Navigating the world of savings bonds can be a complex and overwhelming experience, especially when it comes to filing the necessary paperwork. The Treasury Direct Form 5512, also known as the "Application for Purchase of United States Savings Bonds by Employers" is a crucial document for businesses that offer savings bonds as a benefit to their employees. Filing this form correctly is essential to ensure a smooth and efficient process. In this article, we will delve into the world of Treasury Direct Form 5512 and provide you with 7 tips to help you navigate the filing process with ease.

Understanding the Purpose of Form 5512

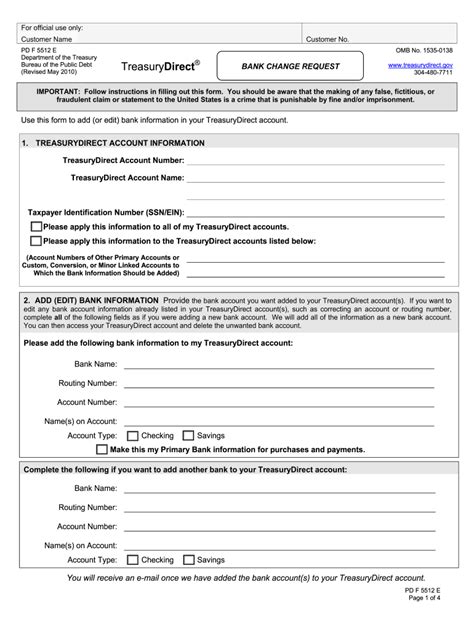

Before we dive into the tips, it's essential to understand the purpose of Form 5512. This form is used by employers to purchase United States savings bonds on behalf of their employees. The form is typically used in conjunction with the Treasury Direct program, which allows employers to purchase savings bonds electronically. The form is used to establish a payroll savings plan, which enables employees to purchase savings bonds through payroll deductions.

Benefits of Using Form 5512

Using Form 5512 offers several benefits to employers and employees alike. Some of the benefits include:

- Convenient payroll deductions: Employees can purchase savings bonds through payroll deductions, making it easy to save for the future.

- Low risk investment: Savings bonds are backed by the full faith and credit of the United States government, making them a low-risk investment option.

- Tax benefits: The interest earned on savings bonds may be tax-free for certain education expenses.

Tips for Filing Form 5512

Now that we've covered the basics, let's dive into the 7 tips for filing Form 5512:

Tip 1: Ensure You Have the Correct Form

Before you start filling out the form, ensure you have the correct version. The Treasury Department regularly updates forms, so it's essential to check the Treasury Direct website for the latest version.

Tip 2: Read the Instructions Carefully

Take the time to read the instructions carefully before filling out the form. The instructions will provide you with essential information on how to complete the form correctly.

Tip 3: Fill Out the Form Completely and Accurately

Make sure to fill out the form completely and accurately. Incomplete or inaccurate forms may be rejected, causing delays in the processing of your application.

Tip 4: Ensure You Have the Required Information

Before filling out the form, ensure you have the required information, including:

- Your employer identification number (EIN)

- Your business address

- The names and social security numbers of the employees participating in the payroll savings plan

Tip 5: Sign and Date the Form

Make sure to sign and date the form in the designated areas. This will ensure that your application is valid and complete.

Tip 6: Submit the Form Correctly

Once you've completed the form, submit it to the Treasury Department according to the instructions provided. You can submit the form online or by mail.

Tip 7: Keep a Record of Your Application

Finally, keep a record of your application, including the completed form and any supporting documentation. This will help you track the status of your application and ensure that any issues are resolved quickly.

Common Mistakes to Avoid

When filing Form 5512, there are several common mistakes to avoid, including:

- Incomplete or inaccurate forms

- Failure to sign and date the form

- Submission of incorrect or incomplete supporting documentation

By avoiding these common mistakes, you can ensure a smooth and efficient filing process.

What is the purpose of Form 5512?

+Form 5512 is used by employers to purchase United States savings bonds on behalf of their employees.

Where can I find the latest version of Form 5512?

+The latest version of Form 5512 can be found on the Treasury Direct website.

What information is required to complete Form 5512?

+The required information includes your employer identification number (EIN), business address, and the names and social security numbers of the employees participating in the payroll savings plan.

By following these 7 tips and avoiding common mistakes, you can ensure a successful filing experience with Form 5512. Remember to take your time, read the instructions carefully, and fill out the form completely and accurately. If you have any questions or concerns, don't hesitate to reach out to the Treasury Department for assistance.