The world of online content creation has experienced a significant shift in recent years, with platforms like Onlyfans gaining popularity. As a content creator on Onlyfans, it's essential to understand the financial aspects of your business, including taxes and the necessary paperwork. One crucial document that you'll encounter as an Onlyfans creator is the 1099 form. In this article, we'll delve into the world of 1099 forms, exploring what they are, how they work, and what you need to know as an Onlyfans creator.

What is a 1099 Form?

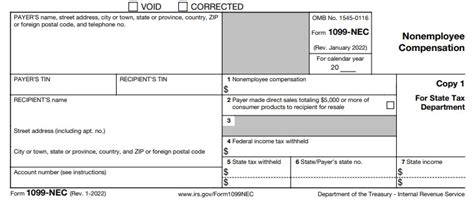

A 1099 form is a series of documents used by the Internal Revenue Service (IRS) to report various types of income that don't come from employment, such as freelance work, contract labor, or self-employment. As an Onlyfans creator, you're considered self-employed, and your earnings are reported on a 1099 form. The form is typically issued by the platform or entity paying you, in this case, Onlyfans.

Types of 1099 Forms

There are several types of 1099 forms, each used to report different types of income. As an Onlyfans creator, you'll likely encounter the following:

- 1099-MISC: This form is used to report miscellaneous income, such as freelance work, tips, or prizes.

- 1099-K: This form is used to report payment card and third-party network transactions, such as credit card payments or PayPal transactions.

How Does Onlyfans Report Income on 1099 Forms?

Onlyfans is required to report your earnings on a 1099 form if you meet certain thresholds. According to the IRS, Onlyfans must issue a 1099-MISC form if you earn more than $600 in a calendar year. If you earn less than $600, you may not receive a 1099 form, but you're still required to report your income on your tax return.

Onlyfans will typically report your earnings on a 1099-MISC form, which will include the following information:

- Your name and address

- Your taxpayer identification number (TIN)

- The amount of money you earned

- The type of payment (e.g., freelance work, tips, etc.)

What Do I Need to Do with My 1099 Form?

As an Onlyfans creator, you'll need to use the information on your 1099 form to complete your tax return. Here are the steps to follow:

- Review your 1099 form for accuracy: Make sure the information on the form is correct, including your name, address, and TIN.

- Report your income on your tax return: You'll need to report the income listed on your 1099 form on your tax return, typically on Schedule C (Form 1040).

- Complete Form 1040: You'll need to complete Form 1040, which is the standard form for personal income tax returns.

- Pay self-employment tax: As a self-employed individual, you're responsible for paying self-employment tax on your earnings. You'll need to complete Schedule SE (Form 1040) to calculate your self-employment tax.

Tax Deductions for Onlyfans Creators

As an Onlyfans creator, you may be eligible for certain tax deductions that can help reduce your taxable income. Some common deductions include:

- Business expenses: You can deduct expenses related to your Onlyfans business, such as equipment, software, or marketing expenses.

- Home office deduction: If you use a dedicated space for your Onlyfans business, you may be eligible for the home office deduction.

- Travel expenses: If you travel for business-related purposes, you can deduct your travel expenses.

Common Mistakes to Avoid

As an Onlyfans creator, it's essential to avoid common mistakes that can lead to errors on your tax return. Here are some mistakes to watch out for:

- Not reporting income: Make sure to report all your income from Onlyfans, even if you don't receive a 1099 form.

- Not paying self-employment tax: As a self-employed individual, you're responsible for paying self-employment tax on your earnings.

- Not keeping accurate records: Keep accurate records of your business expenses and income to ensure you're taking advantage of all eligible deductions.

Conclusion

Understanding 1099 forms is crucial for Onlyfans creators, as it affects their tax obligations and financial reporting. By following the guidelines outlined in this article, you'll be better equipped to navigate the world of 1099 forms and ensure you're meeting your tax obligations as a self-employed individual.

We encourage you to share your experiences and questions about 1099 forms in the comments below. Don't forget to follow us for more informative articles on personal finance and tax-related topics.

What is the deadline for filing my tax return as an Onlyfans creator?

+The deadline for filing your tax return as an Onlyfans creator is typically April 15th of each year. However, you may be eligible for an extension if you need more time to file.

Do I need to report my Onlyfans income on my tax return if I earn less than $600?

+Yes, you're required to report all your income from Onlyfans on your tax return, regardless of the amount. Even if you don't receive a 1099 form, you're still responsible for reporting your income.

Can I deduct business expenses on my tax return as an Onlyfans creator?

+Yes, you can deduct business expenses related to your Onlyfans business on your tax return. Common deductions include equipment, software, and marketing expenses. Keep accurate records of your expenses to ensure you're taking advantage of all eligible deductions.