Sales tax exemptions can be a complex and often confusing topic for businesses operating in the state of Texas. The Texas Sales Tax Exemption Form 01-339 is a crucial document that allows eligible businesses to claim exemptions from paying sales tax on qualified purchases. In this article, we will provide a comprehensive guide to help you understand the certification process and ensure you're taking advantage of the exemptions available to your business.

Understanding the Importance of Sales Tax Exemptions

Sales tax exemptions can have a significant impact on a business's bottom line. By claiming exemptions on qualified purchases, businesses can reduce their tax liability and free up more funds for operations, investments, and growth. In Texas, businesses can claim exemptions on a wide range of purchases, including equipment, machinery, and certain services.

Who is Eligible for Sales Tax Exemptions in Texas?

To be eligible for sales tax exemptions in Texas, businesses must meet specific requirements. The most common exemptions are available to:

- Manufacturers

- Contractors

- Non-profit organizations

- Educational institutions

- Government agencies

These businesses can claim exemptions on purchases related to their operations, such as equipment, machinery, and raw materials.

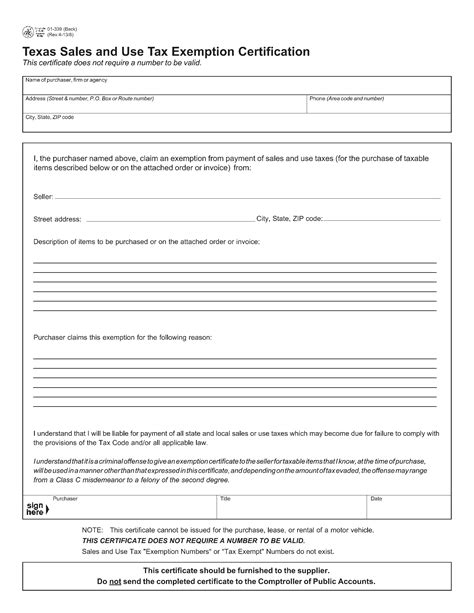

What is the Texas Sales Tax Exemption Form 01-339?

The Texas Sales Tax Exemption Form 01-339 is a certification document that allows eligible businesses to claim exemptions from paying sales tax on qualified purchases. The form must be completed and signed by the business and provided to the seller at the time of purchase.

What Information is Required on the Texas Sales Tax Exemption Form 01-339?

To complete the Texas Sales Tax Exemption Form 01-339, businesses must provide the following information:

- Business name and address

- Business type (e.g., manufacturer, contractor, non-profit organization)

- Exemption type (e.g., manufacturing, construction, resale)

- Description of the purchase

- Purchase amount

Step-by-Step Guide to Completing the Texas Sales Tax Exemption Form 01-339

Completing the Texas Sales Tax Exemption Form 01-339 can be a straightforward process if you have the required information. Here's a step-by-step guide to help you complete the form:

- Download the form: You can download the Texas Sales Tax Exemption Form 01-339 from the Texas Comptroller's website.

- Complete the business information: Enter your business name, address, and type.

- Select the exemption type: Choose the exemption type that applies to your business and purchase.

- Describe the purchase: Provide a detailed description of the purchase, including the item or service being purchased.

- Enter the purchase amount: Enter the total amount of the purchase.

- Sign and date the form: Sign and date the form to certify that the information is accurate.

Common Mistakes to Avoid When Completing the Texas Sales Tax Exemption Form 01-339

When completing the Texas Sales Tax Exemption Form 01-339, it's essential to avoid common mistakes that can lead to delays or rejection. Here are some common mistakes to avoid:

- Inaccurate business information: Ensure that your business information is accurate and up-to-date.

- Incorrect exemption type: Choose the correct exemption type for your business and purchase.

- Insufficient purchase description: Provide a detailed description of the purchase to avoid any confusion.

- Incorrect purchase amount: Enter the correct purchase amount to avoid any discrepancies.

Consequences of Failing to Complete the Texas Sales Tax Exemption Form 01-339 Correctly

Failing to complete the Texas Sales Tax Exemption Form 01-339 correctly can have serious consequences, including:

- Delayed or rejected exemptions: Inaccurate or incomplete forms can lead to delayed or rejected exemptions.

- Additional taxes and penalties: Failure to claim exemptions correctly can result in additional taxes and penalties.

- Audits and investigations: The Texas Comptroller's office may conduct audits and investigations to ensure compliance.

Best Practices for Managing Sales Tax Exemptions in Texas

To ensure you're taking advantage of sales tax exemptions in Texas, follow these best practices:

- Keep accurate records: Maintain accurate records of all purchases and exemptions claimed.

- Stay up-to-date with exemption rules: Regularly review and update your knowledge of exemption rules and regulations.

- Consult with a tax professional: Consult with a tax professional to ensure you're claiming exemptions correctly.

Conclusion

The Texas Sales Tax Exemption Form 01-339 is a crucial document that allows eligible businesses to claim exemptions from paying sales tax on qualified purchases. By following the step-by-step guide and avoiding common mistakes, you can ensure you're taking advantage of the exemptions available to your business. Remember to keep accurate records, stay up-to-date with exemption rules, and consult with a tax professional to ensure compliance.

We hope this guide has been helpful in understanding the Texas Sales Tax Exemption Form 01-339 certification process. If you have any questions or need further assistance, please don't hesitate to contact us.

What is the Texas Sales Tax Exemption Form 01-339?

+The Texas Sales Tax Exemption Form 01-339 is a certification document that allows eligible businesses to claim exemptions from paying sales tax on qualified purchases.

Who is eligible for sales tax exemptions in Texas?

+Eligible businesses include manufacturers, contractors, non-profit organizations, educational institutions, and government agencies.

What information is required on the Texas Sales Tax Exemption Form 01-339?

+The form requires business information, exemption type, purchase description, and purchase amount.