Direct deposit is a convenient and secure way to receive payments, such as payroll, retirement benefits, and tax refunds, directly into your bank account. Redstone Federal Credit Union, a reputable financial institution, offers direct deposit services to its members. In this article, we will provide a comprehensive guide on the Redstone Federal Credit Union Direct Deposit Form, including its benefits, requirements, and step-by-step instructions on how to complete the form.

Benefits of Direct Deposit

Direct deposit offers numerous benefits, including:

- Convenience: Direct deposit eliminates the need to visit a branch or ATM to deposit your paycheck or other payments.

- Security: Direct deposit reduces the risk of lost or stolen checks, as the funds are transferred electronically.

- Speed: Direct deposit ensures that your payments are deposited quickly and efficiently, usually within one to two business days.

- Reduced errors: Direct deposit minimizes the risk of errors, as the payment is transferred electronically, reducing the chance of human error.

Redstone Federal Credit Union Direct Deposit Form Requirements

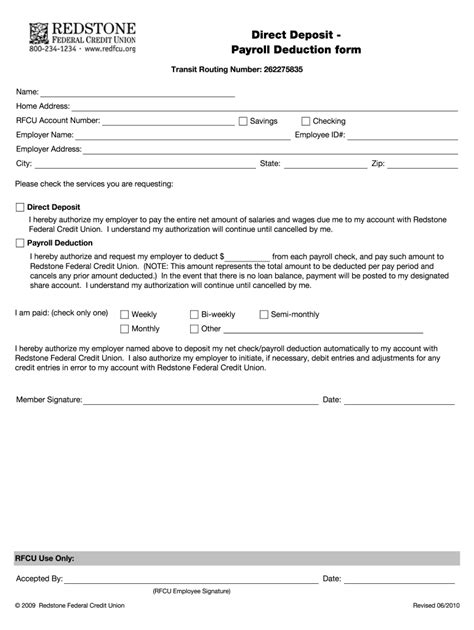

To complete the Redstone Federal Credit Union Direct Deposit Form, you will need to provide the following information:

- Your name and account number

- Your employer's name and address

- The type of payment you want to deposit (e.g., payroll, retirement benefits, tax refund)

- The frequency of the payment (e.g., weekly, biweekly, monthly)

Step-by-Step Guide to Completing the Redstone Federal Credit Union Direct Deposit Form

To complete the Redstone Federal Credit Union Direct Deposit Form, follow these steps:

- Download the form: Visit the Redstone Federal Credit Union website and download the Direct Deposit Form.

- Fill out the form: Complete the form with your name, account number, employer's name and address, and the type of payment you want to deposit.

- Sign the form: Sign the form to authorize the direct deposit.

- Return the form: Return the completed form to your employer or the payment issuer.

- Verify the information: Verify that the information on the form is accurate and complete.

Common Issues with Direct Deposit

Some common issues with direct deposit include:

- Incorrect account information: Ensure that your account number and routing number are accurate to avoid errors.

- Delayed payments: Payments may be delayed due to holidays or weekends.

- Payment limits: Some payments may have limits or restrictions on the amount that can be deposited.

Tips for Managing Direct Deposit

To manage direct deposit effectively, follow these tips:

- Monitor your account: Regularly check your account to ensure that payments are deposited correctly.

- Update your information: Update your employer or payment issuer with any changes to your account information.

- Take advantage of budgeting tools: Use budgeting tools to manage your finances effectively.

Conclusion

Direct deposit is a convenient and secure way to receive payments. By following the steps outlined in this guide, you can complete the Redstone Federal Credit Union Direct Deposit Form and start enjoying the benefits of direct deposit. Remember to monitor your account regularly and update your information as needed to ensure that your payments are deposited correctly.We hope this article has provided you with valuable information on the Redstone Federal Credit Union Direct Deposit Form. If you have any questions or need further assistance, please don't hesitate to contact us.

What is direct deposit?

+Direct deposit is a secure and convenient way to receive payments, such as payroll, retirement benefits, and tax refunds, directly into your bank account.

How do I complete the Redstone Federal Credit Union Direct Deposit Form?

+To complete the form, follow the steps outlined in this guide, including downloading the form, filling it out with your information, signing it, and returning it to your employer or payment issuer.

What are the benefits of direct deposit?

+The benefits of direct deposit include convenience, security, speed, and reduced errors.