As an Onlyfans creator, managing your finances effectively is crucial to maximizing your earnings and minimizing your tax liability. Since Onlyfans creators are considered independent contractors, they receive a 1099 form at the end of each year, which can make tax season more complicated. In this article, we will discuss five essential tax tips for Onlyfans creators to help you navigate the tax landscape and ensure you're taking advantage of all the deductions available to you.

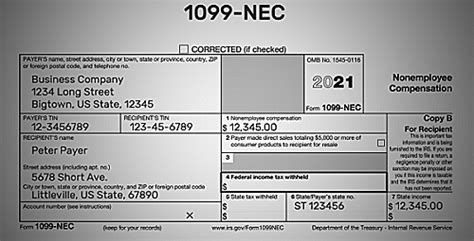

Understanding Your 1099 Form

The 1099 form is used to report miscellaneous income, such as freelance work, consulting fees, and other non-employee compensation. As an Onlyfans creator, you'll receive a 1099 form from Onlyfans if you earned more than $600 in a calendar year. The form will show the total amount of money you earned from Onlyfans, and you'll need to report this income on your tax return.

Tax Tip #1: Keep Accurate Records

As an Onlyfans creator, it's essential to keep accurate records of your income and expenses. This includes:

- Bank statements

- Invoices

- Receipts

- Contracts

- Emails and messages related to your work

Having these records will help you accurately report your income and expenses on your tax return. It's also a good idea to keep a separate business bank account to make it easier to track your business expenses.

Benefits of Keeping Accurate Records

- Accurately report your income and expenses

- Maximize your deductions

- Reduce your tax liability

- Avoid audits and penalties

Tax Tip #2: Take Advantage of Business Expense Deductions

As an Onlyfans creator, you may be eligible to deduct business expenses on your tax return. These expenses can include:

- Equipment and software costs

- Travel expenses

- Marketing and advertising expenses

- Home office expenses

- Professional fees (e.g., accounting, legal)

To qualify for these deductions, you'll need to keep accurate records of your expenses and ensure they're related to your Onlyfans business.

Common Business Expenses for Onlyfans Creators

- Camera and lighting equipment

- Editing software and computer hardware

- Travel expenses for photoshoots or events

- Marketing and advertising expenses (e.g., social media ads, promotions)

- Home office expenses (e.g., rent, utilities, internet)

Tax Tip #3: Utilize the Home Office Deduction

If you use a dedicated space in your home for your Onlyfans business, you may be eligible for the home office deduction. This deduction allows you to deduct a portion of your rent or mortgage interest, utilities, and other expenses related to your home office.

To qualify for the home office deduction, you'll need to meet the following requirements:

- You must use the space regularly and exclusively for business

- The space must be your primary place of business or a place where you meet with clients or customers

- You must be self-employed or a freelancer

Benefits of the Home Office Deduction

- Reduce your taxable income

- Lower your tax liability

- Increase your refund

Tax Tip #4: Consider Hiring a Tax Professional

As an Onlyfans creator, navigating the tax landscape can be complex and time-consuming. Consider hiring a tax professional to help you with your taxes. A tax professional can:

- Ensure you're taking advantage of all the deductions available to you

- Help you navigate the tax laws and regulations

- Reduce your tax liability

- Increase your refund

Benefits of Hiring a Tax Professional

- Save time and reduce stress

- Ensure accuracy and compliance

- Maximize your deductions and refund

Tax Tip #5: Plan for Quarterly Estimated Tax Payments

As an Onlyfans creator, you're required to make quarterly estimated tax payments to the IRS. These payments are due on April 15th, June 15th, September 15th, and January 15th of the following year.

To avoid penalties and interest, make sure to plan for these payments and set aside funds accordingly. You can use Form 1040-ES to make these payments.

Benefits of Planning for Quarterly Estimated Tax Payments

- Avoid penalties and interest

- Reduce your tax liability

- Ensure compliance with tax laws and regulations

What is the deadline for filing my tax return as an Onlyfans creator?

+The deadline for filing your tax return as an Onlyfans creator is typically April 15th of each year. However, if you need more time, you can file for an extension using Form 4868.

Can I deduct my Onlyfans subscription fees as a business expense?

+No, you cannot deduct your Onlyfans subscription fees as a business expense. However, you can deduct other business expenses related to your Onlyfans business, such as equipment costs, travel expenses, and marketing fees.

Do I need to file a separate business tax return as an Onlyfans creator?

+No, you do not need to file a separate business tax return as an Onlyfans creator. You can report your Onlyfans income and expenses on your personal tax return using Schedule C.

We hope these tax tips for Onlyfans creators have been helpful in navigating the tax landscape. Remember to keep accurate records, take advantage of business expense deductions, utilize the home office deduction, consider hiring a tax professional, and plan for quarterly estimated tax payments. By following these tips, you can reduce your tax liability and increase your refund. If you have any further questions or concerns, don't hesitate to reach out to a tax professional or the IRS.