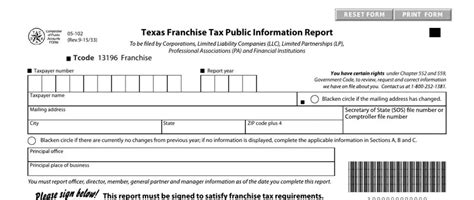

Are you a Texas resident struggling to navigate the complexities of tax season? One crucial document you may need to file is the Texas Form 05-102, also known as the Texas Franchise Tax Report. This form is required for businesses operating in Texas, and its accuracy is crucial for avoiding penalties and ensuring compliance with state regulations. In this article, we will provide you with five tips for filing Texas Form 05-102 correctly, helping you to simplify the process and minimize potential errors.

Understanding Texas Form 05-102

Before we dive into the tips, let's briefly understand what Texas Form 05-102 is all about. This form is used to report the franchise tax liability of businesses operating in Texas. It's essential for entities that are required to file a federal income tax return, such as corporations, limited liability companies, and partnerships. The form requires businesses to provide financial information, calculate their tax liability, and make any necessary payments.

Tip 1: Determine Your Filing Status

To file Texas Form 05-102 correctly, you need to determine your filing status. The Texas Comptroller's office requires businesses to file either a "No Tax Due Report" or a "Franchise Tax Report." If your business has a total revenue of $1.23 million or less, you may be eligible to file a "No Tax Due Report." However, if your revenue exceeds this threshold, you'll need to file a Franchise Tax Report. Make sure to review the Comptroller's guidelines to determine which filing status applies to your business.

Tip 2: Gather Required Documents and Information

Before starting the filing process, gather all required documents and information. You'll need:

- Your business's federal tax ID number

- The business's name and address

- The accounting period and fiscal year-end date

- Total revenue information

- Cost of goods sold and total costs

- Net income or loss

Having all the necessary documents and information at hand will save you time and reduce errors.

Additional Information Requirements

In addition to the above documents, you may need to provide additional information, such as:

- A copy of your federal tax return (Form 1120 or Form 1065)

- A detailed breakdown of your total revenue

- A list of your business's affiliates and related entities

Tip 3: Calculate Your Tax Liability Accurately

Calculating your tax liability is a critical step in filing Texas Form 05-102. The Texas Comptroller's office uses a tiered tax rate system, ranging from 0.375% to 0.75%. You'll need to calculate your total revenue, subtract any deductions and exemptions, and apply the applicable tax rate. Be sure to review the Comptroller's guidelines for calculating tax liability to avoid errors.

Tax Liability Calculation Example

To illustrate the calculation process, let's consider an example:

- Total revenue: $1.5 million

- Cost of goods sold: $750,000

- Total costs: $1.2 million

- Net income: $300,000

- Tax rate: 0.375% (tier 1 rate)

Tax liability = (Total revenue - Cost of goods sold) x Tax rate Tax liability = ($1.5 million - $750,000) x 0.375% Tax liability = $562,500 x 0.00375 Tax liability = $2,109.38

Tip 4: File Electronically or by Mail

The Texas Comptroller's office offers two filing options: electronic filing and mail filing. Electronic filing is the preferred method, as it's faster, more accurate, and reduces the risk of lost or delayed returns. You can file electronically through the Comptroller's website or through a third-party tax preparation software. If you prefer to file by mail, make sure to use the correct address and follow the Comptroller's guidelines for mail filing.

Tip 5: Meet the Filing Deadline

The filing deadline for Texas Form 05-102 is typically May 15th for calendar-year filers. However, the deadline may vary depending on your business's fiscal year-end date. Make sure to check the Comptroller's website for specific filing deadlines and to plan accordingly. Late filing can result in penalties and interest, so it's essential to meet the deadline.

By following these five tips, you'll be well on your way to filing Texas Form 05-102 correctly. Remember to determine your filing status, gather required documents and information, calculate your tax liability accurately, file electronically or by mail, and meet the filing deadline. If you're unsure about any aspect of the filing process, consider consulting with a tax professional or seeking guidance from the Texas Comptroller's office.

What is the purpose of Texas Form 05-102?

+Texas Form 05-102 is used to report the franchise tax liability of businesses operating in Texas.

Who needs to file Texas Form 05-102?

+Entities that are required to file a federal income tax return, such as corporations, limited liability companies, and partnerships, need to file Texas Form 05-102.

What is the filing deadline for Texas Form 05-102?

+The filing deadline for Texas Form 05-102 is typically May 15th for calendar-year filers, but may vary depending on the business's fiscal year-end date.

We hope this article has provided you with valuable insights and tips for filing Texas Form 05-102 correctly. If you have any questions or need further assistance, please don't hesitate to reach out. Share your experiences and feedback in the comments section below, and help others navigate the complexities of tax season.