The 1098-T form is a crucial document for students and families who claim education tax credits or deductions on their federal income tax return. As a student at the University of California, Santa Barbara (UCSB), it's essential to understand the ins and outs of the 1098-T form to maximize your tax benefits. Here are five essential facts about the 1098-T form at UCSB:

What is the 1098-T Form?

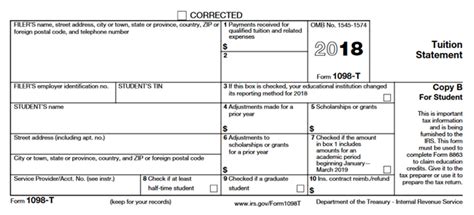

The 1098-T form, also known as the Tuition Statement, is a document provided by the University of California, Santa Barbara (UCSB) to students who have paid qualified tuition and related expenses during the calendar year. The form reports the amount of tuition and fees paid, as well as any scholarships or grants received.

Why is the 1098-T Form Important?

The 1098-T form is essential for students and families who claim education tax credits or deductions on their federal income tax return. The form provides the necessary information to claim the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC). These credits can help reduce the amount of federal income tax owed, providing significant savings for students and families.

How Does UCSB Handle 1098-T Forms?

UCSB is required by the Internal Revenue Service (IRS) to provide the 1098-T form to students by January 31st of each year. The form will be available online through the UCSB Student Portal, and students will receive an email notification when the form is available. Students can also request a paper copy of the form by contacting the UCSB Registrar's Office.

What Information is Reported on the 1098-T Form?

The 1098-T form reports the following information:

- Student's name, address, and taxpayer identification number (TIN)

- Amount of tuition and fees paid during the calendar year

- Amount of scholarships or grants received during the calendar year

- Amount of qualified tuition and related expenses paid during the calendar year

How to Claim Education Tax Credits Using the 1098-T Form

To claim education tax credits using the 1098-T form, students and families will need to follow these steps:

- Gather all necessary documents, including the 1098-T form, W-2 forms, and any other relevant tax documents.

- Complete Form 8863, Education Credits, and attach it to your federal income tax return (Form 1040).

- Claim the AOTC or LLC on your federal income tax return.

Common Mistakes to Avoid When Claiming Education Tax Credits

When claiming education tax credits using the 1098-T form, be sure to avoid the following common mistakes:

- Failing to report all qualified tuition and related expenses

- Claiming the wrong tax credit or deduction

- Failing to attach Form 8863 to your federal income tax return

Additional Resources and Support

UCSB offers a range of resources and support to help students and families understand the 1098-T form and claim education tax credits. These resources include:

- The UCSB Registrar's Office: Provides information and support on the 1098-T form and education tax credits.

- The UCSB Financial Aid Office: Offers guidance on financial aid and education tax credits.

- The IRS Website: Provides detailed information on education tax credits and deductions.

By understanding the 1098-T form and its role in claiming education tax credits, students and families at UCSB can maximize their tax benefits and reduce their federal income tax liability. Remember to review the form carefully, gather all necessary documents, and seek support from UCSB resources as needed.

Now that you've learned more about the 1098-T form at UCSB, take the next step and review your own form to ensure you're taking advantage of all the education tax credits available to you. Share your thoughts and questions in the comments below, and don't forget to share this article with your fellow students and families who may benefit from this information.

What is the deadline for receiving the 1098-T form from UCSB?

+UCSB is required to provide the 1098-T form to students by January 31st of each year.

What information is reported on the 1098-T form?

+The 1098-T form reports the student's name, address, and taxpayer identification number (TIN), as well as the amount of tuition and fees paid, scholarships or grants received, and qualified tuition and related expenses paid during the calendar year.

How do I claim education tax credits using the 1098-T form?

+To claim education tax credits, gather all necessary documents, including the 1098-T form, W-2 forms, and any other relevant tax documents. Complete Form 8863, Education Credits, and attach it to your federal income tax return (Form 1040).