The efficient market hypothesis (EMH) is a fundamental concept in finance that has been debated by scholars and investors for decades. In this article, we will delve into the weak form of the efficient market hypothesis, exploring its definition, implications, and empirical evidence.

What is the Weak Form Efficient Market Hypothesis?

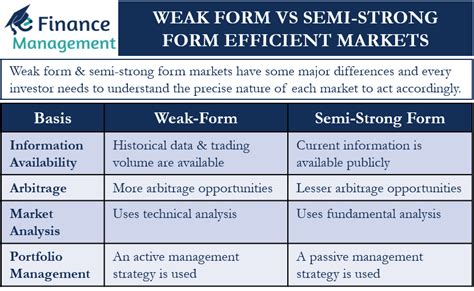

The weak form efficient market hypothesis posits that financial markets are informationally efficient with respect to historical price data. In other words, past stock prices, returns, and trading volumes are reflected in current market prices. This means that investors cannot achieve consistently high returns by analyzing historical price patterns or trends.

The weak form EMH suggests that technical analysis, which involves studying charts and patterns to predict future price movements, is not a reliable investment strategy. This is because any information contained in historical price data is already reflected in current market prices, making it impossible to achieve consistently high returns through technical analysis alone.

Key Implications of the Weak Form EMH

The weak form efficient market hypothesis has several key implications for investors and financial markets:

- Technical analysis is not a reliable investment strategy: As mentioned earlier, technical analysis involves studying charts and patterns to predict future price movements. However, the weak form EMH suggests that this approach is not reliable, as any information contained in historical price data is already reflected in current market prices.

- Past performance is not indicative of future results: The weak form EMH implies that past investment performance is not a reliable indicator of future results. This is because historical price data is already reflected in current market prices, making it impossible to achieve consistently high returns by analyzing past performance.

- Investors should focus on fundamental analysis: Fundamental analysis involves studying a company's financial statements, management team, industry trends, and competitive position to estimate its intrinsic value. The weak form EMH suggests that investors should focus on fundamental analysis rather than technical analysis.

Empirical Evidence for the Weak Form EMH

Numerous studies have tested the weak form efficient market hypothesis, and the empirical evidence is largely supportive. Some of the key findings include:

- Random walk behavior: Many studies have shown that stock prices exhibit random walk behavior, meaning that they move randomly and unpredictably over time. This is consistent with the weak form EMH, which suggests that past price data is already reflected in current market prices.

- Failure of technical analysis: Several studies have tested the effectiveness of technical analysis and found that it is not a reliable investment strategy. For example, a study by Brock et al. (1992) found that technical analysis was no more effective than a random walk in predicting future price movements.

- Anomalies in stock returns: While the weak form EMH suggests that past price data is already reflected in current market prices, some studies have identified anomalies in stock returns that cannot be explained by the EMH. For example, the January effect, where stock prices tend to rise in January, is an anomaly that has been observed in many markets.

Criticisms and Limitations of the Weak Form EMH

While the weak form efficient market hypothesis is widely accepted, it has several criticisms and limitations:

- Ignores other forms of information: The weak form EMH only considers historical price data and ignores other forms of information, such as fundamental data or news events.

- Assumes rational investors: The weak form EMH assumes that investors are rational and make decisions based on available information. However, behavioral finance suggests that investors may be subject to cognitive biases and emotional influences.

- Does not account for market inefficiencies: The weak form EMH assumes that markets are informationally efficient, but there may be market inefficiencies that can be exploited by investors.

Conclusion and Future Directions

In conclusion, the weak form efficient market hypothesis is a widely accepted concept in finance that suggests that historical price data is already reflected in current market prices. While the empirical evidence is largely supportive, there are criticisms and limitations of the weak form EMH. Future research should focus on addressing these limitations and exploring other forms of market inefficiencies.

We invite you to share your thoughts on the weak form efficient market hypothesis in the comments section below. Do you think that technical analysis is a reliable investment strategy? Have you experienced any successes or failures using technical analysis?

What is the weak form efficient market hypothesis?

+The weak form efficient market hypothesis posits that financial markets are informationally efficient with respect to historical price data.

What are the key implications of the weak form EMH?

+The weak form EMH implies that technical analysis is not a reliable investment strategy, past performance is not indicative of future results, and investors should focus on fundamental analysis.

What are some criticisms and limitations of the weak form EMH?

+The weak form EMH ignores other forms of information, assumes rational investors, and does not account for market inefficiencies.