As a student, understanding the tax implications of your education expenses can be overwhelming. The Texas State 1098-T form is an essential document that helps you navigate the tax landscape and claim potential tax credits and deductions. In this article, we will delve into the world of 1098-T forms, exploring what they are, how to read them, and how to use them to your advantage when filing your taxes.

What is the 1098-T Form?

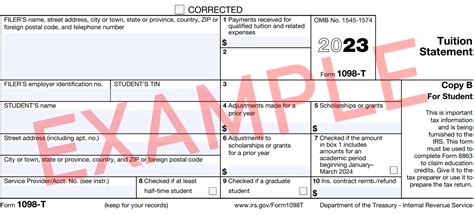

The 1098-T form, also known as the Tuition Statement, is a document provided by educational institutions to students and the Internal Revenue Service (IRS). Its primary purpose is to report the amount of qualified tuition and related expenses (QTRE) paid by students during a calendar year. This information is used to determine eligibility for tax credits and deductions, such as the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC).

How to Read the 1098-T Form

The 1098-T form is divided into several boxes, each containing specific information. Here's a breakdown of what you can expect to find:

- Box 1: Payments received for qualified tuition and related expenses (QTRE)

- Box 2: Amounts billed for qualified tuition and related expenses (QTRE)

- Box 3: Whether the educational institution changed its reporting method

- Box 4: Adjustments made to qualified tuition and related expenses (QTRE) for a prior year

- Box 5: Scholarships or grants

- Box 6: Adjustments to scholarships or grants for a prior year

- Box 7: Whether the amount in Box 1 includes amounts for an academic period beginning in the next calendar year

- Box 8: Whether the student is at least half-time enrolled

- Box 9: Whether the student is a graduate student

- Box 10: Insured amounts of qualified tuition and related expenses (QTRE) not reported in Box 1

Understanding the Boxes

It's essential to understand what each box represents and how it affects your tax situation. For example, Box 1 reports the actual payments made towards QTRE, while Box 2 reports the amounts billed. If you're eligible for tax credits or deductions, you'll need to use the information in these boxes to calculate your claim.

Tax Credits and Deductions

The 1098-T form is crucial in determining eligibility for tax credits and deductions. Here are some of the most common benefits:

- American Opportunity Tax Credit (AOTC): Up to $2,500 credit per eligible student

- Lifetime Learning Credit (LLC): Up to $2,000 credit per tax return

- Tuition and Fees Deduction: Up to $4,000 deduction per tax return

American Opportunity Tax Credit (AOTC)

The AOTC is a refundable credit of up to $2,500 per eligible student. To qualify, students must:

- Be pursuing a degree at an eligible educational institution

- Be enrolled at least half-time for at least one academic period

- Not have finished four years of post-secondary education before the beginning of the tax year

- Not have claimed the AOTC or the former Hope credit for more than four tax years

- Not have a felony conviction

Lifetime Learning Credit (LLC)

The LLC is a non-refundable credit of up to $2,000 per tax return. To qualify, students must:

- Be taking courses at an eligible educational institution to acquire or improve job skills

- Not be pursuing a degree

- Be enrolled in courses that lead to a degree, certificate, or other recognized education credential

How to Claim Tax Credits and Deductions

To claim tax credits and deductions, you'll need to complete the relevant tax forms and schedules. Here's a step-by-step guide:

- Form 8863: Education Credits (AOTC and LLC)

- Schedule A: Itemized Deductions (Tuition and Fees Deduction)

- Form 1040: U.S. Individual Income Tax Return

Additional Requirements

In addition to completing the relevant tax forms and schedules, you may need to provide supporting documentation, such as:

- 1098-T form

- Receipts for qualified tuition and related expenses (QTRE)

- Proof of enrollment and course materials

Common Questions and Answers

Here are some common questions and answers related to the 1098-T form and tax credits and deductions:

- Q: What is the deadline for filing the 1098-T form? A: The deadline for filing the 1098-T form is January 31st of each year.

- Q: Can I claim the AOTC and LLC in the same tax year? A: No, you can only claim one of these credits per tax year.

- Q: Can I claim the Tuition and Fees Deduction and the AOTC or LLC in the same tax year? A: No, you can only claim one of these benefits per tax year.

What is the 1098-T form used for?

+The 1098-T form is used to report qualified tuition and related expenses (QTRE) paid by students during a calendar year. This information is used to determine eligibility for tax credits and deductions.

How do I read the 1098-T form?

+The 1098-T form is divided into several boxes, each containing specific information. You should understand what each box represents and how it affects your tax situation.

Can I claim the AOTC and LLC in the same tax year?

+No, you can only claim one of these credits per tax year.

As a student, understanding the 1098-T form and its implications for your taxes is crucial. By following the guidelines outlined in this article, you'll be better equipped to navigate the tax landscape and claim potential tax credits and deductions. Remember to keep accurate records, complete the relevant tax forms and schedules, and seek professional advice if needed.