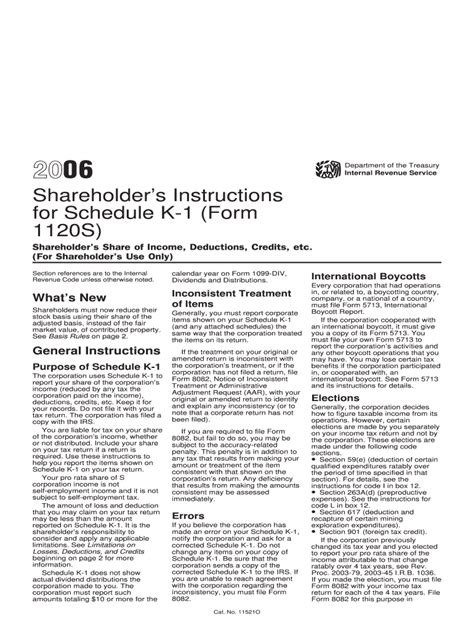

Mastering the Schedule K-1 Form 1120s instructions is crucial for accurate and timely tax filing, particularly for S corporations. The Schedule K-1 Form 1120s is a vital component of the tax return, providing essential information to shareholders regarding their share of income, deductions, and credits. In this article, we will delve into the world of Schedule K-1 Form 1120s, explaining its importance, key components, and steps for accurate completion.

Understanding the Importance of Schedule K-1 Form 1120s

The Schedule K-1 Form 1120s is a critical document used by S corporations to report the shareholder's share of income, losses, deductions, and credits. This form is essential for several reasons:

- Accurate Tax Filing: The Schedule K-1 Form 1120s provides the necessary information for shareholders to accurately report their share of corporate income on their personal tax returns.

- Compliance: Failing to file the Schedule K-1 Form 1120s or providing inaccurate information can result in penalties and fines.

- Shareholder Information: The form provides essential information to shareholders regarding their investment in the S corporation.

Key Components of Schedule K-1 Form 1120s

The Schedule K-1 Form 1120s consists of several key components, including:

- Shareholder Information: The form requires the shareholder's name, address, and tax identification number.

- Corporation Information: The form requires the S corporation's name, address, and tax identification number.

- Income and Losses: The form reports the shareholder's share of corporate income, losses, and deductions.

- Credits: The form reports the shareholder's share of corporate credits, such as foreign tax credits.

**Instructions for Completing Schedule K-1 Form 1120s**

To accurately complete the Schedule K-1 Form 1120s, follow these steps:

Step 1: Gather Essential Information

- Collect the shareholder's information, including name, address, and tax identification number.

- Collect the S corporation's information, including name, address, and tax identification number.

- Gather financial statements, including income statements and balance sheets.

Step 2: Calculate Shareholder's Share of Income and Losses

- Calculate the shareholder's share of corporate income and losses using the financial statements.

- Consider any adjustments or allocations that may affect the shareholder's share.

Step 3: Complete the Form

- Complete the shareholder information section.

- Complete the corporation information section.

- Report the shareholder's share of income, losses, and deductions.

- Report the shareholder's share of corporate credits.

**Common Errors to Avoid**

- Inaccurate Shareholder Information: Ensure that the shareholder's information is accurate and up-to-date.

- Incorrect Calculation of Income and Losses: Ensure that the calculation of the shareholder's share of income and losses is accurate.

- Missing or Incomplete Information: Ensure that all required information is provided.

Best Practices for Schedule K-1 Form 1120s

- Maintain Accurate Records: Maintain accurate and up-to-date records of shareholder information and financial statements.

- Consult with a Tax Professional: Consult with a tax professional to ensure accurate completion of the form.

- Review and Verify: Review and verify the form for accuracy and completeness before filing.

**Frequently Asked Questions**

Q: What is the purpose of the Schedule K-1 Form 1120s?

A: The Schedule K-1 Form 1120s is used to report the shareholder's share of income, losses, deductions, and credits.

Q: Who must file the Schedule K-1 Form 1120s?

A: S corporations must file the Schedule K-1 Form 1120s for each shareholder.

Q: What is the deadline for filing the Schedule K-1 Form 1120s?

A: The deadline for filing the Schedule K-1 Form 1120s is typically March 15th of each year.

What is the purpose of the Schedule K-1 Form 1120s?

+The Schedule K-1 Form 1120s is used to report the shareholder's share of income, losses, deductions, and credits.

Who must file the Schedule K-1 Form 1120s?

+S corporations must file the Schedule K-1 Form 1120s for each shareholder.

What is the deadline for filing the Schedule K-1 Form 1120s?

+The deadline for filing the Schedule K-1 Form 1120s is typically March 15th of each year.

In Closing

Mastering the Schedule K-1 Form 1120s instructions is crucial for accurate and timely tax filing. By following the steps and best practices outlined in this article, S corporations can ensure compliance and provide essential information to shareholders. Don't hesitate to reach out to a tax professional if you have any questions or concerns. Share this article with others to help them navigate the complex world of tax filing.