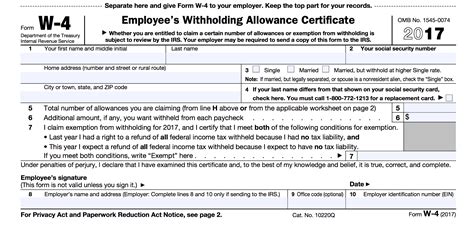

As an employee, you're likely familiar with the concept of tax withholding. But have you ever stopped to think about the form that makes it all possible? The VA W-4 form, also known as the Employee's Withholding Certificate, is a crucial document that helps your employer determine how much federal income tax to withhold from your paycheck. In this article, we'll delve into the world of tax withholding and explore seven essential facts about the VA W-4 form.

What is the VA W-4 Form?

Why is the VA W-4 Form Important?

The VA W-4 form is important because it helps ensure that the correct amount of federal income tax is withheld from your paycheck. If too little tax is withheld, you may end up owing a significant amount of money when you file your tax return. On the other hand, if too much tax is withheld, you may be eligible for a refund. By completing the VA W-4 form accurately, you can avoid any potential tax issues and ensure that you're not overpaying or underpaying your taxes.7 Essential Facts About the VA W-4 Form

1. The VA W-4 Form is Not the Same as the W-2 Form

While both forms are related to employment and taxes, they serve different purposes. The W-2 form, also known as the Wage and Tax Statement, is a document that employers provide to employees at the end of each year, showing the employee's income and taxes withheld. The VA W-4 form, on the other hand, is a document that employees complete to provide their employer with the necessary information to determine the correct amount of federal income tax to withhold.

2. You Can Update Your VA W-4 Form at Any Time

If you experience any changes in your life that affect your tax withholding, such as a change in filing status or number of dependents, you can update your VA W-4 form at any time. You can submit a new form to your employer, and they will adjust your tax withholding accordingly.

3. The VA W-4 Form Has a New Design

In 2020, the IRS introduced a new design for the W-4 form, which includes significant changes to the way employees report their withholding information. The new form is designed to be more accurate and transparent, and it includes a new section for reporting dependents and other income.

4. You Can Claim Exemption from Withholding

If you expect to owe no federal income tax for the year, you can claim exemption from withholding on your VA W-4 form. However, you'll need to meet certain requirements and file a new W-4 form each year to continue claiming exemption.

5. The VA W-4 Form Affects Your Take-Home Pay

The information you provide on your VA W-4 form affects the amount of federal income tax that's withheld from your paycheck, which in turn affects your take-home pay. If you claim too many allowances, you may not have enough tax withheld, and you could end up owing a significant amount of money when you file your tax return.

6. You Can Use the IRS Tax Withholding Estimator Tool

The IRS offers a tax withholding estimator tool that can help you determine the correct amount of federal income tax to withhold from your paycheck. The tool takes into account your income, filing status, and number of dependents, and it provides a personalized recommendation for your tax withholding.

7. The VA W-4 Form is Not Required for All Employees

While most employees are required to complete a VA W-4 form, there are some exceptions. For example, if you're a non-resident alien or a resident of a U.S. territory, you may not be required to complete a W-4 form.

Common Mistakes to Avoid When Completing the VA W-4 Form

- Failing to report all income, including income from side jobs or investments

- Claiming too many allowances, which can result in underwithholding

- Failing to account for changes in filing status or number of dependents

- Not signing and dating the form

Conclusion

The VA W-4 form is an essential document that helps your employer determine the correct amount of federal income tax to withhold from your paycheck. By understanding the seven essential facts about the VA W-4 form, you can ensure that you're providing accurate information and avoiding any potential tax issues. Remember to review and update your form regularly, especially if you experience any changes in your life that affect your tax withholding.We hope this article has provided you with valuable insights into the world of tax withholding and the VA W-4 form. If you have any questions or comments, please feel free to share them below.

What is the purpose of the VA W-4 form?

+The VA W-4 form is used to certify an employee's filing status, number of allowances, and any additional withholding amounts, which helps the employer determine the correct amount of federal income tax to withhold from the employee's paycheck.

Can I update my VA W-4 form at any time?

+Yes, you can update your VA W-4 form at any time if you experience any changes in your life that affect your tax withholding, such as a change in filing status or number of dependents.

What happens if I claim too many allowances on my VA W-4 form?

+If you claim too many allowances, you may not have enough tax withheld, and you could end up owing a significant amount of money when you file your tax return.