Filing taxes can be a daunting task, especially when dealing with state-specific forms. In New York State, residents are required to file a personal income tax return using Form IT-201. This article will provide a comprehensive guide on how to navigate the NY State Form IT-201, including filing instructions, deadlines, and requirements.

Understanding the NY State Form IT-201

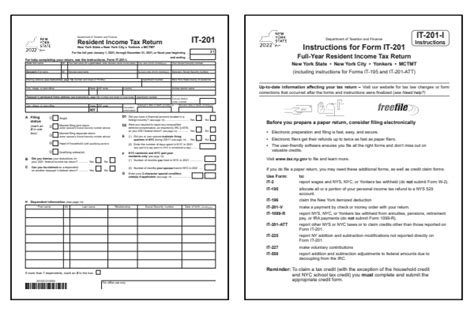

The NY State Form IT-201 is the standard form used by New York State residents to file their personal income tax returns. The form is used to report income, claim deductions and credits, and calculate the amount of taxes owed or refunded. It's essential to understand the different sections of the form and what information is required.

Who Needs to File Form IT-201?

Not all New York State residents need to file Form IT-201. The following individuals are required to file:

- Residents with a gross income exceeding $8,000 (single) or $16,000 (joint)

- Residents who have self-employment income of $400 or more

- Residents who have received unemployment benefits

- Residents who have made estimated tax payments

Filing Status and Residency

When filing Form IT-201, you'll need to determine your filing status and residency. Filing status options include:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Residency options include:

- Resident

- Nonresident

- Part-year resident

Gathering Required Documents

Before starting the filing process, make sure you have the following documents:

- W-2 forms from employers

- 1099 forms for freelance or self-employment income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Completing Form IT-201

The NY State Form IT-201 consists of several sections, including:

- Personal Income: Report your gross income from all sources, including wages, salaries, tips, and self-employment income.

- Deductions: Claim deductions for items like mortgage interest, property taxes, charitable donations, and medical expenses.

- Credits: Claim credits for items like the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits.

Calculating Tax Liability

Once you've completed the income and deduction sections, you'll need to calculate your tax liability. This involves multiplying your taxable income by the applicable tax rate.

Payment Options

If you owe taxes, you can pay online, by phone, or by mail. Payment options include:

- Electronic Funds Withdrawal (EFW)

- Credit card

- Check or money order

Deadlines and Penalties

The deadline for filing Form IT-201 is typically April 15th. If you fail to file or pay taxes on time, you may be subject to penalties and interest.

Amending a Return

If you need to make changes to your original return, you can file an amended return using Form IT-201-X. This form is used to correct errors or report additional income.

Tax Credits and Deductions

New York State offers several tax credits and deductions to help reduce your tax liability. Some of the most common include:

- Earned Income Tax Credit (EITC): A refundable credit for low-income working individuals and families.

- Child Tax Credit: A non-refundable credit for families with dependent children.

- Education Credits: A non-refundable credit for education expenses.

Filing Electronically

Filing electronically is a convenient and secure way to submit your tax return. You can use tax software or the New York State Department of Taxation and Finance's online filing system.

Tips and Reminders

- Make sure to keep accurate records and receipts for deductions and credits.

- Take advantage of tax credits and deductions to reduce your tax liability.

- File electronically to avoid errors and ensure timely processing.

- Check the New York State Department of Taxation and Finance's website for updates and filing instructions.

FAQs

What is the deadline for filing Form IT-201?

+The deadline for filing Form IT-201 is typically April 15th.

Who needs to file Form IT-201?

+Residents with a gross income exceeding $8,000 (single) or $16,000 (joint) need to file Form IT-201.

What is the Earned Income Tax Credit (EITC)?

+The EITC is a refundable credit for low-income working individuals and families.

We hope this comprehensive guide has provided you with the necessary information to navigate the NY State Form IT-201. Remember to file electronically, take advantage of tax credits and deductions, and keep accurate records to ensure a smooth filing process. If you have any further questions or concerns, don't hesitate to reach out to a tax professional or the New York State Department of Taxation and Finance.

Share your thoughts and experiences with filing the NY State Form IT-201 in the comments below. Have you encountered any challenges or successes with the filing process?