The Quarterly Wage Report Form is a crucial document that employers must submit to their state's unemployment insurance office on a quarterly basis. The form provides essential information about an employer's wages, taxes, and employee data, which helps the state to calculate unemployment insurance tax rates and ensure compliance with labor laws. Filing this form accurately and on time is vital for employers to avoid penalties, fines, and potential audits. In this article, we will provide a comprehensive guide on how to file the Quarterly Wage Report Form, including the benefits, requirements, and steps involved in the process.

Benefits of Filing the Quarterly Wage Report Form

Filing the Quarterly Wage Report Form provides several benefits to employers, including:

- Compliance with state labor laws and regulations

- Accurate calculation of unemployment insurance tax rates

- Avoidance of penalties and fines for non-compliance

- Reduced risk of audits and investigations

- Improved management of employee data and wages

What Information is Required on the Quarterly Wage Report Form?

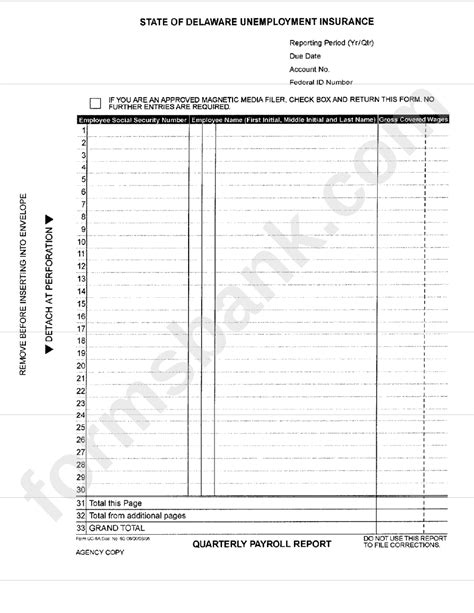

The Quarterly Wage Report Form requires employers to provide detailed information about their employees, wages, and taxes. The form typically includes the following sections:

- Employer information, including name, address, and federal employer identification number (FEIN)

- Employee information, including name, social security number, and wages earned

- Tax information, including unemployment insurance tax rate and amount of taxes paid

- Wages and salaries paid to employees during the quarter

- Number of employees and hours worked during the quarter

Steps to File the Quarterly Wage Report Form

Filing the Quarterly Wage Report Form involves several steps, including:

- Gather required information and documents, including employee data, wages, and tax information

- Complete the form accurately and thoroughly, ensuring all required fields are filled in

- Review and verify the information for accuracy and completeness

- Submit the form to the state's unemployment insurance office by the due date

- Pay any required taxes and fees associated with the form

Common Mistakes to Avoid When Filing the Quarterly Wage Report Form

When filing the Quarterly Wage Report Form, employers should avoid the following common mistakes:

- Late filing or payment of taxes

- Inaccurate or incomplete information

- Failure to report all employees and wages

- Incorrect tax calculations or payments

- Failure to maintain accurate records and documentation

Consequences of Non-Compliance

Failure to file the Quarterly Wage Report Form or pay required taxes can result in severe consequences, including:

- Penalties and fines for non-compliance

- Increased tax rates and payments

- Audits and investigations by the state

- Loss of unemployment insurance benefits for employees

- Damage to an employer's reputation and credibility

Best Practices for Filing the Quarterly Wage Report Form

To ensure accurate and timely filing of the Quarterly Wage Report Form, employers should follow these best practices:

- Maintain accurate and up-to-date records and documentation

- Use payroll software or services to streamline the filing process

- Review and verify information for accuracy and completeness

- Submit the form and pay required taxes by the due date

- Keep a record of filed forms and payments for future reference

Electronic Filing Options

Many states offer electronic filing options for the Quarterly Wage Report Form, which can simplify the filing process and reduce errors. Employers can file the form online or through a payroll service provider, which can help to:

- Reduce paperwork and administrative burdens

- Improve accuracy and completeness of information

- Increase efficiency and speed of the filing process

- Provide a record of filed forms and payments for future reference

FAQs

Q: What is the due date for filing the Quarterly Wage Report Form? A: The due date for filing the Quarterly Wage Report Form varies by state, but is typically within 30 days of the end of the quarter.

Q: What happens if I fail to file the Quarterly Wage Report Form or pay required taxes? A: Failure to file the Quarterly Wage Report Form or pay required taxes can result in penalties, fines, and increased tax rates.

Q: Can I file the Quarterly Wage Report Form electronically? A: Yes, many states offer electronic filing options for the Quarterly Wage Report Form, which can simplify the filing process and reduce errors.

Q: What information is required on the Quarterly Wage Report Form? A: The Quarterly Wage Report Form requires employers to provide detailed information about their employees, wages, and taxes, including employee names, social security numbers, wages earned, and tax information.

Q: How often must I file the Quarterly Wage Report Form? A: The Quarterly Wage Report Form must be filed on a quarterly basis, typically within 30 days of the end of the quarter.

What is the purpose of the Quarterly Wage Report Form?

+The Quarterly Wage Report Form is used to provide information about an employer's wages, taxes, and employee data, which helps the state to calculate unemployment insurance tax rates and ensure compliance with labor laws.

How do I file the Quarterly Wage Report Form?

+Employers can file the Quarterly Wage Report Form online or through a payroll service provider, or by mail or fax using a paper form.

What are the consequences of non-compliance with the Quarterly Wage Report Form?

+Failure to file the Quarterly Wage Report Form or pay required taxes can result in penalties, fines, and increased tax rates, as well as audits and investigations by the state.

By following the guidelines and best practices outlined in this article, employers can ensure accurate and timely filing of the Quarterly Wage Report Form, avoiding penalties and fines, and maintaining compliance with state labor laws and regulations.