As a homeowner, receiving a Form 1098 from Pennymac at the end of each year is a crucial part of your tax preparation process. This document plays a significant role in helping you claim mortgage interest deductions on your tax return. In this article, we will delve into the world of Pennymac Form 1098, explaining what it is, how to read it, and how to use the information to maximize your tax benefits.

What is Pennymac Form 1098?

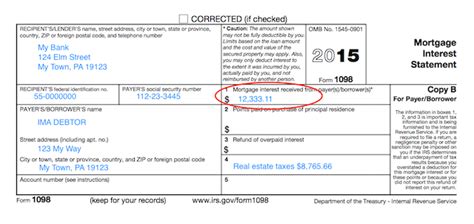

Pennymac Form 1098, also known as the Mortgage Interest Statement, is a document that lenders like Pennymac are required to provide to borrowers who have paid more than $600 in mortgage interest during a calendar year. This form serves as proof of the mortgage interest you have paid and is used to claim deductions on your tax return. The information on the form is also reported to the Internal Revenue Service (IRS).

Why is Pennymac Form 1098 Important?

Receiving a Form 1098 from Pennymac is essential for several reasons:

- Tax Benefits: The mortgage interest reported on Form 1098 is tax-deductible, which can significantly reduce your taxable income and lower your tax liability.

- Accurate Tax Returns: The information on Form 1098 ensures that you report the correct amount of mortgage interest on your tax return, avoiding any potential errors or discrepancies.

- Compliance with IRS Regulations: Lenders like Pennymac are required to provide Form 1098 to borrowers and report the information to the IRS, ensuring compliance with tax laws and regulations.

How to Read Pennymac Form 1098

Understanding the information on Pennymac Form 1098 is crucial for accurate tax preparation. Here's a breakdown of the key components:

- Payer's Name and Address: This section displays the lender's name and address, which in this case is Pennymac.

- Payer's Federal Identification Number: This is the lender's federal identification number, also known as the Employer Identification Number (EIN).

- Borrower's Name and Address: This section shows the borrower's name and address.

- Account Number: This is the unique account number assigned to the borrower's mortgage account.

- Mortgage Interest: This is the total amount of mortgage interest paid during the calendar year.

- Mortgage Insurance Premiums: If applicable, this section reports the amount of mortgage insurance premiums paid during the year.

How to Use Pennymac Form 1098 for Tax Purposes

To claim mortgage interest deductions on your tax return, follow these steps:

- Gather Required Documents: Collect your Pennymac Form 1098, along with other relevant tax documents, such as your W-2 and any other mortgage interest statements.

- Complete Form 1040: Report the mortgage interest from Form 1098 on Schedule A (Itemized Deductions) of your Form 1040.

- Claim Mortgage Interest Deduction: Claim the mortgage interest deduction on Line 8 of Schedule A, which will reduce your taxable income.

Frequently Asked Questions

What if I don't receive a Pennymac Form 1098?

+If you don't receive a Form 1098, contact Pennymac directly to request a duplicate copy. You can also check your online account or contact the IRS for assistance.

Can I claim mortgage interest deductions without a Pennymac Form 1098?

+While it's possible to claim mortgage interest deductions without a Form 1098, it's highly recommended to obtain the form from Pennymac to ensure accuracy and avoid any potential errors or audits.

How long should I keep my Pennymac Form 1098?

+It's recommended to keep your Form 1098 for at least three years in case of an audit or if you need to amend your tax return.

Conclusion

In conclusion, understanding Pennymac Form 1098 is crucial for homeowners who want to claim mortgage interest deductions on their tax return. By following the steps outlined in this article and using the information on the form accurately, you can maximize your tax benefits and ensure compliance with IRS regulations. If you have any further questions or concerns, don't hesitate to reach out to Pennymac or a tax professional for assistance.

We hope this article has been informative and helpful in understanding Pennymac Form 1098. If you have any questions or comments, please feel free to share them below.