As a homeowner, one of the most important investments you can make is purchasing a homeowners insurance policy. This policy not only protects your home and belongings from unexpected events, but it also provides financial protection for you and your family. However, with so many different types of coverage options available, it can be overwhelming to understand what is included in a standard homeowners insurance policy. In this article, we will break down the five basic dwelling coverages that are typically included in a homeowners insurance policy, explaining what they cover and why they are essential for homeowners.

What is Dwelling Coverage?

Dwelling coverage is the part of a homeowners insurance policy that covers the physical structure of your home, including the walls, roof, and foundation. This coverage is essential for homeowners, as it provides financial protection in the event of damage to your home from unexpected events such as natural disasters, fires, or vandalism. Dwelling coverage is typically the most expensive part of a homeowners insurance policy, as it covers the most valuable part of your home.

5 Basic Dwelling Coverages Explained

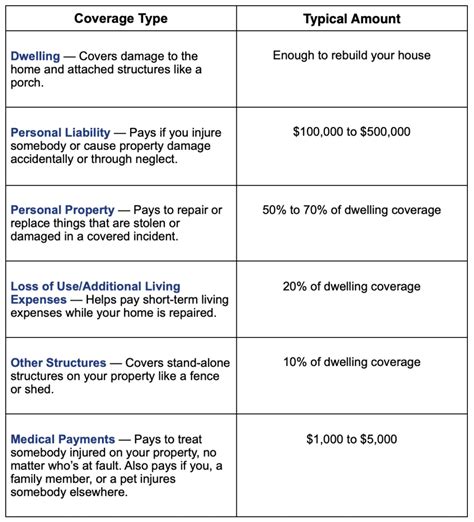

While dwelling coverage may seem straightforward, there are several different types of coverage that are typically included in a standard homeowners insurance policy. Here are five basic dwelling coverages explained:

1. Dwelling Building Coverage

Dwelling building coverage is the most basic type of dwelling coverage, and it covers the physical structure of your home, including the walls, roof, and foundation. This coverage is essential for homeowners, as it provides financial protection in the event of damage to your home from unexpected events such as natural disasters, fires, or vandalism.

For example, if a hurricane damages the roof of your home, dwelling building coverage would help pay for the cost of repairs or replacement.

2. Other Structures Coverage

Other structures coverage is a type of dwelling coverage that covers structures on your property that are not attached to your home, such as a detached garage, shed, or fence. This coverage is important for homeowners who have outbuildings or other structures on their property that could be damaged or destroyed.

For example, if a fire damages your detached garage, other structures coverage would help pay for the cost of repairs or replacement.

3. Personal Property Coverage

Personal property coverage is a type of dwelling coverage that covers your personal belongings, such as furniture, appliances, and clothing. This coverage is essential for homeowners, as it provides financial protection in the event of damage or loss of your personal belongings.

For example, if a burglary results in the loss of your personal belongings, personal property coverage would help pay for the cost of replacement.

4. Loss of Use Coverage

Loss of use coverage is a type of dwelling coverage that provides financial assistance if you are unable to use your home due to damage or destruction. This coverage is essential for homeowners, as it helps pay for the cost of temporary housing or other expenses while your home is being repaired or rebuilt.

For example, if a fire damages your home and you are unable to live there while it is being repaired, loss of use coverage would help pay for the cost of temporary housing.

5. Additional Living Expenses Coverage

Additional living expenses coverage is a type of dwelling coverage that provides financial assistance for expenses related to temporary housing or other living expenses while your home is being repaired or rebuilt. This coverage is essential for homeowners, as it helps pay for the cost of food, lodging, and other expenses while your home is being repaired or rebuilt.

For example, if a hurricane damages your home and you are unable to live there while it is being repaired, additional living expenses coverage would help pay for the cost of temporary housing, food, and other expenses.

Why Dwelling Coverage is Essential

Dwelling coverage is essential for homeowners, as it provides financial protection in the event of damage or destruction of your home. Without dwelling coverage, you could be left with significant financial losses, including the cost of repairs or replacement of your home.

In addition to financial protection, dwelling coverage also provides peace of mind for homeowners. Knowing that you have coverage in place can help reduce stress and anxiety in the event of an unexpected event.

Conclusion

Dwelling coverage is a critical component of a homeowners insurance policy, providing financial protection in the event of damage or destruction of your home. Understanding the different types of dwelling coverage, including dwelling building coverage, other structures coverage, personal property coverage, loss of use coverage, and additional living expenses coverage, can help homeowners make informed decisions about their insurance needs. By choosing the right dwelling coverage, homeowners can protect their investment and ensure financial security in the event of an unexpected event.

We hope this article has provided valuable information about dwelling coverage and its importance for homeowners. If you have any questions or comments, please don't hesitate to share them below.

What is dwelling coverage?

+Dwelling coverage is the part of a homeowners insurance policy that covers the physical structure of your home, including the walls, roof, and foundation.

What is the difference between dwelling building coverage and other structures coverage?

+Dwelling building coverage covers the physical structure of your home, while other structures coverage covers structures on your property that are not attached to your home, such as a detached garage or shed.

Do I need dwelling coverage if I rent my home?

+No, if you rent your home, you do not need dwelling coverage. However, you may want to consider renters insurance to cover your personal belongings.