Dealing with the probate process can be a daunting task, especially when it comes to navigating the complex world of probate forms. One of the most critical forms in this process is the Printable Probate Form 13100. In this article, we will delve into the essential facts about this form, its purpose, and how to use it effectively.

What is Probate Form 13100?

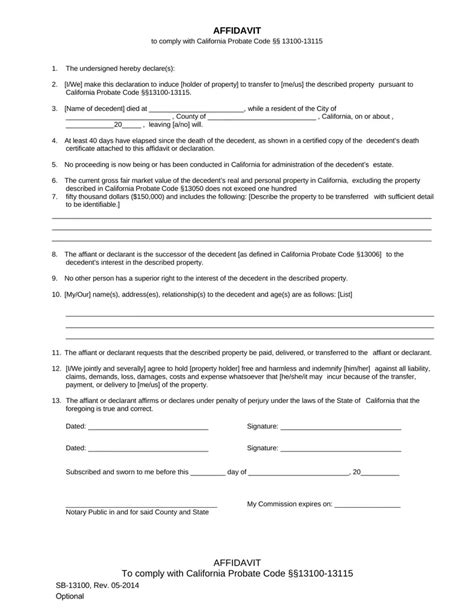

Probate Form 13100, also known as the "Petition for Probate," is a crucial document in the probate process. It is used to initiate the probate process, which involves the court's supervision of the distribution of a deceased person's assets. This form is typically filed with the probate court in the county where the deceased person lived.

Purpose of Probate Form 13100

The primary purpose of Probate Form 13100 is to provide the probate court with the necessary information to begin the probate process. This includes:

- Identifying the deceased person and their beneficiaries

- Describing the assets that are subject to probate

- Requesting the appointment of a personal representative (also known as an executor or administrator)

- Specifying the type of probate administration (e.g., independent or supervised)

Who Needs to File Probate Form 13100?

Probate Form 13100 is typically filed by the personal representative or the beneficiary of the deceased person's estate. The personal representative is responsible for managing the estate and ensuring that the deceased person's wishes are carried out. Beneficiaries may also file the form if they are entitled to receive assets from the estate.

Requirements for Filing Probate Form 13100

To file Probate Form 13100, you will need to provide the following information:

- The deceased person's name, date of birth, and date of death

- A list of the deceased person's assets, including real estate, bank accounts, and personal property

- The names and addresses of the beneficiaries

- A copy of the deceased person's will (if applicable)

- A copy of the deceased person's death certificate

How to Fill Out Probate Form 13100

Filling out Probate Form 13100 can be a complex process, and it is recommended that you seek the assistance of an attorney if you are unsure about any aspect of the form. Here are the general steps to follow:

- Download the form from the probate court's website or obtain a copy from the court clerk's office.

- Fill out the form completely and accurately, using black ink and capital letters.

- Attach all required supporting documents, including the deceased person's will and death certificate.

- Sign the form in the presence of a notary public.

- File the form with the probate court and pay the required filing fee.

Tips for Filling Out Probate Form 13100

- Make sure to use the correct form for your state and county.

- Fill out the form completely and accurately to avoid delays or rejection.

- Use a notary public to sign the form.

- Keep a copy of the form and supporting documents for your records.

Common Mistakes to Avoid When Filing Probate Form 13100

Here are some common mistakes to avoid when filing Probate Form 13100:

- Failing to sign the form in the presence of a notary public.

- Not attaching all required supporting documents.

- Failing to pay the required filing fee.

- Using the incorrect form or filing in the wrong court.

Consequences of Failing to File Probate Form 13100

Failing to file Probate Form 13100 can have serious consequences, including:

- Delays in the probate process

- Loss of assets or property

- Disputes among beneficiaries

- Increased court costs and fees

Conclusion

In conclusion, Probate Form 13100 is a critical document in the probate process. It is essential to understand the purpose and requirements of the form, as well as how to fill it out correctly. By avoiding common mistakes and seeking the assistance of an attorney if necessary, you can ensure that the probate process is completed efficiently and effectively.

We hope this article has provided you with the information you need to navigate the probate process with confidence. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may find it helpful.

What is the purpose of Probate Form 13100?

+The primary purpose of Probate Form 13100 is to provide the probate court with the necessary information to begin the probate process.

Who needs to file Probate Form 13100?

+Probate Form 13100 is typically filed by the personal representative or the beneficiary of the deceased person's estate.

What are the requirements for filing Probate Form 13100?

+To file Probate Form 13100, you will need to provide the deceased person's name, date of birth, and date of death, as well as a list of the deceased person's assets and the names and addresses of the beneficiaries.