What is a Power of Attorney Form in Idaho?

In Idaho, a Power of Attorney (POA) form is a legally binding document that grants an individual, known as the agent or attorney-in-fact, the authority to make decisions on behalf of another person, known as the principal. This document can be customized to fit various situations, making it an essential tool for individuals seeking to plan for the future or handle specific tasks.

A Power of Attorney form in Idaho can be used in various ways, providing individuals with flexibility and control over their affairs. Whether it's for managing finances, making healthcare decisions, or handling real estate transactions, a POA form can ensure that one's wishes are carried out even when they are unable to act themselves.

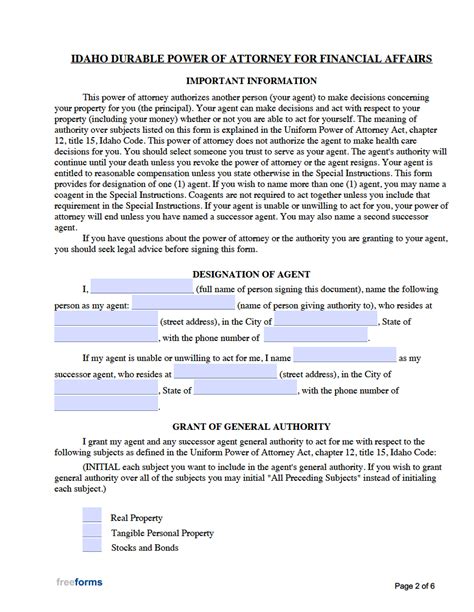

1. General Durable Power of Attorney

A General Durable Power of Attorney is one of the most common types of POA forms used in Idaho. This document grants the agent broad powers to manage the principal's financial affairs, including:

- Managing bank accounts and investments

- Buying and selling real estate

- Paying taxes and bills

- Handling insurance claims

A General Durable Power of Attorney remains effective even if the principal becomes incapacitated, making it an essential tool for estate planning and elder care.

Benefits of a General Durable Power of Attorney

- Provides flexibility and control over financial affairs

- Allows the agent to respond quickly to changing circumstances

- Can be used to avoid costly and time-consuming court proceedings

2. Limited Power of Attorney

A Limited Power of Attorney, also known as a Special Power of Attorney, grants the agent authority to perform specific tasks or make decisions on behalf of the principal. This type of POA is often used for:

- Real estate transactions, such as buying or selling property

- Handling a specific business or financial transaction

- Managing a particular asset or account

A Limited Power of Attorney is ideal for individuals who need assistance with a specific task or situation, but do not want to grant broad powers to the agent.

Benefits of a Limited Power of Attorney

- Provides targeted assistance for specific tasks or situations

- Allows the principal to maintain control over other aspects of their affairs

- Can be used to ensure that specific tasks are completed efficiently

3. Healthcare Power of Attorney

A Healthcare Power of Attorney, also known as a Healthcare Proxy, grants the agent authority to make medical decisions on behalf of the principal. This type of POA is essential for:

- Ensuring that the principal's medical wishes are respected

- Making end-of-life decisions

- Authorizing medical treatment or procedures

A Healthcare Power of Attorney is a crucial component of advance care planning, allowing individuals to ensure that their medical wishes are carried out even if they become incapacitated.

Benefits of a Healthcare Power of Attorney

- Provides peace of mind for the principal and their loved ones

- Ensures that medical wishes are respected and carried out

- Can be used to avoid costly and time-consuming court proceedings

4. Springing Power of Attorney

A Springing Power of Attorney, also known as a Conditional Power of Attorney, grants the agent authority to act on behalf of the principal only when a specific event or condition occurs, such as:

- The principal becomes incapacitated or unable to act

- The principal is unavailable or unreachable

- A specific task or situation arises

A Springing Power of Attorney is ideal for individuals who want to maintain control over their affairs but need assistance in specific situations.

Benefits of a Springing Power of Attorney

- Provides flexibility and control over specific situations

- Allows the principal to maintain autonomy until the triggering event occurs

- Can be used to ensure that specific tasks are completed efficiently

5. Revocable Power of Attorney

A Revocable Power of Attorney grants the agent authority to act on behalf of the principal, but can be revoked or terminated at any time. This type of POA is often used for:

- Estate planning and elder care

- Managing financial affairs during a temporary absence

- Handling specific tasks or situations

A Revocable Power of Attorney provides flexibility and control, allowing the principal to revoke the agent's authority at any time.

Benefits of a Revocable Power of Attorney

- Provides flexibility and control over the agent's authority

- Allows the principal to revoke the agent's authority at any time

- Can be used to ensure that specific tasks are completed efficiently

In conclusion, a Power of Attorney form in Idaho can be used in various ways, providing individuals with flexibility, control, and peace of mind. Whether it's for managing finances, making healthcare decisions, or handling real estate transactions, a POA form is an essential tool for estate planning and elder care.

We invite you to share your thoughts and experiences with Power of Attorney forms in Idaho. Have you used a POA form in the past? Do you have any questions or concerns about using a POA form? Please leave a comment below and we will be happy to assist you.

What is the difference between a General Durable Power of Attorney and a Limited Power of Attorney?

+A General Durable Power of Attorney grants the agent broad powers to manage the principal's financial affairs, while a Limited Power of Attorney grants the agent authority to perform specific tasks or make decisions on behalf of the principal.

Can I revoke a Power of Attorney form in Idaho?

+Do I need to hire an attorney to create a Power of Attorney form in Idaho?

+No, you do not need to hire an attorney to create a Power of Attorney form in Idaho. However, it is recommended that you seek the advice of an attorney to ensure that the form is completed correctly and meets your specific needs.