For many military veterans and active-duty personnel, the VA loan program is a valuable benefit that can help them achieve the dream of homeownership. However, the process of securing a VA loan can be complex and involves several steps, including verification of the borrower's eligibility and income. One crucial document in this process is the VA Form 26-8937, also known as the "Verification of VA Benefits" form. In this article, we will delve into the details of the VA Form 26-8937, its purpose, and how it fits into the overall VA loan verification process.

What is VA Form 26-8937?

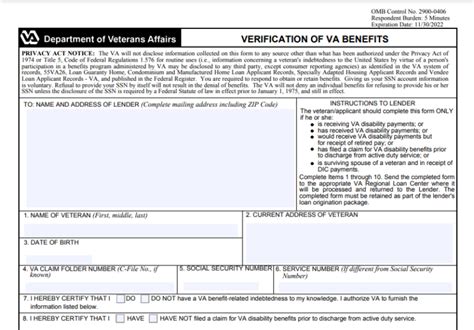

VA Form 26-8937, or the "Verification of VA Benefits" form, is a document used by the Department of Veterans Affairs (VA) to verify a borrower's eligibility for a VA loan. The form is typically completed by the VA and provides confirmation of the borrower's military service, disability status, and entitlement to VA benefits. Lenders use this information to determine the borrower's eligibility for a VA loan and to calculate their entitlement to VA loan guaranty.

Purpose of VA Form 26-8937

The primary purpose of VA Form 26-8937 is to verify a borrower's eligibility for a VA loan. The form provides lenders with essential information about the borrower's military service, including their dates of service, branch of service, and character of discharge. This information is used to determine whether the borrower meets the VA's eligibility requirements for a VA loan.

How to Obtain VA Form 26-8937

Borrowers can obtain VA Form 26-8937 by submitting a request to the VA through their lender or by contacting the VA directly. The form can be requested online, by phone, or by mail. Borrowers will need to provide their social security number, date of birth, and other identifying information to complete the request.

Required Documents for VA Form 26-8937

To complete VA Form 26-8937, borrowers will typically need to provide the following documents:

- DD Form 214 (discharge paperwork)

- VA disability award letter (if applicable)

- Social Security number

- Date of birth

VA Loan Verification Process

The VA loan verification process involves several steps, including:

- Pre-approval: Borrowers submit a loan application and provide financial information to their lender.

- VA Form 26-8937: The lender requests VA Form 26-8937 to verify the borrower's eligibility for a VA loan.

- Credit check: The lender conducts a credit check to determine the borrower's creditworthiness.

- Appraisal: An appraisal is conducted to determine the value of the property.

- Underwriting: The lender reviews the borrower's creditworthiness and the property's value to determine whether to approve the loan.

VA Loan Benefits

VA loans offer several benefits to eligible borrowers, including:

- No down payment: VA loans do not require a down payment, making them more accessible to borrowers who may not have a lot of savings.

- Lower interest rates: VA loans often have lower interest rates compared to conventional loans.

- No mortgage insurance: VA loans do not require mortgage insurance, which can save borrowers hundreds of dollars per year.

- Lenient credit requirements: VA loans have more lenient credit requirements, making them more accessible to borrowers with lower credit scores.

Common Issues with VA Form 26-8937

Some common issues that borrowers may encounter with VA Form 26-8937 include:

- Delays in processing: VA Form 26-8937 can take several weeks to process, which can delay the loan application process.

- Inaccurate information: Borrowers may encounter issues if the information on their VA Form 26-8937 is inaccurate or incomplete.

- Eligibility issues: Borrowers may not be eligible for a VA loan if they do not meet the VA's eligibility requirements.

Resolving Issues with VA Form 26-8937

Borrowers who encounter issues with VA Form 26-8937 can resolve them by:

- Contacting the VA: Borrowers can contact the VA directly to resolve any issues with their VA Form 26-8937.

- Working with their lender: Borrowers can work with their lender to resolve any issues with their VA Form 26-8937.

- Providing additional documentation: Borrowers may need to provide additional documentation to resolve any issues with their VA Form 26-8937.

What is VA Form 26-8937?

+VA Form 26-8937, or the "Verification of VA Benefits" form, is a document used by the Department of Veterans Affairs (VA) to verify a borrower's eligibility for a VA loan.

How do I obtain VA Form 26-8937?

+Borrowers can obtain VA Form 26-8937 by submitting a request to the VA through their lender or by contacting the VA directly.

What are the benefits of a VA loan?

+VA loans offer several benefits to eligible borrowers, including no down payment, lower interest rates, no mortgage insurance, and lenient credit requirements.

In conclusion, VA Form 26-8937 is a crucial document in the VA loan verification process. Borrowers who are eligible for a VA loan can benefit from the lenient credit requirements, lower interest rates, and no down payment requirements. However, borrowers may encounter issues with VA Form 26-8937, such as delays in processing or eligibility issues. By understanding the purpose and requirements of VA Form 26-8937, borrowers can navigate the VA loan verification process with ease.

We hope this article has provided you with a comprehensive understanding of VA Form 26-8937 and the VA loan verification process. If you have any further questions or concerns, please do not hesitate to comment below. Share this article with your friends and family who may be eligible for a VA loan, and don't forget to follow us for more informative articles on VA loans and mortgage financing.