Filling out forms can be a daunting task, especially when it comes to official documents like the PT-61 printable form. This form is used for tax purposes, and accuracy is crucial to avoid any errors or penalties. In this article, we will guide you through six ways to fill out the PT-61 printable form correctly and efficiently.

Understanding the PT-61 Form

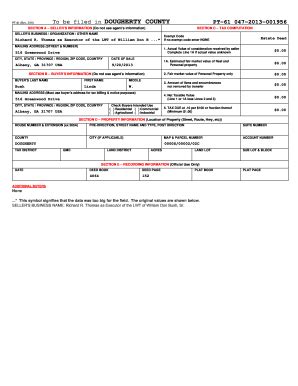

Before we dive into the ways to fill out the form, it's essential to understand what the PT-61 form is and what it's used for. The PT-61 form is a tax form used by businesses to report and pay taxes on certain types of income. It's a critical document that requires accurate and complete information to avoid any issues with tax authorities.

Why Accuracy Matters

Accuracy is crucial when filling out the PT-61 form. Any errors or inaccuracies can lead to delays, penalties, or even audits. To avoid these issues, it's essential to take your time and ensure that all information is correct and complete.

6 Ways to Fill Out the PT-61 Printable Form

Now that we've emphasized the importance of accuracy, let's move on to the six ways to fill out the PT-61 printable form.

1. Use a Computer to Fill Out the Form

Using a computer to fill out the PT-61 form is the most efficient and accurate way. You can download the form from the official website and fill it out using a PDF editor or a spreadsheet software. This method allows you to easily correct errors and make changes as needed.

2. Use a Template or Software

There are many templates and software programs available that can help you fill out the PT-61 form. These tools can guide you through the process and ensure that all required information is included. Some popular options include tax preparation software like TurboTax or H&R Block.

3. Read the Instructions Carefully

Before filling out the form, read the instructions carefully. The instructions will guide you through the process and provide information on what information is required and how to fill out each section.

4. Use a Pen and Paper

If you don't have access to a computer, you can fill out the PT-61 form by hand. Use a pen and paper to fill out the form, and make sure to write clearly and legibly. This method can be time-consuming, but it's a good option if you don't have access to a computer.

5. Seek Help from a Professional

If you're unsure about how to fill out the PT-61 form, consider seeking help from a professional. A tax professional or accountant can guide you through the process and ensure that all information is accurate and complete.

6. Double-Check Your Work

Finally, double-check your work to ensure that all information is accurate and complete. Review the form carefully, and make sure that all required information is included. This step can help you avoid errors and penalties.

Tips and Reminders

Here are some additional tips and reminders to keep in mind when filling out the PT-61 form:

- Make sure to sign and date the form

- Use black ink to fill out the form

- Keep a copy of the form for your records

- Submit the form on time to avoid penalties

Conclusion

Filling out the PT-61 printable form can be a daunting task, but with the right guidance and tools, it can be done efficiently and accurately. By following the six ways outlined in this article, you can ensure that your form is complete and accurate, and avoid any errors or penalties.

Now it's your turn! If you have any questions or need help with filling out the PT-61 form, leave a comment below. Don't forget to share this article with others who may find it helpful.

What is the PT-61 form used for?

+The PT-61 form is used by businesses to report and pay taxes on certain types of income.

Can I fill out the PT-61 form by hand?

+Yes, you can fill out the PT-61 form by hand using a pen and paper. However, it's recommended to use a computer to fill out the form for accuracy and efficiency.

What happens if I make an error on the PT-61 form?

+If you make an error on the PT-61 form, you may be subject to penalties or delays. It's essential to double-check your work to ensure accuracy and completeness.