As a Wisconsin resident, it's essential to understand your tax obligations, including filing your estimated tax form. The Wisconsin estimated tax form is a quarterly payment that helps you stay on top of your tax liability throughout the year. In this article, we'll explore five ways to file your Wisconsin estimated tax form, making it easier for you to meet your tax obligations.

Understanding Wisconsin Estimated Tax

Before we dive into the filing process, let's quickly review what Wisconsin estimated tax is. Wisconsin estimated tax is a quarterly payment that individuals and businesses must make to the state if they expect to owe more than $500 in taxes for the year. This payment is used to prepay your tax liability, reducing the amount you owe when you file your annual tax return.

Why File Wisconsin Estimated Tax Form?

Filing your Wisconsin estimated tax form is crucial to avoid penalties and interest on your tax liability. The state requires you to make quarterly payments if you expect to owe more than $500 in taxes for the year. By filing your estimated tax form, you can:

- Avoid penalties and interest on your tax liability

- Reduce the amount you owe when you file your annual tax return

- Stay on top of your tax obligations throughout the year

5 Ways to File Wisconsin Estimated Tax Form

Now that we've covered the importance of filing your Wisconsin estimated tax form, let's explore five ways to do so:

1. E-File Through the Wisconsin Department of Revenue Website

The Wisconsin Department of Revenue offers an online portal for filing your estimated tax form. You can e-file your form by visiting the department's website and following these steps:

- Log in to your account or create a new one

- Select the "Estimated Tax" option

- Fill out the online form with your tax information

- Make a payment using a credit or debit card, or e-check

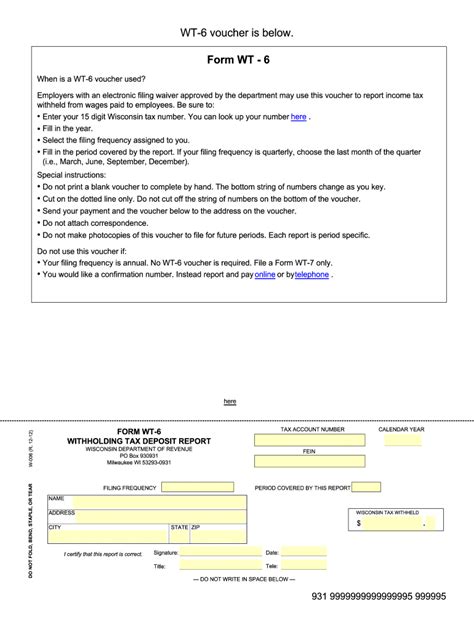

2. Mail a Paper Form

If you prefer to file a paper form, you can download the Wisconsin estimated tax form from the department's website or pick one up from a local library or tax office. To file by mail, follow these steps:

- Fill out the paper form with your tax information

- Make a payment using a check or money order

- Mail the form to the address listed on the form

3. Use a Tax Software Provider

Many tax software providers, such as TurboTax or H&R Block, offer e-filing services for Wisconsin estimated tax forms. To file using a tax software provider, follow these steps:

- Log in to your account or create a new one

- Select the "Estimated Tax" option

- Fill out the online form with your tax information

- Make a payment using a credit or debit card, or e-check

4. Visit a Local Tax Office

If you prefer to file your estimated tax form in person, you can visit a local tax office. To find a tax office near you, visit the Wisconsin Department of Revenue's website and follow these steps:

- Search for a tax office in your area

- Call the office to confirm their hours and availability

- Bring your tax information and payment to the office

5. Use a Tax Professional

If you're not comfortable filing your estimated tax form yourself, you can hire a tax professional to do it for you. To find a tax professional, visit the Wisconsin Department of Revenue's website and follow these steps:

- Search for a tax professional in your area

- Check their credentials and experience

- Contact them to schedule an appointment

Filing Deadlines and Payment Schedules

It's essential to file your Wisconsin estimated tax form on time to avoid penalties and interest. The filing deadlines and payment schedules are as follows:

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

Conclusion

Filing your Wisconsin estimated tax form is a crucial step in managing your tax obligations. By understanding the five ways to file your form, you can stay on top of your tax liability and avoid penalties and interest. Remember to file your form on time, and don't hesitate to reach out to a tax professional if you need help.

Call to Action

We hope this article has helped you understand the process of filing your Wisconsin estimated tax form. If you have any questions or concerns, please don't hesitate to comment below. Share this article with your friends and family who may need help with their tax obligations.

What is the deadline for filing Wisconsin estimated tax form?

+The deadlines for filing Wisconsin estimated tax form are April 15th, June 15th, September 15th, and January 15th of the following year.

Can I file my Wisconsin estimated tax form online?

+Yes, you can file your Wisconsin estimated tax form online through the Wisconsin Department of Revenue's website or through a tax software provider.

What happens if I don't file my Wisconsin estimated tax form on time?

+If you don't file your Wisconsin estimated tax form on time, you may be subject to penalties and interest on your tax liability.