As the old adage goes, "death and taxes are inevitable." While we can't avoid these two certainties, we can make the process of dealing with them a bit more manageable. If you're a resident of New York State, you may have heard of the RP-5217 form, also known as the "Real Property Transfer Report." In this article, we'll guide you through the process of downloading and filing this form, making it easier for you to navigate the world of real estate and taxation.

What is the RP-5217 Form?

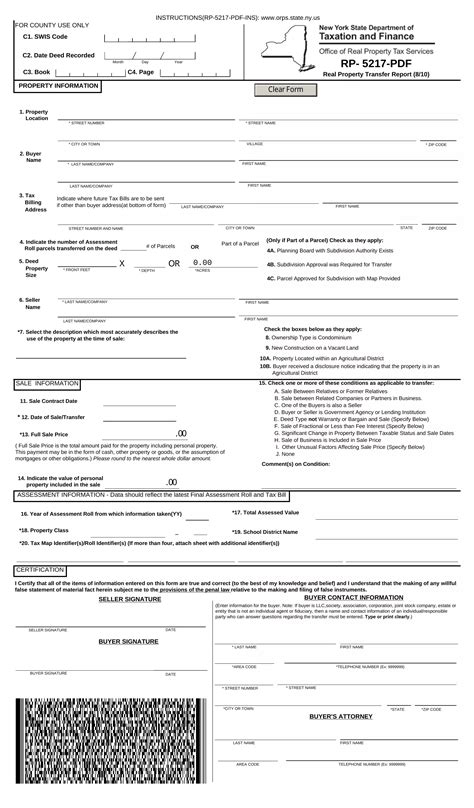

The RP-5217 form is a crucial document used to report the transfer of real property in New York State. It's typically filed when there's a change in ownership of a property, such as when someone buys or sells a house. The form provides essential information about the property, including its location, type, and value. This data is used by the state to update its records and assess taxes accordingly.

Why is the RP-5217 Form Important?

The RP-5217 form plays a vital role in the real estate transfer process. By filing this form, you're helping the state to:

- Update property records

- Assess taxes accurately

- Monitor changes in property ownership

- Prevent errors or discrepancies in property records

Where to Download the RP-5217 Form?

You can download the RP-5217 form from the official website of the New York State Department of Taxation and Finance. Here's a step-by-step guide to help you download the form:

- Visit the New York State Department of Taxation and Finance website at .

- Click on the "Forms and Instructions" tab.

- Select "Real Property Transfer Report (RP-5217)" from the list of available forms.

- Choose the correct form version (e.g., RP-5217-PDF) and click on the download link.

- Save the form to your computer or print it directly.

How to Fill Out the RP-5217 Form?

Filling out the RP-5217 form requires attention to detail and accuracy. Here's a brief overview of the information you'll need to provide:

- Property Information:

- Property address

- Property type (residential, commercial, etc.)

- Property value

- Transfer Information:

- Date of transfer

- Type of transfer (sale, gift, etc.)

- Transferor's name and address

- Transferee's name and address

- Additional Information:

- Reason for transfer

- Any additional comments or explanations

Tips for Filling Out the RP-5217 Form

- Make sure to use black ink and print clearly.

- Complete all required fields.

- Attach any supporting documents, such as deeds or title reports.

- Keep a copy of the completed form for your records.

How to File the RP-5217 Form?

Once you've completed the RP-5217 form, you'll need to file it with the relevant authorities. Here's where to file the form:

- New York State Department of Taxation and Finance:

- Mail the form to: NYS Department of Taxation and Finance, Real Property Transfer Report, Albany, NY 12227-0001.

- Fax the form to: (518) 485-5555.

- County Clerk's Office:

- File the form with the County Clerk's Office in the county where the property is located.

Deadlines for Filing the RP-5217 Form

- The RP-5217 form must be filed within 30 days of the property transfer.

- Late filing fees may apply if the form is not filed on time.

What is the purpose of the RP-5217 form?

+The RP-5217 form is used to report the transfer of real property in New York State, providing essential information about the property and its ownership.

Where can I download the RP-5217 form?

+You can download the RP-5217 form from the official website of the New York State Department of Taxation and Finance at .

How do I file the RP-5217 form?

+You can file the RP-5217 form with the New York State Department of Taxation and Finance or with the County Clerk's Office in the county where the property is located.

We hope this guide has made it easier for you to understand and navigate the RP-5217 form. Remember to download the form from the official website, fill it out accurately, and file it with the relevant authorities on time. If you have any further questions or concerns, feel free to ask in the comments section below. Don't forget to share this article with others who may find it helpful!