The Standard Form 678, also known as the Employee Claim for Reimbursement, is a crucial document used by federal employees to request reimbursement for expenses incurred while performing official duties. Understanding the intricacies of this form is essential for employees to ensure they receive fair compensation for their expenditures. In this article, we will delve into the world of SF 678, exploring its purpose, benefits, and the step-by-step process of completing and submitting the form.

What is SF 678?

The Standard Form 678 is a document designed by the U.S. General Services Administration (GSA) to facilitate the reimbursement process for federal employees. The form allows employees to claim reimbursement for various expenses, including travel, transportation, and other work-related expenditures.

Benefits of Using SF 678

The SF 678 form offers several benefits to federal employees, including:

- Simplified reimbursement process: The form provides a structured format for employees to report their expenses, making it easier for agencies to process reimbursement claims.

- Increased accuracy: By using the SF 678 form, employees can ensure that their expense reports are accurate and complete, reducing the likelihood of errors or discrepancies.

- Improved record-keeping: The form helps employees maintain a record of their expenses, which can be useful for future reference or auditing purposes.

Eligible Expenses

To be eligible for reimbursement, expenses must be reasonable, necessary, and directly related to official duties. Some examples of eligible expenses include:

- Travel expenses (e.g., transportation, lodging, meals)

- Transportation expenses (e.g., mileage, parking fees)

- Conference registration fees

- Training or education expenses

Completing the SF 678 Form

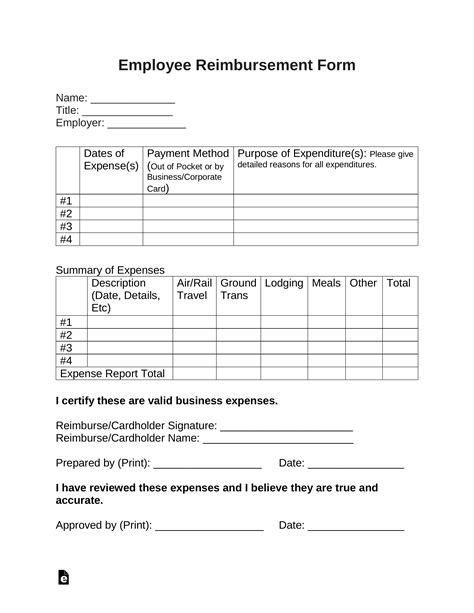

To complete the SF 678 form, employees must provide the following information:

- Employee information (name, grade, and agency)

- Travel dates and destinations

- Expense type and amount

- Supporting documentation (e.g., receipts, invoices)

Step-by-Step Guide to Submitting the SF 678 Form

- Obtain a copy of the SF 678 form from the GSA website or your agency's intranet.

- Complete the form in its entirety, ensuring that all required information is accurate and legible.

- Attach supporting documentation, such as receipts or invoices, to the form.

- Submit the completed form to your agency's administrative office or designated personnel.

- Verify that your agency has received the form and is processing your reimbursement claim.

Tips for Ensuring a Smooth Reimbursement Process

To ensure a smooth reimbursement process, employees should:

- Keep accurate and detailed records of their expenses

- Submit the SF 678 form in a timely manner

- Provide clear and concise supporting documentation

- Follow up with their agency's administrative office to confirm receipt and processing of the form

Common Mistakes to Avoid

When completing the SF 678 form, employees should avoid the following common mistakes:

- Incomplete or inaccurate information

- Insufficient supporting documentation

- Failure to submit the form in a timely manner

- Not following agency-specific reimbursement policies

Conclusion

In conclusion, understanding the Standard Form 678 is essential for federal employees to ensure they receive fair compensation for their expenses. By following the guidelines outlined in this article, employees can complete and submit the form with confidence, avoiding common mistakes and ensuring a smooth reimbursement process.

We invite you to share your thoughts and experiences with the SF 678 form in the comments section below. Have you encountered any challenges or successes with the reimbursement process? Your feedback can help others navigate the process with ease.

FAQ Section

What is the purpose of the SF 678 form?

+The SF 678 form is used by federal employees to request reimbursement for expenses incurred while performing official duties.

What types of expenses are eligible for reimbursement?

+Eligible expenses include travel, transportation, conference registration fees, and training or education expenses, as long as they are reasonable, necessary, and directly related to official duties.

How do I submit the SF 678 form?

+Submit the completed form to your agency's administrative office or designated personnel, along with supporting documentation, such as receipts or invoices.