The Symetra withdrawal form is a crucial document for individuals who have invested in Symetra's financial products, such as life insurance policies or retirement accounts. Withdrawing funds from these accounts can be a complex process, and it's essential to understand the steps involved to avoid any potential issues or penalties. In this article, we will provide a comprehensive, step-by-step guide on how to complete the Symetra withdrawal form.

Symetra is a well-established financial services company that offers a range of products, including life insurance, annuities, and retirement plans. Their products are designed to help individuals plan for their financial future, achieve their goals, and secure their loved ones' well-being. However, there may come a time when policyholders need to access their funds, and that's where the Symetra withdrawal form comes in.

Why Withdraw Funds from Symetra?

There are various reasons why individuals may need to withdraw funds from their Symetra accounts. Some common reasons include:

- Financial emergencies or unexpected expenses

- Retirement or separation from employment

- Changing financial goals or circumstances

- Needing to access funds for education or medical expenses

Eligibility for Withdrawal

Before initiating the withdrawal process, it's essential to check if you're eligible to withdraw funds from your Symetra account. The eligibility criteria may vary depending on the type of product you have and the terms of your contract. Generally, you may be eligible to withdraw funds if:

- You have reached the minimum age requirement (e.g., 59 1/2 for retirement accounts)

- You have completed the required waiting period (if applicable)

- You have sufficient funds in your account to cover the withdrawal amount

Step-by-Step Guide to Completing the Symetra Withdrawal Form

To complete the Symetra withdrawal form, follow these steps:

- Gather Required Information: Before starting the withdrawal process, ensure you have all the necessary information and documents ready. This may include:

- Your policy or account number

- Your name and contact information

- The withdrawal amount and frequency (if applicable)

- Your bank account information (for direct deposit)

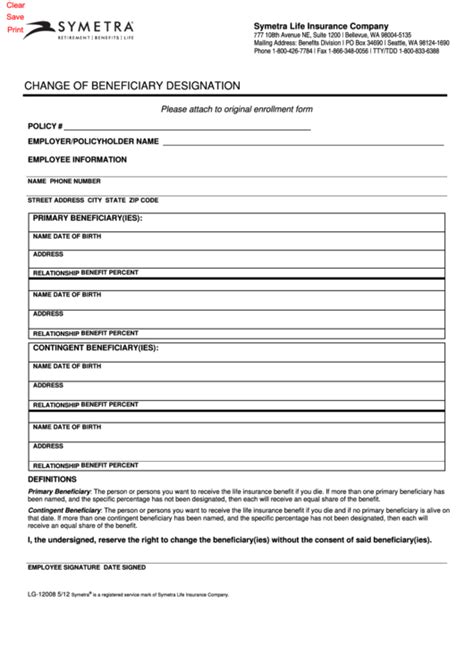

- Download or Obtain the Withdrawal Form: You can download the Symetra withdrawal form from the company's website or request a copy by phone or mail. Make sure you have the correct form for your specific product.

- Fill Out the Form: Carefully complete the withdrawal form, providing all the required information. Be sure to:

- Sign and date the form

- Specify the withdrawal amount and frequency (if applicable)

- Choose your payment method (e.g., direct deposit, check)

- Attach Required Documents: Depending on the type of withdrawal, you may need to attach supporting documents, such as:

- Proof of identity (e.g., driver's license, passport)

- Proof of age (e.g., birth certificate)

- Proof of address (e.g., utility bill, lease agreement)

- Submit the Form: Once you've completed the form and attached all required documents, submit it to Symetra via mail, fax, or email. Make sure to keep a copy of the form and supporting documents for your records.

- Review and Verify: Symetra will review your withdrawal request and verify the information provided. This may take a few days or weeks, depending on the complexity of the request.

- Receive Your Funds: Once your withdrawal request is approved, Symetra will process the payment according to your chosen method.

Important Considerations

Before withdrawing funds from your Symetra account, consider the following:

- Taxes and Penalties: Withdrawals may be subject to taxes and penalties, depending on the type of product and your individual circumstances. Consult with a tax professional or financial advisor to understand the implications.

- Surrender Charges: Some Symetra products may have surrender charges or fees associated with withdrawals. Review your contract to understand any potential charges.

- Impact on Benefits: Withdrawing funds may affect your benefits or coverage under your Symetra policy. Carefully review the terms of your contract to understand any potential implications.

Common Mistakes to Avoid

When completing the Symetra withdrawal form, avoid the following common mistakes:

- Inaccurate or incomplete information: Ensure you provide accurate and complete information to avoid delays or rejection of your withdrawal request.

- Insufficient documentation: Attach all required documents to support your withdrawal request.

- Incorrect payment method: Choose the correct payment method to receive your funds promptly.

Seeking Help and Support

If you need help or have questions about the Symetra withdrawal form, you can:

- Contact Symetra's customer service department via phone or email

- Consult with a financial advisor or tax professional

- Review Symetra's website or online resources for additional information

Conclusion

Completing the Symetra withdrawal form requires careful attention to detail and an understanding of the process. By following the steps outlined in this guide, you can ensure a smooth and efficient withdrawal process. Remember to review the terms of your contract, consider the potential implications, and seek help if needed.

Invitation to Comment and Share

Have you had experience with the Symetra withdrawal form? Share your thoughts and feedback in the comments section below. If you found this guide helpful, please share it with others who may benefit from this information.

FAQ Section:

What is the Symetra withdrawal form?

+The Symetra withdrawal form is a document used to request the withdrawal of funds from a Symetra life insurance policy or retirement account.

How do I obtain a Symetra withdrawal form?

+You can download the Symetra withdrawal form from the company's website or request a copy by phone or mail.

What information do I need to provide on the Symetra withdrawal form?

+You will need to provide your policy or account number, name and contact information, withdrawal amount and frequency (if applicable), and bank account information (for direct deposit).