Government forms can be a daunting task for many, but understanding the process can make a huge difference. The SF 425 form, also known as the "Financial Report" form, is a crucial document used by the U.S. government to track financial transactions and manage funds. In this article, we will delve into the world of the SF 425 form, providing a comprehensive guide on how to fill it out accurately and efficiently.

What is the SF 425 Form?

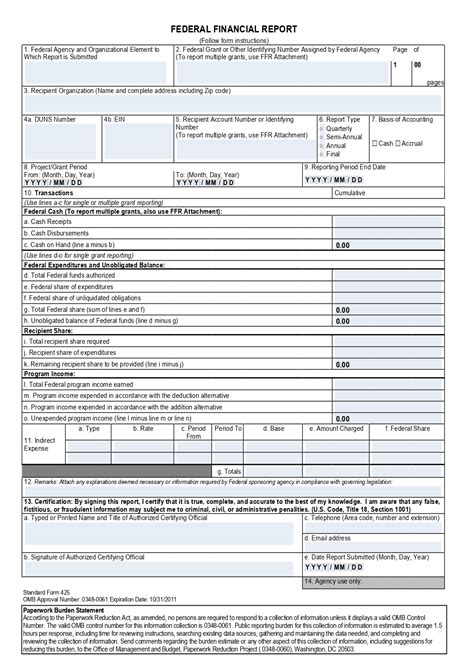

The SF 425 form is a standard government form used to report financial information on grants, cooperative agreements, and other federal funding awards. It is typically used by recipient organizations, such as non-profit institutions, universities, and state and local governments, to report on their financial activities and expenditures. The form is designed to provide a clear and concise overview of an organization's financial situation, allowing the government to monitor and manage funds effectively.

Who Needs to Fill Out the SF 425 Form?

Eligible Recipients

The SF 425 form is required for organizations that receive federal funding awards, including:

- Non-profit institutions

- Universities and colleges

- State and local governments

- Tribal governments

- For-profit organizations (in certain circumstances)

These organizations must submit the SF 425 form on a regular basis, usually quarterly or annually, depending on the terms of their funding award.

Step-by-Step Guide to Filling Out the SF 425 Form

Section 1: Reporting Period and Award Information

- Report the reporting period and award information, including the award number, project period, and total award amount.

- Ensure that all information is accurate and up-to-date.

Section 2: Financial Report

- Report all financial transactions related to the funding award, including:

- Obligations (e.g., contracts, grants, and loans)

- Expenditures (e.g., salaries, equipment, and travel)

- Unobligated balance (e.g., funds not yet spent or committed)

- Use the provided tables and columns to report financial data.

Section 3: Program Income

- Report any program income earned during the reporting period, including:

- Interest earned on investments

- Rent and royalties

- Sales of goods or services

- Use the provided tables and columns to report program income.

Section 4: Audit and Compliance

- Certify that the financial report is accurate and complete.

- Report any audit findings or compliance issues.

Tips and Best Practices for Filling Out the SF 425 Form

- Read the instructions carefully and thoroughly before starting the form.

- Use the provided tables and columns to ensure accurate and complete reporting.

- Ensure that all financial data is accurate and up-to-date.

- Review and edit the form carefully before submission.

- Submit the form on time, as late submissions may result in delays or penalties.

Common Mistakes to Avoid When Filling Out the SF 425 Form

- Inaccurate or incomplete reporting

- Failure to report program income

- Failure to certify the financial report

- Late submission

- Inadequate supporting documentation

Conclusion

Filling out the SF 425 form may seem like a daunting task, but by following this step-by-step guide, you can ensure that your organization's financial report is accurate, complete, and submitted on time. Remember to read the instructions carefully, use the provided tables and columns, and review and edit the form carefully before submission. By avoiding common mistakes and following best practices, you can ensure a smooth and successful reporting process.

FAQ Section

Who is required to fill out the SF 425 form?

+Organizations that receive federal funding awards, including non-profit institutions, universities, state and local governments, tribal governments, and for-profit organizations (in certain circumstances).

How often do I need to submit the SF 425 form?

+Quarterly or annually, depending on the terms of your funding award.

What happens if I submit the SF 425 form late?

+Late submissions may result in delays or penalties.