Losing a loved one is never easy, and navigating the complexities of their estate can be overwhelming. When it comes to Wells Fargo IRA beneficiary claims, it's essential to understand the process to ensure a smooth and efficient transfer of funds. In this article, we'll guide you through the 5-step process of completing a Wells Fargo IRA beneficiary claim.

Understanding the Importance of Beneficiary Designations

Before we dive into the claim process, it's crucial to understand the importance of beneficiary designations. When you open an IRA with Wells Fargo, you're required to designate a beneficiary. This ensures that your assets are distributed according to your wishes in the event of your passing. Failing to designate a beneficiary or not keeping the designations up-to-date can lead to unnecessary complications and delays in the claim process.

Step 1: Gather Required Documents

To initiate the claim process, you'll need to gather the required documents. These typically include:

- The deceased's IRA account information

- A certified copy of the death certificate

- Proof of your identity (driver's license, passport, or state ID)

- Proof of your relationship to the deceased (birth certificate, marriage certificate, or trust document)

It's essential to ensure that all documents are accurate and up-to-date to avoid any delays in the claim process.

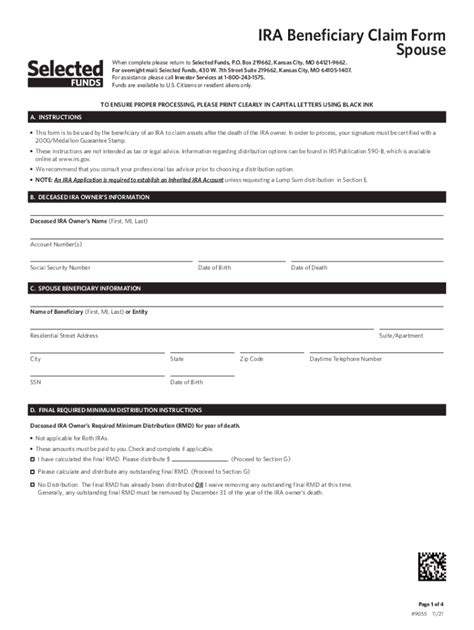

Wells Fargo IRA Claim Form

You'll also need to complete the Wells Fargo IRA Claim Form, which can be obtained from the Wells Fargo website or by contacting their customer service. This form will require you to provide detailed information about the deceased, their IRA account, and your relationship to them.Step 2: Notify Wells Fargo

Once you've gathered all the required documents, it's time to notify Wells Fargo of the deceased's passing. You can do this by:

- Calling their customer service at 1-800-869-3557

- Sending a letter to the address listed on the Wells Fargo website

- Filing a claim online through the Wells Fargo website

It's essential to provide all the required documents and information to avoid any delays in the claim process.

Step 3: Complete the Claim Process

After notifying Wells Fargo, you'll need to complete the claim process. This typically involves:

- Filling out the Wells Fargo IRA Claim Form

- Providing any additional documentation required by Wells Fargo

- Waiting for Wells Fargo to review and process the claim

Wells Fargo IRA Claim Review Process

Wells Fargo will review your claim to ensure that all the necessary documentation is in order. This process can take several weeks to several months, depending on the complexity of the claim.Step 4: Receive the Claim Distribution

Once your claim has been approved, you'll receive the claim distribution. This can be paid out in a lump sum or as an annuity, depending on the terms of the IRA.

Wells Fargo IRA Claim Payout Options

Wells Fargo offers several payout options, including:- Lump sum payment

- Annuity payments

- Roll-over to a new IRA account

It's essential to carefully review the payout options to ensure that you choose the one that best suits your needs.

Step 5: Follow Up and Seek Professional Advice

Finally, it's essential to follow up with Wells Fargo to ensure that the claim process is completed smoothly. You may also want to seek professional advice from a financial advisor or attorney to ensure that you're making the best decisions for your financial future.

Wells Fargo IRA Beneficiary Claim FAQs

We've compiled a list of frequently asked questions to help you navigate the Wells Fargo IRA beneficiary claim process.What is the Wells Fargo IRA beneficiary claim process?

+The Wells Fargo IRA beneficiary claim process involves gathering required documents, notifying Wells Fargo, completing the claim process, receiving the claim distribution, and following up with Wells Fargo.

How long does the Wells Fargo IRA beneficiary claim process take?

+The Wells Fargo IRA beneficiary claim process can take several weeks to several months, depending on the complexity of the claim.

What are the payout options for a Wells Fargo IRA beneficiary claim?

+Wells Fargo offers several payout options, including lump sum payment, annuity payments, and roll-over to a new IRA account.

In conclusion, completing a Wells Fargo IRA beneficiary claim requires patience, attention to detail, and a clear understanding of the process. By following these 5 steps, you can ensure a smooth and efficient transfer of funds. Remember to seek professional advice if you're unsure about any aspect of the process. Share your experiences or ask questions in the comments below.