As an employee, it's essential to understand the W-4 form, also known as the Employee's Withholding Certificate. This form is used by employers to determine the amount of federal income tax to withhold from your paycheck. In this article, we'll break down the W-4 form into 5 easy steps, helping you to better comprehend its purpose, importance, and how to fill it out accurately.

Step 1: Purpose and Importance of the W-4 Form

The W-4 form is a crucial document that helps your employer determine how much federal income tax to withhold from your paycheck. By filling out the form accurately, you can ensure that the correct amount of taxes is withheld, reducing the likelihood of owing taxes or receiving a large refund when you file your tax return.

The W-4 form is also important because it helps the government to collect taxes throughout the year, rather than all at once when you file your tax return. This is known as pay-as-you-earn taxation, and it's a key component of the U.S. tax system.

Why is the W-4 Form Important for Employees?

The W-4 form is important for employees because it allows you to:

- Control the amount of taxes withheld from your paycheck

- Reduce the likelihood of owing taxes or receiving a large refund

- Take advantage of tax credits and deductions

- Ensure compliance with tax laws and regulations

Step 2: Who Needs to Fill Out a W-4 Form?

All employees, including part-time and seasonal workers, need to fill out a W-4 form when they start a new job. This includes:

- U.S. citizens and resident aliens

- Nonresident aliens who are subject to U.S. taxation

- Employees who receive a salary, wages, or tips

However, some employees may not need to fill out a W-4 form, including:

- Employees who are exempt from federal income tax withholding

- Employees who are subject to a reduced rate of withholding

- Employees who are entitled to a withholding exemption

Step 3: How to Fill Out a W-4 Form

Filling out a W-4 form is relatively straightforward. Here are the steps to follow:

- Step 1: Personal Information: Provide your name, address, and Social Security number.

- Step 2: Filing Status: Choose your filing status, such as single, married, or head of household.

- Step 3: Allowances: Claim the number of allowances you're eligible for, based on your filing status and number of dependents.

- Step 4: Additional Withholding: Request additional withholding, if desired.

- Step 5: Signature: Sign and date the form.

Understanding Allowances

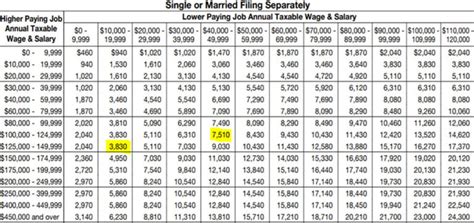

Allowances are the key to determining how much federal income tax is withheld from your paycheck. The more allowances you claim, the less tax will be withheld. Here's how to calculate your allowances:

- Single: Claim 1 allowance if you're single and have no dependents.

- Married: Claim 2 allowances if you're married and have no dependents.

- Head of Household: Claim 2 allowances if you're head of household and have no dependents.

- Dependents: Claim 1 additional allowance for each dependent you claim on your tax return.

Step 4: Common Mistakes to Avoid

When filling out a W-4 form, it's essential to avoid common mistakes, such as:

- Underreporting income: Failing to report all income, including tips and freelance work.

- Overreporting allowances: Claiming too many allowances, which can result in underwithholding.

- Not updating the form: Failing to update the form when your personal or financial situation changes.

Step 5: Review and Update Your W-4 Form

It's essential to review and update your W-4 form regularly, especially when your personal or financial situation changes. Here are some scenarios that may require you to update your W-4 form:

- Marriage or divorce: Update your filing status and number of allowances.

- Birth or adoption: Claim an additional allowance for each dependent.

- Job change: Update your income and number of allowances.

- Tax law changes: Review your W-4 form to ensure compliance with new tax laws and regulations.

By following these 5 easy steps, you'll be able to understand and fill out a W-4 form accurately, ensuring that the correct amount of federal income tax is withheld from your paycheck.

We encourage you to share your thoughts and experiences with the W-4 form in the comments section below. If you have any questions or need further clarification, don't hesitate to ask.

What is the purpose of the W-4 form?

+The W-4 form is used by employers to determine the amount of federal income tax to withhold from an employee's paycheck.

Who needs to fill out a W-4 form?

+All employees, including part-time and seasonal workers, need to fill out a W-4 form when they start a new job.

How do I calculate my allowances?

+Allowances are based on your filing status and number of dependents. Claim 1 allowance if you're single and have no dependents, 2 allowances if you're married and have no dependents, and 1 additional allowance for each dependent you claim on your tax return.