Tapping into your retirement savings can be a significant decision, and it's essential to understand the process involved. If you have an Individual Retirement Account (IRA) with Wells Fargo, you'll need to complete the Wells Fargo IRA Distribution Form to initiate the withdrawal process. In this article, we'll break down the form, its requirements, and provide a step-by-step guide to help you navigate the process with ease.

Understanding the Wells Fargo IRA Distribution Form

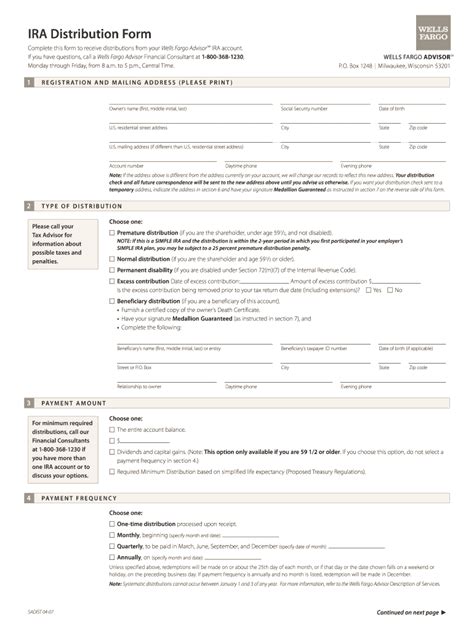

The Wells Fargo IRA Distribution Form is a critical document that enables account holders to request distributions from their IRA accounts. The form is used to specify the type of distribution, the amount, and the payment method. Before we dive into the step-by-step guide, it's essential to understand the types of distributions you can request using this form.

Types of Distributions

There are several types of distributions you can request using the Wells Fargo IRA Distribution Form:

- Lump Sum Distribution: A one-time payment of a portion or the entire balance of your IRA account.

- Periodic Distribution: Regular payments from your IRA account, which can be monthly, quarterly, or annually.

- Required Minimum Distribution (RMD): Mandatory annual distributions from your IRA account, starting at age 72.

Step-by-Step Guide to Completing the Wells Fargo IRA Distribution Form

To complete the Wells Fargo IRA Distribution Form, follow these steps:

- Gather Required Information: Before starting the form, ensure you have the following information:

- Your IRA account number

- Your name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- The type of distribution you want to request (lump sum, periodic, or RMD)

- Section 1: Account Information: Fill in your IRA account number, name, and address.

- Section 2: Distribution Information: Specify the type of distribution you want to request:

- Lump Sum Distribution: Enter the amount you want to withdraw.

- Periodic Distribution: Choose the frequency (monthly, quarterly, or annually) and enter the amount.

- RMD: Wells Fargo will calculate the RMD amount based on your account balance and age.

- Section 3: Payment Information: Choose how you want to receive the distribution:

- Direct Deposit: Provide your bank account information.

- Check: Wells Fargo will mail a check to your address.

- Section 4: Tax Withholding: Decide if you want to withhold federal income taxes from the distribution:

- Yes: Specify the percentage or amount you want to withhold.

- No: No taxes will be withheld.

- Section 5: Signature: Sign and date the form.

Additional Requirements and Considerations

Before submitting the form, consider the following:

- Tax Implications: Distributions from your IRA account are subject to income taxes. You may want to consult with a tax professional to understand the tax implications of your distribution.

- Penalty for Early Withdrawal: If you're under age 59 1/2, you may be subject to a 10% penalty for early withdrawal, in addition to income taxes.

- Required Minimum Distribution (RMD): If you're 72 or older, you must take RMDs from your IRA account each year.

Submitting the Wells Fargo IRA Distribution Form

Once you've completed the form, you can submit it to Wells Fargo in one of the following ways:

- Mail: Send the form to the address listed on the form.

- Fax: Fax the form to the number listed on the form.

- Online: Upload the completed form through the Wells Fargo website.

Conclusion

Withdrawing from your Wells Fargo IRA account requires careful consideration and attention to detail. By following this step-by-step guide, you'll be able to complete the Wells Fargo IRA Distribution Form with ease. Remember to consider the tax implications and potential penalties for early withdrawal before submitting the form.

We encourage you to share your experiences or ask questions about the Wells Fargo IRA Distribution Form in the comments section below.

What is the Wells Fargo IRA Distribution Form used for?

+The Wells Fargo IRA Distribution Form is used to request distributions from your IRA account, including lump sum, periodic, and Required Minimum Distribution (RMD) payments.

What information do I need to complete the Wells Fargo IRA Distribution Form?

+You'll need your IRA account number, name, address, Social Security number or ITIN, and the type of distribution you want to request.

How do I submit the Wells Fargo IRA Distribution Form?

+You can submit the form by mail, fax, or online through the Wells Fargo website.