Entering Form 3922 on TurboTax can seem like a daunting task, but with the right guidance, you can easily navigate the process. In this article, we will walk you through the steps to enter Form 3922 on TurboTax, making it easier for you to complete your tax return.

Understanding Form 3922

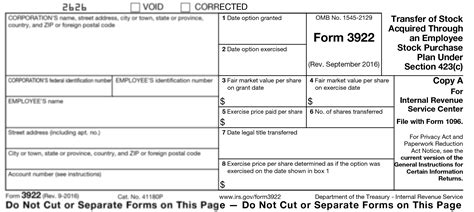

Before we dive into the steps, let's briefly discuss what Form 3922 is and why it's essential. Form 3922, also known as the Exercise of an Incentive Stock Option Under Section 422(b), is used to report the exercise of an incentive stock option (ISO). If you exercised an ISO in the tax year, your employer will provide you with a copy of Form 3922.

Step 1: Gather Required Information

To enter Form 3922 on TurboTax, you'll need the following information:

- Your copy of Form 3922

- The date you exercised the ISO

- The number of shares exercised

- The exercise price per share

- The fair market value (FMV) per share on the exercise date

Locating the Required Information on Form 3922

- Box 1: Date option was granted

- Box 2: Date option was exercised

- Box 3: Number of shares

- Box 4: Exercise price per share

- Box 5: Fair market value per share on exercise date

Step 2: Open TurboTax and Navigate to the Correct Section

Once you have gathered the required information, open TurboTax and navigate to the "Investments" or "Employment" section, depending on the version of TurboTax you're using. Look for the "Stock Options" or "Incentive Stock Options" subsection.

Search for the Correct Topic in TurboTax

- Type "Stock Options" or "Incentive Stock Options" in the search bar

- Click on the relevant topic to access the correct section

Step 3: Enter Form 3922 Information

In the "Stock Options" or "Incentive Stock Options" section, click on the "Add" or "Start" button to create a new entry. Follow the prompts to enter the required information from Form 3922.

Enter the Following Information

- Date option was exercised (Box 2)

- Number of shares (Box 3)

- Exercise price per share (Box 4)

- Fair market value per share on exercise date (Box 5)

Step 4: Review and Submit Your Return

After entering the Form 3922 information, review your tax return for accuracy. Ensure all other required information is complete and accurate. Once you're satisfied with your return, submit it to the IRS.

What to Expect After Submitting Your Return

- Receive a confirmation from the IRS

- Review your tax refund or balance due

- Address any potential issues or errors

Now that you've successfully entered Form 3922 on TurboTax, take a moment to review your tax return and ensure everything is accurate. If you have any questions or concerns, don't hesitate to reach out to TurboTax support or a tax professional.

Common Questions and Answers

Here are some common questions and answers related to entering Form 3922 on TurboTax:

Q: What if I have multiple Form 3922s to report?

A: You can enter multiple Form 3922s in TurboTax by following the same steps outlined above. Simply click on the "Add" or "Start" button to create a new entry for each Form 3922.

Q: Can I e-file my tax return with Form 3922?

A: Yes, you can e-file your tax return with Form 3922. TurboTax will guide you through the e-filing process and ensure your return is submitted accurately.

Q: What if I need help entering Form 3922?

A: If you need help entering Form 3922, you can contact TurboTax support or consult a tax professional. They can assist you with the process and ensure your tax return is accurate.

What is the deadline for filing Form 3922?

+The deadline for filing Form 3922 is the same as the deadline for filing your tax return. Typically, this is April 15th of each year.

Can I file an amended return if I forgot to include Form 3922?

+Yes, you can file an amended return (Form 1040X) to include Form 3922. However, you must do so within three years from the original filing deadline.

How do I report the sale of stock acquired through an ISO?

+To report the sale of stock acquired through an ISO, you'll need to complete Schedule D (Form 1040) and Form 8949. TurboTax can guide you through this process.

We hope this article has helped you understand the process of entering Form 3922 on TurboTax. If you have any further questions or concerns, please don't hesitate to reach out. Share your experiences or ask questions in the comments below!