The world of tax filing can be complex and overwhelming, especially when it comes to navigating the various forms and updates. One such form that has undergone significant changes is the Turbotax Form 8915-F. In this article, we will delve into the updates and changes you need to know about Turbotax Form 8915-F, ensuring you stay ahead of the game when it comes to your tax obligations.

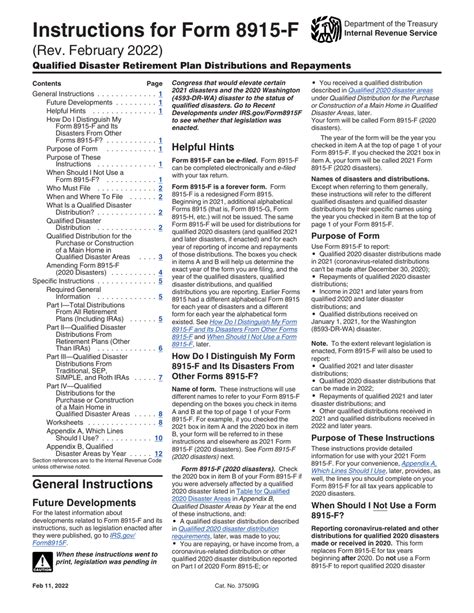

The Taxpayer First Act of 2019 introduced several changes to the tax code, including the creation of Form 8915-F. This form is used to report qualified 2020 disaster-related retirement plan distributions and repayments. The updates to this form are crucial, and understanding them will help you avoid any potential pitfalls or penalties.

What is Turbotax Form 8915-F?

Understanding the Purpose of Form 8915-F

Turbotax Form 8915-F is used to report qualified 2020 disaster-related retirement plan distributions and repayments. This form is essential for individuals who have received distributions from their retirement plans due to a qualified disaster-related event. The form helps taxpayers to report these distributions and repayments accurately, ensuring they comply with the tax code.

Changes to Turbotax Form 8915-F

Updates to the Form You Need to Know

The updates to Turbotax Form 8915-F are significant, and taxpayers need to be aware of the following changes:

- New reporting requirements: The updated form requires taxpayers to report qualified 2020 disaster-related retirement plan distributions and repayments. This includes distributions from 401(k), 403(b), and other eligible retirement plans.

- Repayment rules: The form includes new repayment rules for taxpayers who have received qualified disaster-related distributions. Taxpayers can repay these distributions within three years, and the form provides guidance on how to report these repayments.

- Threshold amounts: The form includes updated threshold amounts for qualified disaster-related distributions. Taxpayers can receive up to $100,000 in qualified distributions without incurring penalties or taxes.

Benefits of Turbotax Form 8915-F

How the Updates Benefit Taxpayers

The updates to Turbotax Form 8915-F provide several benefits to taxpayers, including:

- Simplified reporting: The updated form simplifies the reporting process for qualified disaster-related distributions and repayments.

- Reduced penalties: Taxpayers who report qualified distributions and repayments accurately using Form 8915-F can avoid penalties and taxes.

- Increased flexibility: The form provides taxpayers with more flexibility in repaying qualified distributions, allowing them to repay within three years.

How to File Turbotax Form 8915-F

A Step-by-Step Guide to Filing the Form

Filing Turbotax Form 8915-F requires attention to detail and accuracy. Here's a step-by-step guide to help you file the form correctly:

- Gather required documents: Collect all required documents, including your retirement plan statements and disaster-related distribution records.

- Complete Form 8915-F: Fill out the form accurately, ensuring you report all qualified disaster-related distributions and repayments.

- Attach supporting documentation: Attach all supporting documentation, including your retirement plan statements and disaster-related distribution records.

- File the form: File the form with the IRS, either electronically or by mail.

Common Mistakes to Avoid

Common Errors to Watch Out For

When filing Turbotax Form 8915-F, it's essential to avoid common mistakes that can lead to penalties and delays. Here are some common errors to watch out for:

- Inaccurate reporting: Ensure you report all qualified disaster-related distributions and repayments accurately.

- Missing documentation: Attach all required documentation, including your retirement plan statements and disaster-related distribution records.

- Incorrect filing status: Ensure you file the form with the correct filing status, either electronically or by mail.

Conclusion

Stay Ahead of the Game with Turbotax Form 8915-F

The updates to Turbotax Form 8915-F are significant, and taxpayers need to be aware of the changes to avoid penalties and delays. By understanding the purpose, benefits, and filing requirements of the form, you can stay ahead of the game and ensure compliance with the tax code. Remember to avoid common mistakes and seek professional help if needed.

Share Your Thoughts

We hope this article has provided you with valuable insights into the updates and changes to Turbotax Form 8915-F. Share your thoughts and experiences with us in the comments below. Have you filed Form 8915-F before? What challenges did you face, and how did you overcome them? Your feedback will help us create more informative and engaging content.

FAQ Section

What is Turbotax Form 8915-F used for?

+Turbotax Form 8915-F is used to report qualified 2020 disaster-related retirement plan distributions and repayments.

What are the updates to Turbotax Form 8915-F?

+The updates to Turbotax Form 8915-F include new reporting requirements, repayment rules, and threshold amounts for qualified disaster-related distributions.

How do I file Turbotax Form 8915-F?

+To file Turbotax Form 8915-F, gather required documents, complete the form accurately, attach supporting documentation, and file the form with the IRS, either electronically or by mail.