The W-2c form, also known as the Corrected Wage and Tax Statement, is a crucial document used to correct errors or inaccuracies on a previously filed W-2 form. Employers are required to file a W-2c form with the Social Security Administration (SSA) whenever they need to correct information reported on a W-2 form, such as an employee's name, address, or wages. Filling out a W-2c form can be a daunting task, but with the right guidance, it can be done easily and efficiently.

Understanding the W-2c Form

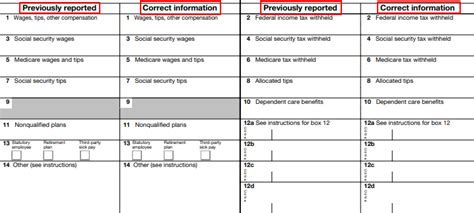

Before we dive into the steps to fill out a W-2c form, it's essential to understand the purpose and components of the form. The W-2c form is a corrected version of the W-2 form, which is used to report an employee's income and taxes withheld to the SSA. The W-2c form consists of several sections, including:

- Employee's name and address

- Employer's name and address

- Corrected information (e.g., wages, taxes withheld, etc.)

- Reason for correction

Step 1: Gather Required Information

To fill out a W-2c form accurately, you'll need to gather specific information, including:

- Employee's name and address

- Employer's name and address

- Corrected wages and taxes withheld

- Reason for correction (e.g., error in reporting, change in employee's name or address, etc.)

You can obtain this information from your payroll records, employee files, or by contacting the employee directly.

Why is it Important to Gather Accurate Information?

Gathering accurate information is crucial to ensure that the W-2c form is filled out correctly. Inaccurate information can lead to delays, fines, or even penalties from the SSA. Therefore, it's essential to double-check the information before submitting the W-2c form.

Step 2: Fill Out the W-2c Form

Once you have gathered all the required information, you can begin filling out the W-2c form. The form consists of several sections, which must be completed accurately and thoroughly.

- Section 1: Employee's name and address

- Section 2: Employer's name and address

- Section 3: Corrected information (e.g., wages, taxes withheld, etc.)

- Section 4: Reason for correction

Tips for Filling Out the W-2c Form

- Use black ink to fill out the form

- Make sure to sign and date the form

- Use a separate W-2c form for each employee being corrected

- Keep a copy of the completed form for your records

Step 3: Submit the W-2c Form

After completing the W-2c form, you'll need to submit it to the SSA. You can submit the form electronically or by mail.

- Electronic submission: Use the SSA's online portal, Business Services Online (BSO), to submit the W-2c form electronically.

- Mail submission: Send the completed form to the SSA's address listed on the form.

Deadlines for Submitting the W-2c Form

- January 31st: Deadline for submitting W-2c forms for the previous tax year

- April 15th: Deadline for submitting W-2c forms for corrections made after January 31st

Step 4: Notify the Employee

After submitting the W-2c form, you'll need to notify the employee of the correction. This can be done by providing the employee with a copy of the corrected W-2 form.

Why is it Important to Notify the Employee?

Notifying the employee of the correction is essential to ensure that they are aware of the changes made to their W-2 form. This can also help prevent any potential issues or disputes that may arise from the correction.

Step 5: Keep Records

Finally, it's essential to keep records of the W-2c form and any supporting documentation. This can help you track any corrections made and provide proof of submission to the SSA.

Why is it Important to Keep Records?

Keeping records of the W-2c form and supporting documentation can help you:

- Track any corrections made

- Provide proof of submission to the SSA

- Resolve any potential issues or disputes that may arise from the correction

By following these five steps, you can easily fill out a W-2c form and ensure that any corrections are made accurately and efficiently.

What is the purpose of the W-2c form?

+The W-2c form is used to correct errors or inaccuracies on a previously filed W-2 form.

How do I submit the W-2c form?

+You can submit the W-2c form electronically through the SSA's online portal, Business Services Online (BSO), or by mail to the SSA's address listed on the form.

What is the deadline for submitting the W-2c form?

+The deadline for submitting W-2c forms is January 31st for the previous tax year and April 15th for corrections made after January 31st.

We hope this article has provided you with valuable insights and guidance on how to fill out a W-2c form easily. If you have any further questions or concerns, please don't hesitate to reach out to us.