South Carolina taxpayers who are unable to meet the original tax filing deadline can request a six-month extension to file their state tax return. The deadline for filing state tax returns in South Carolina is typically April 15th, but with an extension, taxpayers can file their return by October 15th. Here are five ways to file a South Carolina extension form:

Understanding the Importance of Filing an Extension

Filing an extension in South Carolina can help prevent penalties and fines for late filing. The state may impose a penalty of up to 22% of the unpaid tax if the return is filed late. Additionally, interest may accrue on the unpaid tax, further increasing the taxpayer's liability. By filing an extension, taxpayers can avoid these additional costs and have extra time to gather necessary documents, resolve any tax disputes, or address other tax-related issues.

Option 1: Online Filing through the South Carolina Department of Revenue Website

The South Carolina Department of Revenue (SCDOR) allows taxpayers to file an extension online through their website. To do so, taxpayers will need to:

- Visit the SCDOR website and log in to their account

- Select the "Extensions" tab and choose the tax year for which they want to file an extension

- Complete the online application, providing required information, such as name, Social Security number or federal employer identification number (FEIN), and tax year

- Submit the application and receive confirmation of the extension filing

Benefits of Online Filing

- Convenient and accessible 24/7

- Faster processing time compared to paper filing

- Immediate confirmation of extension filing

Option 2: Filing an Extension by Phone

Taxpayers can also file an extension by calling the SCDOR's customer service center. To do so, taxpayers will need to:

- Call the SCDOR's customer service center at (803) 898-5577

- Provide required information, such as name, Social Security number or FEIN, and tax year

- Answer questions from the representative to complete the extension application

- Receive confirmation of the extension filing

Benefits of Phone Filing

- Quick and convenient for those without internet access

- Opportunity to ask questions or resolve issues with a representative

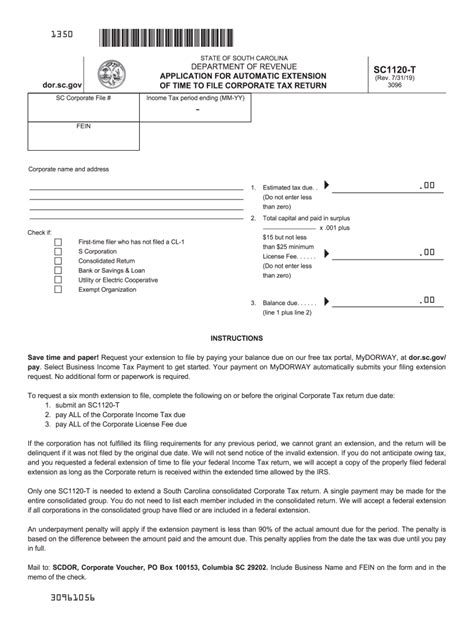

Option 3: Filing an Extension by Mail

Taxpayers can file an extension by mailing a paper application to the SCDOR. To do so, taxpayers will need to:

- Download and complete Form SC4868 (Application for Automatic Extension of Time to File Individual Income Tax Return)

- Attach a copy of federal Form 4868, if applicable

- Mail the application to the SCDOR at the address listed on the form

- Keep a copy of the application for their records

Benefits of Mail Filing

- Suitable for those who prefer paper filing or need to attach additional documentation

- Opportunity to review and edit the application before submission

Option 4: Filing an Extension through Tax Software

Many tax software providers, such as TurboTax or H&R Block, offer extension filing services. Taxpayers can use these software programs to prepare and file their extension application. To do so, taxpayers will need to:

- Create an account or log in to their existing account with the tax software provider

- Follow the software's prompts to complete the extension application

- Review and edit the application before submission

- Submit the application and receive confirmation of the extension filing

Benefits of Tax Software Filing

- Convenient and accessible 24/7

- Faster processing time compared to paper filing

- Opportunity to review and edit the application before submission

Option 5: Filing an Extension through a Tax Professional

Taxpayers can also file an extension through a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA). To do so, taxpayers will need to:

- Contact a tax professional and provide required information, such as name, Social Security number or FEIN, and tax year

- Answer questions from the tax professional to complete the extension application

- Review and sign the application before submission

- Receive confirmation of the extension filing

Benefits of Tax Professional Filing

- Opportunity to receive guidance and support from a tax expert

- Reduced risk of errors or omissions on the application

- Potential for additional tax planning and optimization strategies

We hope this article has provided valuable insights and guidance on filing a South Carolina extension form. If you have any further questions or concerns, please don't hesitate to ask. We encourage you to share your thoughts and experiences in the comments below.

What is the deadline for filing a South Carolina state tax return?

+The deadline for filing a South Carolina state tax return is typically April 15th. However, taxpayers can request a six-month extension to file their return by October 15th.

How do I file an extension in South Carolina?

+There are five ways to file an extension in South Carolina: online through the SCDOR website, by phone, by mail, through tax software, or through a tax professional.

What is the penalty for late filing in South Carolina?

+The penalty for late filing in South Carolina can be up to 22% of the unpaid tax, plus interest on the unpaid tax.