from anywhere, at any time, as long as you have an internet connection.

- Speed: Online filing is significantly faster than traditional paper-based methods.

- Accuracy: Automated checks help reduce errors and ensure the form is completed accurately.

Practical Tips for Online Filing

To ensure a smooth online filing experience, follow these practical tips:

- Use a Reputable Service: Choose a well-established and reputable online filing service.

- Double-Check Data: Verify all data entered into the form is accurate and complete.

- Save Progress: Regularly save your progress to avoid losing work in case of an interruption.

Common Mistakes to Avoid

When filing the 147c form online, avoid common mistakes, such as:

- Incomplete Data: Ensure all required fields are completed accurately.

- Incorrect Data: Double-check data entered into the form to avoid errors.

- Missed Deadlines: File the form well before the deadline to avoid penalties.

Conclusion: Simplifying the 147c Form Filing Process

Filing the 147c form online is a convenient, secure, and efficient way to certify the identity of employees. By understanding the importance of this form and following the steps outlined above, employers can ensure compliance with tax regulations and avoid costly penalties. Take the first step towards simplifying your tax preparation process by filing the 147c form online today.

Get Started with 147c Form Filing

Don't wait any longer to file your 147c form. Choose a reputable online filing service and follow the steps outlined above to ensure a smooth and secure filing experience. Contact us today to learn more about our 147c form filing services and how we can help you simplify your tax preparation process.

Share Your Thoughts

We'd love to hear from you. Share your experiences with filing the 147c form online or ask any questions you may have about the process. Your feedback will help us improve our services and provide better support to our readers.

What is the purpose of the 147c form?

+The 147c form is used to certify the identity of employees and establish the employer-employee relationship.

How do I file the 147c form online?

+Choose a reputable online filing service, gather required documents, complete the form accurately, and submit it for processing.

What are the benefits of online filing?

+Online filing offers convenience, speed, and accuracy, making it a preferred method for filing the 147c form.