The SCIF mileage form is a crucial document for individuals and businesses that use their vehicles for official purposes. It helps track and record mileage expenses, making it easier to claim reimbursements or deductions on tax returns. However, filling out mileage forms can be a tedious and time-consuming task, especially for those who are not familiar with the process. In this article, we will explore the importance of SCIF mileage forms, their benefits, and provide a step-by-step guide on how to simplify the reporting process.

What is a SCIF Mileage Form?

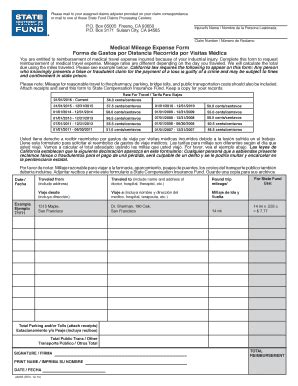

A SCIF mileage form, also known as a mileage log or mileage record, is a document used to track and record the mileage of a vehicle used for official purposes. It is typically used by employees, self-employed individuals, and businesses to record the miles driven for work-related activities. The form helps to calculate the total mileage expenses, which can be used to claim reimbursements or deductions on tax returns.

Why is a SCIF Mileage Form Important?

A SCIF mileage form is essential for several reasons:

- Accurate tracking of mileage expenses: A mileage form helps to track and record the miles driven for work-related activities, making it easier to calculate the total mileage expenses.

- Simplified reimbursement process: By using a mileage form, individuals and businesses can easily claim reimbursements for mileage expenses.

- Tax deductions: Mileage expenses can be deducted on tax returns, and a mileage form provides the necessary documentation to support these deductions.

Benefits of Using a SCIF Mileage Form

Using a SCIF mileage form offers several benefits, including:

- Simplified reporting process: A mileage form helps to streamline the reporting process, making it easier to track and record mileage expenses.

- Increased accuracy: A mileage form reduces the risk of errors and inaccuracies, ensuring that mileage expenses are accurately tracked and recorded.

- Improved compliance: A mileage form helps to ensure compliance with tax laws and regulations, reducing the risk of audits and penalties.

Step-by-Step Guide to Simplifying the Reporting Process

To simplify the reporting process, follow these steps:

- Obtain a mileage form: Obtain a SCIF mileage form from your employer or create one using a template.

- Track mileage expenses: Record the miles driven for work-related activities, including the date, starting and ending points, and total miles driven.

- Calculate mileage expenses: Calculate the total mileage expenses by multiplying the total miles driven by the mileage rate.

- Submit the form: Submit the completed mileage form to your employer or accountant.

Best Practices for Using a SCIF Mileage Form

To get the most out of a SCIF mileage form, follow these best practices:

- Use a mileage form template: Use a mileage form template to ensure that all necessary information is included.

- Keep accurate records: Keep accurate and detailed records of mileage expenses.

- Submit the form on time: Submit the completed mileage form on time to avoid delays in reimbursement or deductions.

Common Mistakes to Avoid

When using a SCIF mileage form, avoid the following common mistakes:

- Inaccurate records: Inaccurate records can lead to errors and inaccuracies in mileage expenses.

- Late submissions: Late submissions can delay reimbursement or deductions.

- Missing information: Missing information can make it difficult to calculate mileage expenses.

Conclusion

A SCIF mileage form is a crucial document for individuals and businesses that use their vehicles for official purposes. By following the steps outlined in this article, you can simplify the reporting process and ensure accurate tracking of mileage expenses. Remember to use a mileage form template, keep accurate records, and submit the form on time to avoid common mistakes.

Take Action

Take action today and simplify your reporting process with a SCIF mileage form. Whether you are an employee, self-employed individual, or business owner, a mileage form can help you track and record mileage expenses with ease. Share this article with your colleagues and friends who may benefit from using a SCIF mileage form.

What is a SCIF mileage form?

+A SCIF mileage form is a document used to track and record the mileage of a vehicle used for official purposes.

Why is a SCIF mileage form important?

+A SCIF mileage form is essential for accurate tracking of mileage expenses, simplified reimbursement process, and tax deductions.

How do I simplify the reporting process with a SCIF mileage form?

+To simplify the reporting process, obtain a mileage form, track mileage expenses, calculate mileage expenses, and submit the form on time.