Navigating the complex world of child support can be a daunting task, especially when faced with the added burden of arrears. Wisconsin residents struggling to manage their child support debt may feel overwhelmed, but there are options available to help alleviate this financial strain. In this article, we will delve into the world of Wisconsin child support arrears forgiveness, exploring the various options and pathways to achieve debt relief.

Understanding Child Support Arrears in Wisconsin

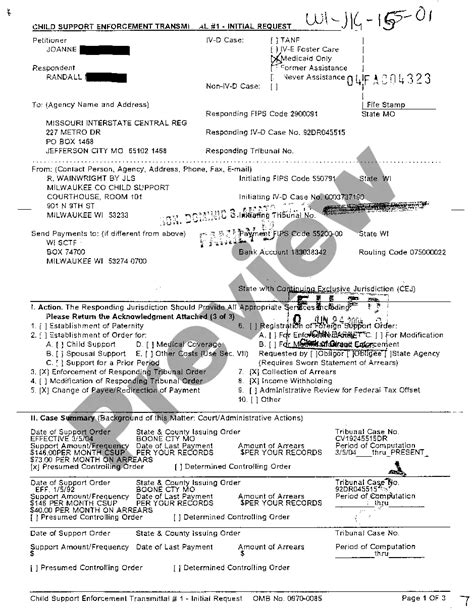

Child support arrears refer to the accumulation of unpaid child support obligations. In Wisconsin, child support orders are typically issued by the court, outlining the amount and frequency of payments. When payments are missed, the outstanding balance grows, and the paying parent may face penalties, fines, and even contempt of court charges. Understanding the intricacies of Wisconsin child support arrears is crucial for developing an effective plan to address and ultimately forgive the debt.

Wisconsin Child Support Forgiveness Programs

Wisconsin offers several child support forgiveness programs aimed at providing relief to paying parents struggling with arrears. These programs include:

- Partial Payment Program: This program allows paying parents to make reduced payments towards their arrears while maintaining regular child support payments. By participating in this program, paying parents can avoid collections and contempt of court charges.

- Compromise of Arrears Program: This program enables paying parents to settle their arrears debt for a lump sum payment, often significantly lower than the original amount owed.

- Stipulation and Order for Reduced Arrears: Paying parents can negotiate with the state or the receiving parent to reduce the outstanding arrears balance.

Eligibility Requirements for Forgiveness Programs

To qualify for these forgiveness programs, paying parents typically must meet specific eligibility requirements, such as:

- Being current on regular child support payments

- Having a reduced income or experiencing financial hardship

- Cooperating with child support agencies and providing financial information

- Making a lump sum payment or agreeing to a payment plan

Tax Refund Offset and Child Support Arrears

In Wisconsin, the state may intercept tax refunds to collect child support arrears. This process, known as tax refund offset, can help reduce the outstanding balance. However, paying parents can take steps to avoid or minimize tax refund offset by:

- Filing for a tax refund exemption

- Making timely child support payments

- Participating in a forgiveness program

Modifying Child Support Orders to Reduce Arrears

In some cases, paying parents may be able to modify their child support orders to reduce the amount of arrears owed. This can be achieved by:

- Requesting a downward modification of the child support order

- Providing evidence of a significant change in circumstances, such as job loss or reduced income

- Negotiating with the receiving parent or the state

Bankruptcy and Child Support Arrears

Filing for bankruptcy may not necessarily discharge child support arrears. In Wisconsin, child support debts are generally considered non-dischargeable in bankruptcy proceedings. However, bankruptcy may still provide some relief by:

- Allowing paying parents to reorganize their finances and create a plan to address arrears

- Stopping collections and contempt of court charges

- Providing an opportunity to negotiate with creditors and the state

Seeking Professional Help to Address Child Support Arrears

Navigating the complexities of Wisconsin child support arrears forgiveness can be overwhelming. Seeking the guidance of a qualified attorney or child support specialist can help paying parents:

- Understand their options and develop an effective plan

- Negotiate with the state or the receiving parent

- Complete the necessary paperwork and documentation

If you are struggling with child support arrears in Wisconsin, we encourage you to explore the options outlined above. By taking proactive steps to address your debt, you can work towards a more stable financial future for yourself and your family. Share your thoughts and experiences in the comments below, and don't hesitate to reach out for support.

Can I negotiate with the state to reduce my child support arrears?

+Yes, you can negotiate with the state to reduce your child support arrears. This can be done through the Wisconsin Department of Children and Families or a private attorney.

Will filing for bankruptcy discharge my child support arrears?

+No, child support debts are generally considered non-dischargeable in bankruptcy proceedings in Wisconsin.

Can I modify my child support order to reduce the amount of arrears owed?

+Yes, you may be able to modify your child support order by requesting a downward modification or providing evidence of a significant change in circumstances.