Retirement savings are essential for securing a comfortable financial future. For Ohio public employees, the Ohio Deferred Compensation Program (ODCP) provides a valuable tool for supplementing their retirement income. One crucial aspect of the ODCP is understanding how to access your savings when you need them. In this article, we'll delve into the Ohio Deferred Compensation Withdrawal Form, exploring its purpose, benefits, and the steps to complete it.

Understanding the Ohio Deferred Compensation Program

The Ohio Deferred Compensation Program is a 457(b) plan designed to help Ohio public employees save for retirement. By contributing a portion of their income to the plan, participants can build a nest egg that will provide them with a steady income stream in retirement. The ODCP offers a range of investment options and allows participants to manage their accounts online or through a mobile app.

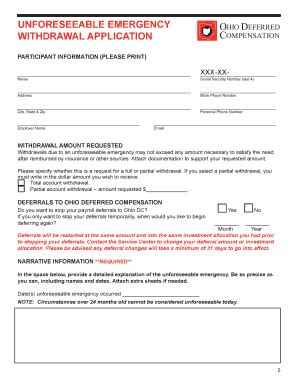

What is the Ohio Deferred Compensation Withdrawal Form?

The Ohio Deferred Compensation Withdrawal Form is a document used by ODCP participants to request withdrawals from their accounts. This form is typically used when a participant wants to access their savings for a specific purpose, such as retirement, separation from service, or a qualified unforeseen emergency.

Benefits of the Ohio Deferred Compensation Withdrawal Form

The Ohio Deferred Compensation Withdrawal Form offers several benefits to ODCP participants, including:

- Tax-free withdrawals: Withdrawals from the ODCP are tax-free, as long as they are made after age 59 1/2 or due to a qualified unforeseen emergency.

- Flexibility: The withdrawal form allows participants to choose how much they want to withdraw and when they want to receive the funds.

- Convenience: The form can be completed online or by mail, making it easy for participants to request withdrawals from the comfort of their own homes.

Steps to Complete the Ohio Deferred Compensation Withdrawal Form

To complete the Ohio Deferred Compensation Withdrawal Form, follow these steps:

- Log in to your account: Go to the ODCP website and log in to your account using your username and password.

- Click on "Withdrawals": Once logged in, click on the "Withdrawals" tab and select "Request a Withdrawal."

- Choose your withdrawal type: Select the type of withdrawal you want to make (e.g., lump sum, installment, or rollover).

- Enter your withdrawal amount: Enter the amount you want to withdraw, keeping in mind any applicable fees or taxes.

- Choose your payment method: Select how you want to receive your withdrawal funds (e.g., direct deposit or check).

- Review and submit: Review your withdrawal request carefully and submit it for processing.

Additional Tips and Considerations

Before completing the Ohio Deferred Compensation Withdrawal Form, consider the following:

- Fees and taxes: Withdrawals from the ODCP may be subject to fees and taxes, depending on your age and the type of withdrawal.

- Penalty for early withdrawal: If you withdraw funds before age 59 1/2, you may be subject to a 10% penalty.

- Required minimum distributions: If you are 72 or older, you may be required to take minimum distributions from your ODCP account.

Common Mistakes to Avoid

When completing the Ohio Deferred Compensation Withdrawal Form, avoid the following common mistakes:

- Incorrect account information: Double-check your account information to ensure accuracy.

- Insufficient funds: Make sure you have sufficient funds in your account to cover the withdrawal amount.

- Incomplete form: Complete all required fields on the form to avoid delays in processing.

By following these steps and tips, you can ensure a smooth and successful withdrawal process from your Ohio Deferred Compensation Program account.