In real estate transactions, earnest money is a deposit made by a buyer to demonstrate their commitment to purchasing a property. The Texas Real Estate Commission (TREC) provides a standard form, known as the Earnest Money Release Form, to facilitate the release of earnest money in case a transaction falls through. Here are five ways to fill out the TREC Earnest Money Release Form:

Understanding the TREC Earnest Money Release Form

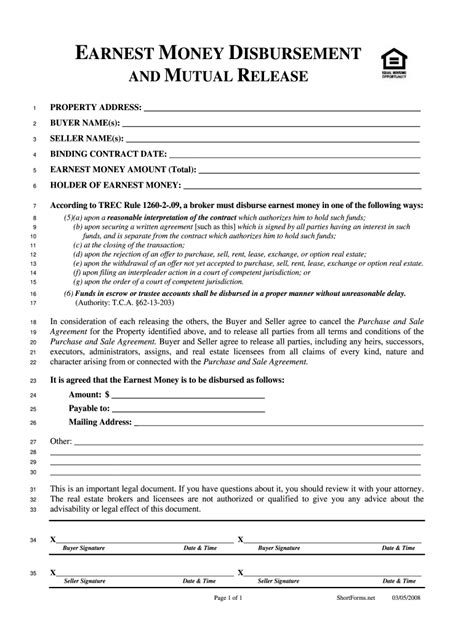

The TREC Earnest Money Release Form is a critical document that helps resolve disputes over earnest money when a real estate transaction is terminated. The form requires the parties involved to acknowledge the release of earnest money and specify the terms of the release.

1. Identifying the Parties Involved

Filling Out the Parties' Information

The first step in filling out the TREC Earnest Money Release Form is to identify the parties involved in the transaction. This includes the buyer, seller, and the title company or escrow agent holding the earnest money.

- Buyer's Name: Enter the full name of the buyer as it appears on the purchase agreement.

- Seller's Name: Enter the full name of the seller as it appears on the purchase agreement.

- Title Company/Escrow Agent: Enter the name and address of the title company or escrow agent holding the earnest money.

2. Specifying the Earnest Money Details

Earnest Money Details

The next step is to specify the details of the earnest money deposit.

- Earnest Money Amount: Enter the amount of the earnest money deposit.

- Deposit Date: Enter the date the earnest money was deposited.

- Deposit Method: Specify the method used to deposit the earnest money (e.g., check, wire transfer).

3. Selecting the Release Option

Release Options

The TREC Earnest Money Release Form provides three release options:

- Option 1: Mutual Release - This option is used when both the buyer and seller agree to release the earnest money.

- Option 2: Release to Buyer - This option is used when the seller agrees to release the earnest money to the buyer.

- Option 3: Release to Seller - This option is used when the buyer agrees to release the earnest money to the seller.

Select the applicable release option and check the corresponding box.

4. Providing Additional Information

Additional Information

If necessary, provide additional information to support the release of earnest money. This may include:

- A brief explanation of the reason for the release

- Any supporting documentation (e.g., a termination letter)

5. Signing and Dating the Form

Signing and Dating the Form

Finally, all parties involved must sign and date the TREC Earnest Money Release Form.

- Buyer's Signature: The buyer must sign and date the form.

- Seller's Signature: The seller must sign and date the form.

- Title Company/Escrow Agent's Signature: The title company or escrow agent must sign and date the form.

By following these steps, you can accurately fill out the TREC Earnest Money Release Form and facilitate the release of earnest money in a terminated real estate transaction.

We hope this article has provided you with valuable insights into filling out the TREC Earnest Money Release Form. If you have any further questions or concerns, please don't hesitate to comment below.

What is the purpose of the TREC Earnest Money Release Form?

+The TREC Earnest Money Release Form is used to facilitate the release of earnest money in case a real estate transaction is terminated.

Who needs to sign the TREC Earnest Money Release Form?

+All parties involved in the transaction, including the buyer, seller, and title company or escrow agent, must sign and date the form.

What happens to the earnest money after the form is signed?

+The earnest money will be released according to the terms specified in the form. If the parties have agreed to a mutual release, the earnest money will be released to the parties as specified.