The 2016 tax season brought several changes and updates to the filing requirements for various tax forms, including the Form 1096. As a payer or a filer, it's essential to understand the new regulations and instructions to ensure accurate and timely submissions. In this article, we'll delve into the 2016 Form 1096 filing requirements and instructions, highlighting the key changes and providing guidance on how to comply.

What is Form 1096?

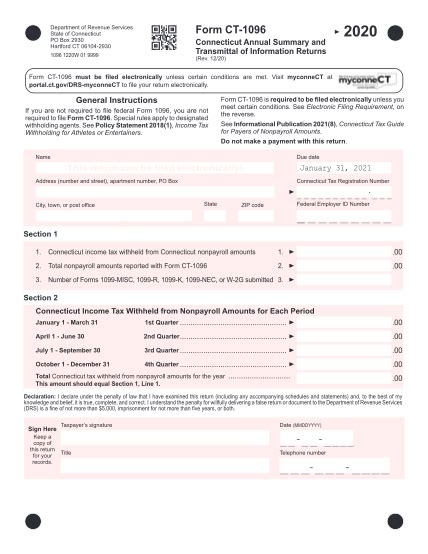

Form 1096, also known as the Annual Summary and Transmittal of U.S. Information Returns, is used to summarize and transmit various information returns, such as Form 1099, to the Internal Revenue Service (IRS). This form serves as a cover sheet, providing the IRS with a summary of the total number of returns and the total amount of payments reported on the accompanying Forms 1099.

Who Must File Form 1096?

The following individuals and entities are required to file Form 1096:

- Employers and payers who issue Forms 1099, 1098, or other information returns

- Payees who receive payments reported on Forms 1099, such as independent contractors, freelancers, and consultants

- Financial institutions, such as banks and credit unions, that issue Forms 1098 and 1099

- Government agencies, such as state and local governments, that issue Forms 1099 and 1098

2016 Form 1096 Filing Requirements

The 2016 Form 1096 filing requirements introduced several changes and updates. Some of the key changes include:

- Earlier Filing Deadline: The filing deadline for Form 1096 and accompanying Forms 1099 was moved up to January 31st for most types of returns. This change was implemented to provide the IRS with more time to process the returns and reduce the risk of identity theft.

- New Box for FATCA Reporting: A new box was added to Form 1096 to report Foreign Account Tax Compliance Act (FATCA) information.

- Updated Instructions: The instructions for Form 1096 were updated to reflect changes in the filing requirements and to provide clarification on specific reporting requirements.

When to File Form 1096

Form 1096 and accompanying Forms 1099 must be filed by the following deadlines:

- January 31st: For most types of returns, including Forms 1099-MISC, 1099-B, and 1099-S

- February 28th (March 31st if filed electronically): For Forms 1099-A, 1099-B, and 1099-C

- March 31st: For Forms 1099-G, 1099-H, and 1099-K

Instructions for Completing Form 1096

To ensure accurate and complete filing, follow these instructions for completing Form 1096:

- Step 1: Identify the Type of Return: Check the box to indicate the type of return being filed (e.g., Form 1099-MISC, Form 1098, etc.)

- Step 2: Enter the Total Number of Returns: Enter the total number of returns being filed (including any corrected or amended returns)

- Step 3: Enter the Total Amount of Payments: Enter the total amount of payments reported on the accompanying Forms 1099

- Step 4: Sign and Date the Form: Sign and date the form, as required by the payer or filer

Electronic Filing Requirements

The IRS requires electronic filing for most types of returns, including Forms 1099 and 1096. To file electronically, use the IRS's FIRE (Filing Information Returns Electronically) system. Ensure that you have the necessary software and follow the instructions provided by the IRS.

Common Errors to Avoid

When filing Form 1096, avoid the following common errors:

- Incorrect or Missing Information: Ensure that all required information is accurate and complete, including the payer's name, address, and Employer Identification Number (EIN)

- Incorrect Filing Deadline: Verify the correct filing deadline for the type of return being filed

- Failure to Sign and Date the Form: Ensure that the form is signed and dated by the payer or filer

Penalties for Non-Compliance

Failure to file or failure to file correctly can result in penalties, including:

- Late Filing Penalty: Up to $250 per return for late filing

- Failure to File Penalty: Up to $250 per return for failure to file

- Accuracy-Related Penalty: Up to 40% of the underpayment or understatement

Conclusion

The 2016 Form 1096 filing requirements introduced several changes and updates, including an earlier filing deadline and new reporting requirements. It's essential to understand these changes and follow the instructions provided to ensure accurate and timely submissions. By avoiding common errors and complying with the filing requirements, you can reduce the risk of penalties and ensure a smooth filing process.

Call to Action

If you have any questions or concerns about the 2016 Form 1096 filing requirements, please don't hesitate to comment below. Share this article with your colleagues and peers to help spread awareness about the importance of accurate and timely filing.

FAQ Section

What is the deadline for filing Form 1096?

+The deadline for filing Form 1096 varies depending on the type of return being filed. For most types of returns, the deadline is January 31st. However, some types of returns have a later deadline, such as February 28th or March 31st.

What is the penalty for late filing of Form 1096?

+The penalty for late filing of Form 1096 can range from $50 to $250 per return, depending on the type of return and the length of time the return is late.