Securian 401k plans are a type of employer-sponsored retirement plan that helps employees save for their future. Withdrawing funds from a 401k plan can be a complex process, but understanding the steps involved can make it easier. In this article, we will guide you through the process of filling out a Securian 401k withdrawal form, explaining the rules and regulations surrounding 401k withdrawals, and providing tips on how to make the most of your retirement savings.

Understanding 401k Withdrawal Rules

Before we dive into the Securian 401k withdrawal form, it's essential to understand the rules surrounding 401k withdrawals. The IRS allows 401k participants to withdraw funds from their accounts under certain circumstances. These circumstances include:

- Separation from service (e.g., quitting or being terminated)

- Disability

- Death

- Reaching age 55 (and separating from service)

- Reaching age 59 1/2

- Financial hardship (e.g., medical expenses, tuition fees, or funeral expenses)

Keep in mind that 401k withdrawals are subject to income tax and may be subject to a 10% penalty if taken before age 59 1/2, unless an exception applies.

Types of 401k Withdrawals

There are several types of 401k withdrawals, including:

- Lump-sum distribution: A one-time payment of the entire account balance.

- Installment payments: Regular payments over a set period (e.g., monthly or quarterly).

- Annuity payments: Guaranteed payments for a set period (e.g., 10 years) or for life.

Securian 401k Withdrawal Form: A Step-By-Step Guide

To initiate a 401k withdrawal from a Securian plan, you will need to complete a withdrawal form. Here's a step-by-step guide to help you navigate the process:

- Gather required documents: You will need to provide identification, proof of age, and proof of separation from service (if applicable).

- Determine the withdrawal amount: Calculate the amount you wish to withdraw, keeping in mind the 10% penalty for withdrawals before age 59 1/2.

- Choose a withdrawal method: Select the type of withdrawal you prefer (lump-sum, installment, or annuity).

- Complete the withdrawal form: Fill out the Securian 401k withdrawal form, which can be obtained from your plan administrator or downloaded from the Securian website.

- Submit the form: Return the completed form to your plan administrator, along with any required documentation.

Securian 401k Withdrawal Form Sections

The Securian 401k withdrawal form typically includes the following sections:

- Participant information: Your name, address, Social Security number, and date of birth.

- Withdrawal information: The amount you wish to withdraw, the withdrawal method, and the date of withdrawal.

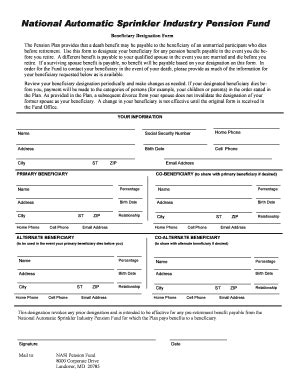

- Beneficiary information: The name and address of your beneficiary (if applicable).

- Tax withholding: Your choice of tax withholding (e.g., federal, state, or local).

- Certification: Your signature, certifying that you have read and understood the withdrawal rules and regulations.

Tips for Filing a Securian 401k Withdrawal Form

To ensure a smooth withdrawal process, keep the following tips in mind:

- Consult with a financial advisor: Before withdrawing funds, consider consulting with a financial advisor to determine the best course of action for your retirement savings.

- Understand the tax implications: Be aware of the tax implications of your withdrawal, including any penalties or tax withholding.

- Keep records: Maintain records of your withdrawal, including the form, receipts, and any correspondence with your plan administrator.

- Consider alternative options: If you're experiencing financial hardship, consider alternative options, such as a loan or a Roth IRA conversion.

FAQs

Can I withdraw funds from my Securian 401k plan at any time?

+No, you can only withdraw funds from your Securian 401k plan under certain circumstances, such as separation from service, disability, or reaching age 59 1/2.

Are 401k withdrawals subject to income tax?

+Yes, 401k withdrawals are subject to income tax and may be subject to a 10% penalty if taken before age 59 1/2, unless an exception applies.

Can I roll over my 401k withdrawal into an IRA?

+Yes, you can roll over your 401k withdrawal into an IRA, which may provide more investment options and flexibility.

By following this step-by-step guide, you'll be well on your way to navigating the Securian 401k withdrawal form and making informed decisions about your retirement savings. Remember to consult with a financial advisor, understand the tax implications, and keep records of your withdrawal.