Filling out tax forms can be a daunting task, especially for those who are new to the process. The UTA tax form, specifically, can be a bit complex due to its various sections and requirements. However, with a clear understanding of the process, you can easily navigate through it and submit your tax returns without any hassle. In this article, we will break down the process of filling out the UTA tax form into 5 easy steps.

Filling out tax forms can be a stressful experience, especially for those who are not familiar with the process. However, it is a necessary task that must be completed in order to report your income and claim any deductions or credits you are eligible for. The UTA tax form is a specific type of tax form that is used by residents of the state of Utah. It is designed to report income earned within the state and claim any state-specific deductions or credits.

UTA tax forms are typically due on April 15th of each year, but it is essential to check the official Utah State Tax Commission website for any updates or changes to the filing deadline. Failing to file your tax returns on time can result in penalties and interest on the amount owed. Therefore, it is crucial to stay on top of the filing process and submit your tax returns well before the deadline.

Step 1: Gather Required Documents

Before starting to fill out the UTA tax form, it is essential to gather all the required documents. These documents may include:

- W-2 forms from your employer(s)

- 1099 forms for freelance or contract work

- Interest statements from banks and investments

- Dividend statements from stocks and mutual funds

- Charitable donation receipts

- Medical expense receipts

Having all the necessary documents will make it easier to fill out the tax form accurately and ensure that you claim all the deductions and credits you are eligible for.

Step 2: Choose the Correct Filing Status

The next step is to choose the correct filing status. The UTA tax form provides five filing status options:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Your filing status will determine the tax rates and deductions you are eligible for. It is essential to choose the correct filing status to ensure that you are reporting your income accurately and claiming the correct deductions.

Step 3: Report Income and Claim Deductions

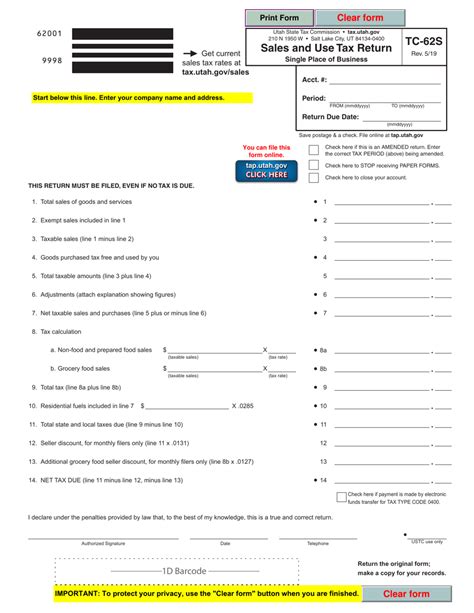

This step involves reporting your income and claiming any deductions or credits you are eligible for. The UTA tax form has various sections for reporting different types of income, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Business income and expenses

You will also need to claim any deductions or credits you are eligible for, such as:

- Standard deduction

- Itemized deductions

- Mortgage interest deduction

- Charitable donation deduction

Step 4: Calculate Tax Liability

Once you have reported your income and claimed any deductions or credits, you will need to calculate your tax liability. The UTA tax form provides a worksheet for calculating your tax liability, which takes into account your filing status, income, and deductions.

Step 5: Sign and Submit the Form

The final step is to sign and submit the UTA tax form. You will need to sign the form in ink and date it. You can submit the form electronically or by mail, depending on your preference.

If you owe taxes, you will need to make a payment by the filing deadline to avoid penalties and interest. If you are due a refund, you can choose to receive it via direct deposit or check.

We hope this article has provided you with a clear understanding of the process of filling out the UTA tax form. By following these 5 easy steps, you can ensure that you submit your tax returns accurately and on time.

Do you have any questions or concerns about filling out the UTA tax form? Share your thoughts in the comments section below.

What is the deadline for filing the UTA tax form?

+The deadline for filing the UTA tax form is typically April 15th of each year, but it is essential to check the official Utah State Tax Commission website for any updates or changes to the filing deadline.

What documents do I need to gather before filling out the UTA tax form?

+You will need to gather documents such as W-2 forms, 1099 forms, interest statements, dividend statements, charitable donation receipts, and medical expense receipts.

How do I calculate my tax liability on the UTA tax form?

+The UTA tax form provides a worksheet for calculating your tax liability, which takes into account your filing status, income, and deductions.