New York State's estimated tax form can be a complex and daunting task for many taxpayers. Failing to comply with the state's estimated tax requirements can result in penalties and interest. However, with the right guidance, taxpayers can navigate the process with ease.

Understanding the Importance of Estimated Tax Payments

The New York State estimated tax form is designed for individuals who expect to owe more than $400 in taxes for the year. This includes self-employed individuals, freelancers, and those who receive income from sources such as investments, rental properties, or alimony. Making timely estimated tax payments is crucial to avoid penalties and interest.

Who Needs to File Form IT-2105?

Form IT-2105 is the NYS estimated tax form that individuals must file if they expect to owe more than $400 in taxes for the year. This includes:

- Self-employed individuals

- Freelancers

- Those who receive income from investments, rental properties, or alimony

- Individuals who receive income that is not subject to withholding

5 Tips for Filing Form IT-2105

- Understand the Due Dates

Form IT-2105 is due on a quarterly basis. The due dates are:

- April 15th for January 1 – March 31

- June 15th for April 1 – May 31

- September 15th for June 1 – August 31

- January 15th of the following year for September 1 – December 31

Consequences of Missing a Due Date

Missing a due date can result in penalties and interest on the amount owed. It's essential to make timely payments to avoid these consequences.

- Estimate Your Tax Liability

To file Form IT-2105, you'll need to estimate your tax liability for the year. You can use last year's tax return as a guide or consult with a tax professional. Be sure to consider any changes in income or deductions that may affect your tax liability.

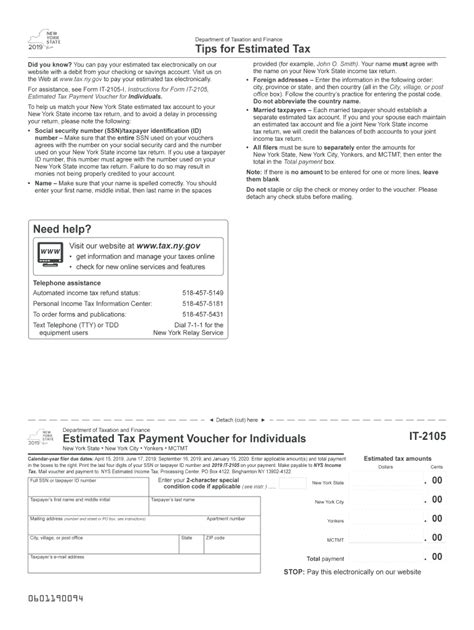

- Make Timely Payments

Once you've estimated your tax liability, make timely payments using Form IT-2105. You can pay online, by phone, or by mail. Be sure to keep a record of your payments, including the date and amount paid.

Payment Options

- Online: You can pay online through the NYS Department of Taxation and Finance website.

- Phone: You can pay by phone using a credit or debit card.

- Mail: You can pay by mail using a check or money order.

- Annualize Your Income

If you receive income that is not evenly distributed throughout the year, you may be able to annualize your income. This can help reduce your estimated tax payments.

How to Annualize Your Income

- Complete Form IT-2105, Section 4

- Calculate your annualized income

- Multiply your annualized income by the applicable tax rate

- Seek Professional Help

Filing Form IT-2105 can be complex, especially if you're new to estimated tax payments. Consider seeking the help of a tax professional to ensure you're in compliance with NYS tax laws.

Benefits of Seeking Professional Help

- Ensure accuracy and compliance with NYS tax laws

- Reduce the risk of penalties and interest

- Receive guidance on annualizing income and making timely payments

Take Action Today

Don't wait until the last minute to file Form IT-2105. Take action today by understanding the due dates, estimating your tax liability, making timely payments, annualizing your income, and seeking professional help. By following these tips, you can avoid penalties and interest and ensure compliance with NYS tax laws.

What is Form IT-2105?

+Form IT-2105 is the NYS estimated tax form that individuals must file if they expect to owe more than $400 in taxes for the year.

Who needs to file Form IT-2105?

+Form IT-2105 is required for self-employed individuals, freelancers, and those who receive income from investments, rental properties, or alimony.

What are the due dates for Form IT-2105?

+The due dates for Form IT-2105 are April 15th, June 15th, September 15th, and January 15th of the following year.