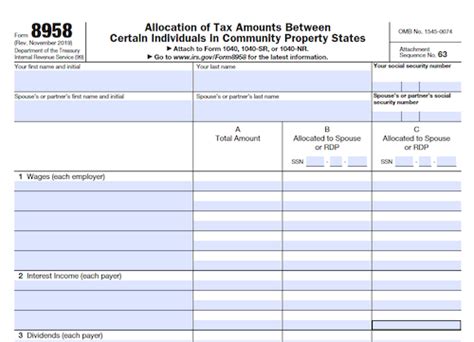

Tax season can be a daunting time for many individuals and businesses, with numerous forms to fill out and deadlines to meet. One form that may be unfamiliar to some is Tax Form 8958, also known as the "Allocation of Tax Amounts Among Certain Individuals" form. In this article, we will delve into the details of Tax Form 8958, its purpose, and how it is used.

What is Tax Form 8958?

Tax Form 8958 is an Internal Revenue Service (IRS) form used by certain entities, such as trusts, estates, and real estate mortgage investment conduits (REMICs), to allocate tax amounts among their beneficiaries or investors. The form is used to report the allocation of tax items, including income, deductions, and credits, among the entities' interest holders.

Who Needs to File Tax Form 8958?

The following entities are required to file Tax Form 8958:

- Trusts: Trusts that are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts, must also file Form 8958 to allocate tax amounts among their beneficiaries.

- Estates: Estates that are required to file Form 1041 must also file Form 8958 to allocate tax amounts among their beneficiaries.

- REMICs: REMICs that are required to file Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, must also file Form 8958 to allocate tax amounts among their interest holders.

How to Fill Out Tax Form 8958

To fill out Tax Form 8958, the entity must provide the following information:

- The entity's name, address, and taxpayer identification number (TIN)

- The names, addresses, and TINs of the beneficiaries or interest holders

- The amount of tax allocated to each beneficiary or interest holder

- A statement explaining the method used to allocate the tax amounts

Important Deadlines and Requirements

The deadline for filing Tax Form 8958 is the same as the deadline for filing the entity's tax return (Form 1041 or Form 1066). For trusts and estates, this is typically April 15th of each year, while REMICs must file by March 15th.

In addition to filing the form, entities must also provide a copy of the form to each beneficiary or interest holder by the same deadline. This ensures that each individual receives the necessary information to complete their own tax return.

Benefits of Filing Tax Form 8958

Filing Tax Form 8958 provides several benefits to entities and their beneficiaries or interest holders:

- Accurate tax allocation: The form ensures that tax amounts are accurately allocated among the entity's interest holders.

- Compliance with IRS regulations: Filing the form demonstrates compliance with IRS regulations and avoids potential penalties.

- Simplified tax preparation: The form provides a clear and concise summary of tax allocations, making it easier for interest holders to complete their own tax returns.

Potential Consequences of Not Filing Tax Form 8958

Failure to file Tax Form 8958 can result in significant consequences, including:

- Penalties: The IRS may impose penalties on the entity for failing to file the form.

- Interest: The entity may be required to pay interest on any unpaid taxes.

- Loss of benefits: Failure to file the form may result in the loss of tax benefits, such as deductions and credits.

Conclusion

In conclusion, Tax Form 8958 is an essential tool for certain entities to allocate tax amounts among their beneficiaries or interest holders. By understanding the purpose and requirements of the form, entities can ensure compliance with IRS regulations and avoid potential penalties. If you are required to file Tax Form 8958, it is essential to consult with a tax professional to ensure accurate completion and timely filing.

We encourage you to share your thoughts and experiences with Tax Form 8958 in the comments below. If you have any questions or need further clarification, please don't hesitate to ask.

What is the purpose of Tax Form 8958?

+Tax Form 8958 is used to allocate tax amounts among certain entities' beneficiaries or interest holders.

Who needs to file Tax Form 8958?

+Trusts, estates, and REMICs are required to file Tax Form 8958.

What is the deadline for filing Tax Form 8958?

+The deadline for filing Tax Form 8958 is the same as the deadline for filing the entity's tax return (Form 1041 or Form 1066).