Form 3554 is a crucial document for businesses and individuals looking to claim tax credits for their investments in research and development, renewable energy, and other qualifying activities. The tax credit application process can be complex and time-consuming, but with a thorough understanding of Form 3554, applicants can navigate the process with ease.

The importance of tax credits cannot be overstated. Tax credits can significantly reduce a company's tax liability, providing a much-needed boost to their bottom line. For individuals, tax credits can result in a larger refund or a reduced tax bill. However, to take advantage of these benefits, applicants must carefully complete Form 3554 and submit it to the relevant authorities.

In this article, we will delve into the world of Form 3554, exploring its purpose, benefits, and the step-by-step process of completing and submitting the form. We will also discuss common mistakes to avoid and provide tips for ensuring a successful application.

What is Form 3554?

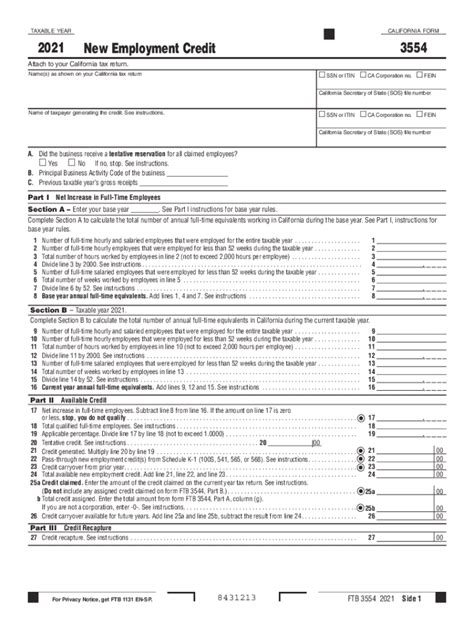

Form 3554 is a tax form used to apply for tax credits under various programs, including the Research and Development (R&D) Tax Credit, the Renewable Energy Tax Credit, and the Historic Preservation Tax Credit. The form is used to calculate the amount of tax credit available to the applicant and to provide supporting documentation for the claimed credits.

Benefits of Form 3554

The benefits of Form 3554 are numerous. By completing and submitting the form, applicants can:

- Claim tax credits for qualifying activities, such as R&D and renewable energy investments

- Reduce their tax liability, resulting in a lower tax bill or a larger refund

- Increase their cash flow, allowing them to invest in new projects and expand their business

- Enhance their competitiveness, by reducing their tax burden and increasing their profitability

Step-by-Step Process of Completing and Submitting Form 3554

Completing and submitting Form 3554 requires careful attention to detail and a thorough understanding of the tax credit programs. Here is a step-by-step guide to help applicants navigate the process:

- Determine Eligibility: Before starting the application process, applicants must determine if they are eligible for the tax credit program. This involves reviewing the program's requirements and ensuring that their activities qualify for the credit.

- Gather Supporting Documentation: Applicants must gather supporting documentation, such as financial records, invoices, and receipts, to support their claimed credits.

- Complete Form 3554: The applicant must complete Form 3554, providing detailed information about their qualifying activities, expenses, and credits claimed.

- Calculate the Tax Credit: The applicant must calculate the tax credit amount, using the formulas and rates provided in the tax credit program.

- Submit the Form: The completed Form 3554 must be submitted to the relevant authorities, along with the supporting documentation.

Common Mistakes to Avoid

When completing and submitting Form 3554, applicants must avoid common mistakes that can delay or even reject their application. These mistakes include:

- Inaccurate or incomplete information: Providing inaccurate or incomplete information can result in delays or rejection of the application.

- Insufficient supporting documentation: Failing to provide sufficient supporting documentation can result in the application being rejected.

- Incorrect calculation of the tax credit: Calculating the tax credit incorrectly can result in a reduced or denied credit.

Tips for a Successful Application

To ensure a successful application, applicants should:

- Carefully review the tax credit program: Before starting the application process, applicants should carefully review the tax credit program, ensuring they understand the requirements and qualifications.

- Seek professional advice: Applicants should consider seeking professional advice, such as from a tax consultant or attorney, to ensure they are meeting all the requirements.

- Keep accurate records: Applicants should keep accurate records of their qualifying activities, expenses, and credits claimed, to support their application.

Frequently Asked Questions

What is the deadline for submitting Form 3554?

+The deadline for submitting Form 3554 varies depending on the tax credit program. Applicants should check the program's requirements for specific deadlines.

Can I amend my Form 3554 if I make a mistake?

+Yes, applicants can amend their Form 3554 if they make a mistake. However, they must follow the procedures outlined in the tax credit program.

How long does it take to process Form 3554?

+The processing time for Form 3554 varies depending on the tax credit program. Applicants should check the program's requirements for specific processing times.

In conclusion, Form 3554 is a critical document for businesses and individuals looking to claim tax credits for their investments in research and development, renewable energy, and other qualifying activities. By understanding the purpose, benefits, and step-by-step process of completing and submitting the form, applicants can navigate the process with ease and avoid common mistakes. Remember to carefully review the tax credit program, seek professional advice, and keep accurate records to ensure a successful application.