The Form 941x - a crucial document for employers who need to make adjustments to their quarterly employment tax returns. But where do you mail this form once it's completed? Don't worry, we've got you covered! In this article, we'll explore three easy options for mailing Form 941x, ensuring you meet the IRS requirements and avoid any potential penalties.

Understanding Form 941x

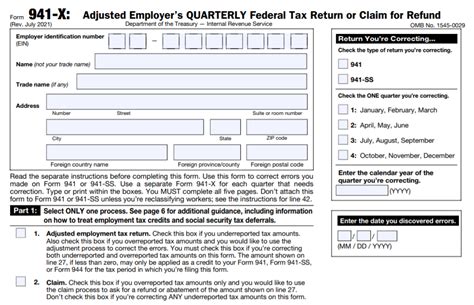

Before we dive into the mailing options, let's quickly review what Form 941x is all about. This form is used to correct errors or make adjustments to previously filed Form 941 returns. Employers use it to report changes in employment taxes, such as correcting wages, tips, or taxes withheld. The IRS requires employers to file Form 941x for each quarter that needs corrections.

Option 1: Mailing to the IRS Address Listed in the Instructions

The first option is to mail Form 941x to the address listed in the instructions for the form. You can find the current mailing address in the Form 941x instructions or on the IRS website. Make sure to use the correct address, as it may change over time. When mailing to this address, ensure you include the following:

- The completed Form 941x

- Any required supporting documentation

- A check or money order for any tax due (if applicable)

Tips for Mailing to the IRS Address

- Use certified mail or a trackable shipping method to ensure delivery and receipt confirmation.

- Keep a copy of the form and supporting documentation for your records.

- Double-check the address and ensure it's the most current one.

Option 2: Mailing to a Private Delivery Service (PDS) Address

Another option is to mail Form 941x to a Private Delivery Service (PDS) address. The IRS has designated certain PDS providers, such as FedEx and UPS, to accept tax returns and other documents. When using a PDS, ensure you follow these guidelines:

- Use the correct PDS address listed in the Form 941x instructions or on the IRS website.

- Include the required documentation and payment (if applicable).

- Keep a copy of the form and supporting documentation for your records.

Tips for Mailing to a PDS Address

- Verify the PDS provider and address before mailing.

- Use a trackable shipping method to confirm delivery and receipt.

- Keep a record of the mailing date and delivery confirmation.

Option 3: Electronic Filing (e-file)

The third option is to e-file Form 941x using the IRS's Electronic Federal Tax Payment System (EFTPS). This method is convenient and faster than mailing a physical copy. To e-file, you'll need to:

- Register for an EFTPS account on the IRS website.

- Follow the online instructions for e-filing Form 941x.

- Ensure you have the required documentation and payment (if applicable) ready for upload.

Tips for E-filing

- Ensure you have a secure internet connection and a compatible browser.

- Double-check the form and supporting documentation before submitting.

- Keep a copy of the confirmation receipt for your records.

By following these three easy options, you'll be able to successfully mail your Form 941x and meet the IRS requirements. Remember to always verify the mailing address or PDS provider before sending your form, and consider e-filing for a faster and more convenient experience.

What is the deadline for mailing Form 941x?

+The deadline for mailing Form 941x is typically the same as the deadline for filing the original Form 941 return. However, it's best to check the IRS website or consult with a tax professional for the most up-to-date information.

Can I fax Form 941x to the IRS?

+No, the IRS does not accept faxed copies of Form 941x. You must mail or e-file the form according to the instructions.

What if I need to make corrections to multiple quarters?

+If you need to make corrections to multiple quarters, you'll need to complete a separate Form 941x for each quarter. You can mail or e-file each form separately, following the instructions for each quarter.

We hope this article has provided you with the necessary information to successfully mail your Form 941x. Remember to double-check the mailing address or PDS provider, and consider e-filing for a faster and more convenient experience. If you have any further questions or concerns, feel free to ask in the comments below!