The W-2 form is a crucial document for employees and employers alike, as it reports an employee's income and taxes withheld from their paycheck. Understanding the W-2 form is essential for accurately filing taxes and ensuring compliance with tax laws. In this article, we will explore five ways to understand the W-2 form, including its purpose, structure, and key components.

What is the Purpose of the W-2 Form?

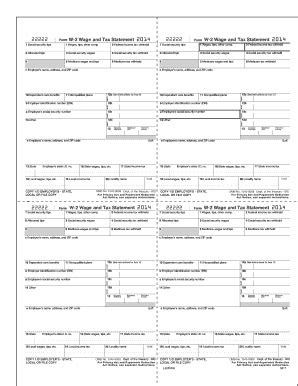

The W-2 form, also known as the Wage and Tax Statement, is a document that employers must provide to their employees and the Social Security Administration (SSA) by January 31st of each year. The purpose of the W-2 form is to report an employee's income, taxes withheld, and other relevant tax information for the previous tax year. This information is used by the employee to file their tax return and by the SSA to update the employee's earnings record.

Key Components of the W-2 Form

A typical W-2 form contains several key components, including:

- Employee's name, address, and Social Security number

- Employer's name, address, and Employer Identification Number (EIN)

- Wages, tips, and other compensation

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

- State and local taxes withheld

- Retirement plan contributions

- Other relevant tax information

How to Read a W-2 Form

Reading a W-2 form can be overwhelming, especially for those who are new to the workforce or are not familiar with tax documents. Here are some steps to help you understand your W-2 form:

- Verify your information: Make sure your name, address, and Social Security number are accurate.

- Check your wages: Ensure that your wages, tips, and other compensation are correct.

- Review your taxes withheld: Verify that your federal income tax, Social Security tax, and Medicare tax withheld are accurate.

- Check for errors: Review your W-2 form for any errors or discrepancies.

Common Errors on W-2 Forms

Common errors on W-2 forms include:

- Incorrect Social Security number

- Incorrect wages or taxes withheld

- Missing or incorrect employer information

- Incorrect state or local taxes withheld

How to Correct Errors on a W-2 Form

If you find an error on your W-2 form, you should contact your employer immediately. Here are some steps to correct errors on a W-2 form:

- Contact your employer: Reach out to your employer's payroll department to report the error.

- Provide documentation: Provide documentation to support your claim, such as pay stubs or bank statements.

- Wait for correction: Wait for your employer to correct the error and provide a revised W-2 form.

What to Do if You Don't Receive a W-2 Form

If you don't receive a W-2 form by January 31st, you should contact your employer to request a copy. Here are some steps to take if you don't receive a W-2 form:

- Contact your employer: Reach out to your employer's payroll department to request a copy of your W-2 form.

- Contact the SSA: If you're unable to get a copy from your employer, contact the SSA to request a replacement W-2 form.

- File your tax return: If you're unable to get a copy of your W-2 form, you can still file your tax return using Form 4852, Substitute for Form W-2, Wage and Tax Statement.

How to Use Your W-2 Form to File Your Tax Return

Your W-2 form is a crucial document for filing your tax return. Here are some steps to use your W-2 form to file your tax return:

- Gather your documents: Collect all your tax documents, including your W-2 form, 1099 forms, and any other relevant tax documents.

- Enter your information: Enter your information from your W-2 form into your tax return, including your wages, taxes withheld, and other relevant tax information.

- Claim your deductions: Claim any deductions you're eligible for, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit.

Tips for Filing Your Tax Return

Here are some tips for filing your tax return:

- File electronically: File your tax return electronically to reduce errors and speed up your refund.

- Use tax software: Use tax software to guide you through the filing process and ensure accuracy.

- Seek professional help: Seek professional help if you're unsure about any part of the filing process.

Conclusion

Understanding the W-2 form is essential for accurately filing taxes and ensuring compliance with tax laws. By following the tips outlined in this article, you can ensure that you're using your W-2 form correctly and taking advantage of all the deductions and credits you're eligible for. Remember to verify your information, check for errors, and seek professional help if you're unsure about any part of the filing process.

Take Action: Review your W-2 form carefully and ensure that you're using it correctly to file your tax return. If you have any questions or concerns, seek professional help or contact the SSA for guidance.

What is the purpose of the W-2 form?

+The W-2 form is a document that reports an employee's income, taxes withheld, and other relevant tax information for the previous tax year.

What should I do if I don't receive a W-2 form?

+If you don't receive a W-2 form, contact your employer to request a copy. If you're unable to get a copy from your employer, contact the SSA to request a replacement W-2 form.

How do I use my W-2 form to file my tax return?

+Enter your information from your W-2 form into your tax return, including your wages, taxes withheld, and other relevant tax information. Claim any deductions you're eligible for and seek professional help if you're unsure about any part of the filing process.