As an Instacart shopper, understanding the 1099 form is crucial for your tax obligations. The 1099 form is used by the Internal Revenue Service (IRS) to report income earned from various sources, including freelance work, self-employment, and independent contractor arrangements. Here are five essential facts about the 1099 form for Instacart shoppers:

What is a 1099 Form?

The 1099 form is a series of documents used by the IRS to report income earned from various sources. There are several types of 1099 forms, including the 1099-MISC, 1099-INT, and 1099-DIV. Instacart shoppers typically receive a 1099-MISC form, which reports miscellaneous income earned from freelance work or independent contractor arrangements.

Types of 1099 Forms for Instacart Shoppers

Instacart shoppers may receive one or more of the following types of 1099 forms:

- 1099-MISC: Reports miscellaneous income earned from freelance work or independent contractor arrangements.

- 1099-NEC: Reports non-employee compensation earned from freelance work or independent contractor arrangements.

- 1099-K: Reports payment card and third-party network transactions.

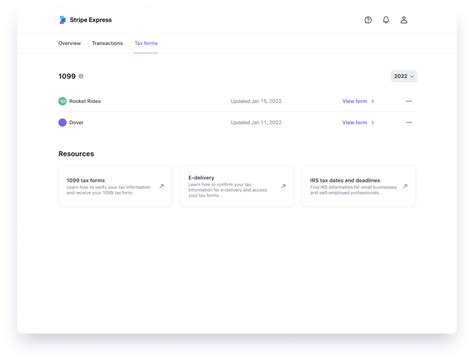

How to Receive a 1099 Form from Instacart

To receive a 1099 form from Instacart, you must meet certain requirements:

- Earn at least $600 in gross payments from Instacart in a calendar year.

- Have a valid Social Security number or Employer Identification Number (EIN).

- Have a valid email address on file with Instacart.

Instacart typically sends 1099 forms to eligible shoppers by January 31st of each year.

What Information is Included on a 1099 Form from Instacart?

A 1099 form from Instacart typically includes the following information:

- Your name and address.

- Instacart's name, address, and Employer Identification Number (EIN).

- The amount of gross payments earned from Instacart in a calendar year.

- The amount of federal income tax withheld, if applicable.

Understanding the Different Boxes on a 1099 Form

The 1099 form includes several boxes that report different types of income. Here's a breakdown of the most common boxes:

- Box 1: Reports miscellaneous income earned from freelance work or independent contractor arrangements.

- Box 2: Reports royalty payments.

- Box 3: Reports other income.

- Box 4: Reports federal income tax withheld.

How to File Taxes with a 1099 Form from Instacart

To file taxes with a 1099 form from Instacart, follow these steps:

- Gather all necessary tax documents, including your 1099 form and any other relevant income statements.

- Determine your business expenses and deductions.

- Complete Form 1040 and attach Schedule C (Form 1040).

- Report your business income and expenses on Schedule C.

- Complete Form 8949 and Schedule D (Form 1040) if you have any capital gains or losses.

Common Mistakes to Avoid When Filing Taxes with a 1099 Form from Instacart

Here are some common mistakes to avoid when filing taxes with a 1099 form from Instacart:

- Failing to report all income earned from Instacart.

- Failing to claim business expenses and deductions.

- Incorrectly completing Form 1040 and Schedule C.

- Failing to attach supporting documentation.

Tips for Accurate Tax Filing

To ensure accurate tax filing, follow these tips:

- Keep accurate records of your business income and expenses.

- Consult with a tax professional or accountant.

- Use tax preparation software to streamline the filing process.

FAQs About 1099 Forms for Instacart Shoppers

Do I need to file taxes if I earn less than $600 from Instacart?

+Yes, even if you earn less than $600 from Instacart, you may still need to file taxes. Consult with a tax professional or accountant to determine your tax obligations.

How do I report business expenses on my tax return?

+Report business expenses on Schedule C (Form 1040). You may need to complete Form 4562 to report depreciation and amortization.

Can I file my taxes electronically with a 1099 form from Instacart?

+Yes, you can file your taxes electronically with a 1099 form from Instacart. Use tax preparation software or consult with a tax professional or accountant to ensure accurate filing.

In conclusion, understanding the 1099 form is essential for Instacart shoppers to fulfill their tax obligations. By knowing the types of 1099 forms, how to receive a 1099 form from Instacart, and how to file taxes accurately, you can ensure a smooth tax filing process. Remember to avoid common mistakes and seek professional help if needed.