Washington residents have access to a wide range of health insurance plans through the Washington Healthplanfinder, the state's online health insurance marketplace. The application process can be overwhelming, especially for those who are new to health insurance or have complex family situations. In this article, we will guide you through the Washington Health Plan Finder application form, highlighting key sections, requirements, and tips to ensure a smooth and successful enrollment process.

Understanding the Washington Healthplanfinder

The Washington Healthplanfinder is a website that allows individuals and families to compare and purchase health insurance plans from various insurance companies. The marketplace also provides access to financial assistance, such as tax credits and cost-sharing reductions, to eligible applicants. To apply for health insurance through the Washington Healthplanfinder, you will need to complete an application form, which can be done online, by phone, or in person with the help of a certified navigator or broker.

Gathering Required Documents

Before starting the application process, it's essential to gather all required documents to ensure a smooth and efficient experience. These documents may include:

- Identification documents (driver's license, state ID, or passport)

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Proof of income (pay stubs, W-2 forms, or tax returns)

- Proof of Washington state residency (utility bills, lease agreements, or mail with your name and address)

Completing the Application Form

The Washington Health Plan Finder application form is divided into several sections, each requesting specific information about you and your household. Here's a breakdown of the key sections:

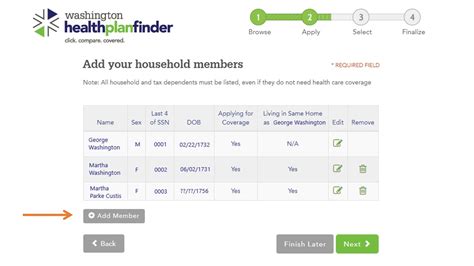

- Section 1: Household Information

- List all household members, including yourself, spouse, children, and anyone else who lives with you.

- Provide each household member's name, date of birth, Social Security number, and relationship to you.

- Section 2: Income and Employment

- Report your income from all sources, including jobs, self-employment, and investments.

- Provide information about your employer and job, including your employer's name, address, and phone number.

- Section 3: Health Insurance Coverage

- Indicate whether you or any household member currently has health insurance coverage.

- Provide information about your current health insurance plan, including the plan name, policy number, and effective dates.

- Section 4: Eligibility and Enrollment

- Answer questions about your eligibility for health insurance coverage, including your citizenship status and Washington state residency.

- Choose your preferred health insurance plan and enrollment effective date.

Tips and Reminders

- Make sure to review and update your application carefully before submitting it.

- If you're applying for financial assistance, ensure that you provide all required documentation to support your income and household information.

- Don't hesitate to ask for help if you need it – certified navigators and brokers are available to assist you with the application process.

Special Enrollment Periods

In addition to the annual open enrollment period, you may be eligible for a special enrollment period if you experience a qualifying life event, such as:

- Losing your job or health insurance coverage

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new state or zip code

If you experience a qualifying life event, you can apply for health insurance coverage through the Washington Healthplanfinder outside of the annual open enrollment period.

Additional Resources

- Washington Healthplanfinder website:

- Washington Healthplanfinder customer support: 1-855-923-4633

- Certified navigators and brokers: Find a certified navigator or broker in your area by visiting the Washington Healthplanfinder website.

By following this guide and taking the time to carefully review and complete the Washington Health Plan Finder application form, you'll be well on your way to securing health insurance coverage that meets your needs and budget.

FAQs

What is the deadline to apply for health insurance through the Washington Healthplanfinder?

+The annual open enrollment period typically runs from November to January. However, if you experience a qualifying life event, you may be eligible for a special enrollment period.

Can I apply for health insurance through the Washington Healthplanfinder if I'm not a U.S. citizen?

+Yes, you may be eligible for health insurance coverage through the Washington Healthplanfinder, even if you're not a U.S. citizen. However, you'll need to meet certain eligibility requirements and provide documentation to support your application.

How do I know if I'm eligible for financial assistance through the Washington Healthplanfinder?

+To determine your eligibility for financial assistance, you'll need to complete an application and provide documentation to support your income and household information. The Washington Healthplanfinder will review your application and determine your eligibility for tax credits and cost-sharing reductions.

We hope this guide has been helpful in navigating the Washington Health Plan Finder application form. If you have any further questions or concerns, don't hesitate to reach out to a certified navigator or broker for assistance.