Receiving a 1098-T form from your university can be a bit daunting, especially if you're not familiar with the ins and outs of tax season. As a student or family member, it's essential to understand the importance of this form and how it can impact your tax return. In this comprehensive guide, we'll break down the Uic 1098-T form, its purpose, and provide you with a step-by-step explanation of how to use it.

What is the 1098-T Form?

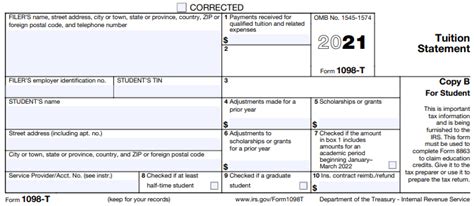

The 1098-T form, also known as the Tuition Statement, is an information return that colleges and universities are required to provide to students and the Internal Revenue Service (IRS). The form reports the amount of qualified tuition and related expenses (QTRE) paid by students during the calendar year.

Why is the 1098-T Form Important?

The 1098-T form is crucial for students and families who want to claim education tax credits or deductions on their tax return. The form provides the necessary information to calculate the amount of eligible expenses, which can help reduce taxable income.

How to Read the 1098-T Form

The 1098-T form typically contains the following information:

- Student's name, address, and taxpayer identification number (TIN)

- University's name, address, and employer identification number (EIN)

- Amounts reported in boxes 1 and 2:

- Box 1: Payments received for QTRE

- Box 2: Amounts billed for QTRE

- Academic period covered by the form

- Institution's certification

Understanding Box 1 and Box 2

Box 1 reports the total amount of payments received by the university for QTRE, while Box 2 reports the total amount billed for QTRE. It's essential to note that Box 2 is only reported if the university has changed its reporting method to include amounts billed.

Education Tax Credits and Deductions

The 1098-T form is used to support education tax credits and deductions, such as:

- American Opportunity Tax Credit (AOTC)

- Lifetime Learning Credit (LLC)

- Tuition and Fees Deduction

These tax benefits can help reduce taxable income, resulting in a lower tax bill or increased refund.

Eligibility Requirements

To be eligible for education tax credits and deductions, students must meet specific requirements, such as:

- Being enrolled at least half-time in a degree program

- Not having been convicted of a felony

- Not having claimed the AOTC or LLC in four previous tax years

Steps to Take with Your 1098-T Form

Once you receive your 1098-T form, follow these steps:

- Review the form for accuracy and completeness

- Use the information to complete Form 8863 (Education Credits) or Form 8917 (Tuition and Fees Deduction)

- Attach the completed form to your tax return (Form 1040)

- Keep a copy of the 1098-T form and supporting documentation for your records

Tips and Reminders

- Make sure to review your 1098-T form carefully, as errors can delay your tax refund

- Keep accurate records of tuition payments and expenses, as you may need to provide documentation to support your tax credits or deductions

- Consult with a tax professional or financial aid expert if you have questions or concerns about your 1098-T form or education tax benefits

We hope this comprehensive guide has helped you understand the Uic 1098-T form and its importance for students and families. If you have any further questions or concerns, please don't hesitate to reach out to your university's financial aid office or a tax professional.

What is the deadline for receiving my 1098-T form?

+The deadline for receiving your 1098-T form is January 31st of each year.

Can I claim education tax credits or deductions if I receive financial aid?

+Yes, you can claim education tax credits or deductions even if you receive financial aid. However, the amount of your tax benefits may be reduced or eliminated if you receive certain types of financial aid.

What if I have questions or concerns about my 1098-T form?

+If you have questions or concerns about your 1098-T form, you should contact your university's financial aid office or a tax professional for assistance.