The world of financial reporting can be complex and overwhelming, especially when it comes to deciphering the various transaction codes used in SEC Form 4 filings. As a key component of insider trading regulations, Form 4 is a crucial document that provides valuable insights into the buying and selling activities of company insiders, including executives, directors, and major shareholders. In this article, we will delve into the world of Form 4 transaction codes, exploring their meanings, significance, and practical applications.

Understanding Form 4 Transaction Codes

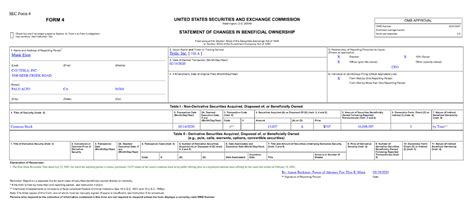

Form 4 transaction codes are a series of letters and numbers used to identify the type of transaction being reported. These codes are essential for accurately interpreting the data contained in Form 4 filings, which can have a significant impact on investment decisions and market analysis. With over 20 different transaction codes to navigate, it's essential to understand the meanings behind each code to gain a deeper understanding of insider trading activities.

Common Form 4 Transaction Codes

Here are some of the most common Form 4 transaction codes, along with their meanings:

- A: Grant, award, or other acquisition of securities (e.g., stock options, restricted stock units)

- D: Sale or disposition of securities (e.g., selling shares, exercising options)

- F: Payment of exercise price or tax liability using portion of securities received (e.g., using stock to cover taxes)

- G: Gift of securities (e.g., transferring shares to a family member)

- I: Exercise of derivative security (e.g., stock options, warrants)

- J: Other acquisition or disposition of securities (e.g., acquisition through a merger or disposition through a sale)

- K: Transaction under Rule 16b-3 (e.g., certain transactions by executive officers or directors)

- L: Small acquisition under Rule 16a-6 (e.g., purchases of less than $10,000)

These codes provide a wealth of information about the transactions being reported, including the type of security, the date of the transaction, and the number of shares involved.

Practical Applications of Form 4 Transaction Codes

Form 4 transaction codes have numerous practical applications in the world of finance and investing. Here are a few examples:

- Investment research: By analyzing Form 4 transaction codes, investors can gain valuable insights into insider trading activities, which can inform investment decisions and help identify potential trends.

- Risk management: Understanding Form 4 transaction codes can help companies and investors manage risk by identifying potential conflicts of interest and ensuring compliance with regulatory requirements.

- Regulatory compliance: Accurate reporting of Form 4 transaction codes is essential for ensuring compliance with SEC regulations and avoiding potential fines and penalties.

Best Practices for Working with Form 4 Transaction Codes

When working with Form 4 transaction codes, it's essential to follow best practices to ensure accuracy and compliance. Here are a few tips:

- Verify code meanings: Take the time to verify the meanings of each transaction code to ensure accurate interpretation and reporting.

- Use reliable sources: Rely on trusted sources, such as the SEC website or reputable financial databases, to ensure access to accurate and up-to-date information.

- Maintain accurate records: Keep accurate records of all transactions, including dates, codes, and details, to facilitate reporting and compliance.

By following these best practices and gaining a deeper understanding of Form 4 transaction codes, you can unlock the full potential of insider trading data and make more informed investment decisions.

Conclusion

Decoding Form 4 transaction codes can seem like a daunting task, but with practice and patience, you can unlock the secrets of insider trading data. By understanding the meanings behind each code and applying this knowledge in practical contexts, you can gain valuable insights into the world of finance and investing. Remember to always verify code meanings, use reliable sources, and maintain accurate records to ensure compliance and accuracy.

We hope this article has provided you with a comprehensive guide to Form 4 transaction codes. Whether you're an investor, researcher, or compliance officer, we encourage you to continue exploring the world of insider trading data and unlock its full potential.

What is Form 4?

+Form 4 is a document filed with the Securities and Exchange Commission (SEC) by company insiders, including executives, directors, and major shareholders, to report their buying and selling activities.

What are Form 4 transaction codes?

+Form 4 transaction codes are a series of letters and numbers used to identify the type of transaction being reported, such as a sale, purchase, or exercise of options.

Why are Form 4 transaction codes important?

+Form 4 transaction codes provide valuable insights into insider trading activities, which can inform investment decisions and help identify potential trends.