The Oklahoma Form 200 is a crucial document for businesses operating in the state of Oklahoma. It is used to report franchise taxes, which are levied on businesses for the privilege of doing business in the state. In this article, we will provide a comprehensive guide to Oklahoma Form 200 instructions, walking you through the step-by-step process of completing and submitting the form.

Understanding Oklahoma Form 200

Before we dive into the instructions, it's essential to understand the purpose of Oklahoma Form 200. The form is used to report franchise taxes, which are calculated based on the business's net worth or total assets. The tax rate is 1.25% of the net worth or total assets, whichever is greater.

Who Needs to File Oklahoma Form 200?

Not all businesses operating in Oklahoma need to file Form 200. The following types of businesses are required to file:

- Corporations (including S corporations and C corporations)

- Limited liability companies (LLCs)

- Limited partnerships (LPs)

- Limited liability partnerships (LLPs)

Gathering Required Information

Before you start completing Oklahoma Form 200, you'll need to gather some essential information. This includes:

- Business name and address

- Business type (corporation, LLC, LP, or LLP)

- Federal Employer Identification Number (FEIN)

- Net worth or total assets

- Tax year-end date

Calculating Net Worth or Total Assets

To calculate the net worth or total assets, you'll need to prepare a balance sheet that includes the following:

- Assets: cash, accounts receivable, inventory, property, and equipment

- Liabilities: accounts payable, loans, and other debts

- Equity: shareholder equity or member equity

Net worth is calculated by subtracting total liabilities from total assets. If the result is negative, you'll need to report zero net worth.

Completing Oklahoma Form 200

Now that you have gathered the required information, it's time to complete Oklahoma Form 200. The form consists of several sections:

- Section 1: Business Information

- Section 2: Net Worth or Total Assets

- Section 3: Franchise Tax Calculation

- Section 4: Payment and Credits

Section 1: Business Information

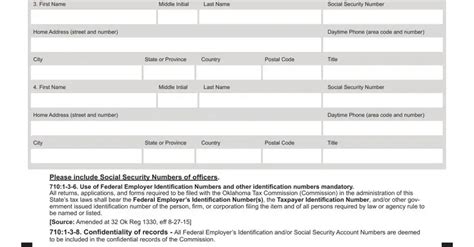

In this section, you'll need to provide your business name, address, and FEIN.

Section 2: Net Worth or Total Assets

In this section, you'll need to report your net worth or total assets. If you're reporting net worth, you'll need to attach a balance sheet to the form.

Section 3: Franchise Tax Calculation

In this section, you'll need to calculate the franchise tax. The tax rate is 1.25% of the net worth or total assets, whichever is greater.

Section 4: Payment and Credits

In this section, you'll need to report any payments or credits. If you've made any payments or have any credits, you'll need to attach a payment voucher to the form.

Submitting Oklahoma Form 200

Once you've completed Oklahoma Form 200, you'll need to submit it to the Oklahoma Tax Commission. You can submit the form online or by mail.

Online Submission

To submit the form online, you'll need to create an account on the Oklahoma Tax Commission website. You can upload the completed form and make payment online.

Mail Submission

To submit the form by mail, you'll need to send the completed form and payment voucher to the Oklahoma Tax Commission. The address is:

Oklahoma Tax Commission 2501 N. Classen Blvd. Oklahoma City, OK 73106

Penalties and Interest

If you fail to file Oklahoma Form 200 or pay the franchise tax on time, you may be subject to penalties and interest. The penalty for late filing is 10% of the tax due, and the interest rate is 1.25% per month.

Common Mistakes to Avoid

To avoid penalties and interest, make sure to avoid the following common mistakes:

- Failing to file the form on time

- Underreporting net worth or total assets

- Failing to attach required documentation

- Making payment late or incorrectly

Conclusion

Completing and submitting Oklahoma Form 200 can be a complex process. However, by following the step-by-step guide outlined in this article, you can ensure that you're in compliance with the Oklahoma Tax Commission's requirements. Remember to gather all required information, complete the form accurately, and submit it on time to avoid penalties and interest.

What's Next?

If you have any questions or concerns about Oklahoma Form 200, we encourage you to comment below. You can also share this article with others who may find it helpful. Stay tuned for more articles on tax-related topics!

What is Oklahoma Form 200?

+Oklahoma Form 200 is a document used to report franchise taxes, which are levied on businesses for the privilege of doing business in the state of Oklahoma.

Who needs to file Oklahoma Form 200?

+Corporations, LLCs, LPs, and LLPs operating in Oklahoma need to file Form 200.

What is the penalty for late filing?

+The penalty for late filing is 10% of the tax due, and the interest rate is 1.25% per month.