The world of sales tax exemptions can be complex and overwhelming, especially for businesses operating in the state of New Jersey. As a business owner, it's essential to understand the ins and outs of sales tax exemptions to avoid any potential penalties or fines. In this article, we'll delve into the details of the NJ ST-3 Form, also known as the Sales Tax Exemption Certificate, and provide you with a comprehensive guide on how to navigate this crucial document.

What is the NJ ST-3 Form?

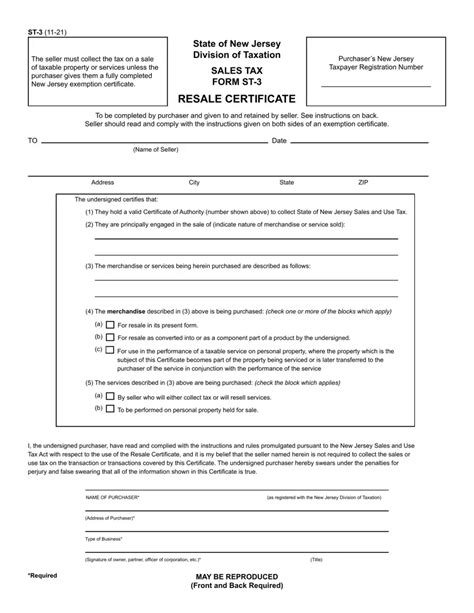

The NJ ST-3 Form is a certificate that allows a business or organization to claim exemption from sales tax on certain purchases. The form is used to certify that the buyer is eligible for a sales tax exemption and must be presented to the seller at the time of purchase. The NJ ST-3 Form is typically used for purchases of tangible personal property, such as equipment, supplies, and materials.

Who is Eligible for a Sales Tax Exemption?

To be eligible for a sales tax exemption, the buyer must meet specific criteria. The following types of organizations and businesses are typically eligible for a sales tax exemption in New Jersey:

- Non-profit organizations

- Government agencies

- Educational institutions

- Hospitals and healthcare organizations

- Certain types of manufacturing and industrial businesses

Additionally, some businesses may be eligible for a partial exemption, depending on the type of products they purchase and the intended use.

Types of Sales Tax Exemptions

There are several types of sales tax exemptions available in New Jersey, including:

- Exemption for non-profit organizations (NJ ST-3 Form)

- Exemption for government agencies (NJ ST-3 Form)

- Exemption for educational institutions (NJ ST-3 Form)

- Exemption for hospitals and healthcare organizations (NJ ST-3 Form)

- Exemption for certain types of manufacturing and industrial businesses (NJ ST-5 Form)

Each type of exemption has its own set of eligibility criteria and requirements.

How to Complete the NJ ST-3 Form

To complete the NJ ST-3 Form, you'll need to provide the following information:

- Business name and address

- Business type and federal tax ID number

- Description of the exempt purchases

- Certification statement

The form must be signed and dated by an authorized representative of the business.

Common Mistakes to Avoid

When completing the NJ ST-3 Form, it's essential to avoid common mistakes that can result in delays or even penalties. Some common mistakes to avoid include:

- Incomplete or inaccurate information

- Failure to provide required documentation

- Using an outdated version of the form

- Not signing and dating the form

By avoiding these common mistakes, you can ensure a smooth and hassle-free experience when claiming a sales tax exemption.

Benefits of Using the NJ ST-3 Form

Using the NJ ST-3 Form can provide several benefits to businesses and organizations, including:

- Reduced costs: By claiming a sales tax exemption, businesses can reduce their costs and save money on purchases.

- Increased efficiency: The NJ ST-3 Form streamlines the exemption process, making it easier and faster to claim an exemption.

- Compliance: Using the NJ ST-3 Form helps businesses comply with state regulations and avoid potential penalties.

FAQs

Who is eligible for a sales tax exemption in New Jersey?

+Non-profit organizations, government agencies, educational institutions, hospitals and healthcare organizations, and certain types of manufacturing and industrial businesses are eligible for a sales tax exemption in New Jersey.

What is the NJ ST-3 Form used for?

+The NJ ST-3 Form is used to certify that the buyer is eligible for a sales tax exemption and must be presented to the seller at the time of purchase.

How do I complete the NJ ST-3 Form?

+To complete the NJ ST-3 Form, you'll need to provide business information, description of exempt purchases, and certification statement. The form must be signed and dated by an authorized representative of the business.

By understanding the NJ ST-3 Form and how to use it correctly, businesses and organizations can take advantage of sales tax exemptions and reduce their costs. Remember to complete the form accurately and avoid common mistakes to ensure a smooth and hassle-free experience.